Table of Contents

Living abroad as an American opens doors to extraordinary experiences, whether you're savoring croissants in Paris, teaching in Tokyo, working remotely from Bali, or building a business in Berlin. The expat journey offers rich cultural immersion and personal growth as you navigate new languages, customs, and lifestyles around the globe.

However, one aspect of expat life often creates unexpected stress: U.S. tax obligations. Unlike citizens of most countries, Americans abroad face citizenship-based taxation, meaning Uncle Sam expects tax returns regardless of where you live. This creates the challenge of potential double taxation and raises critical questions about tax burden reduction, compliance requirements, and how foreign accounts affect your U.S. tax situation. While complex, the IRS does provide mechanisms to prevent double taxation, and understanding these before you relocate can save you significant headaches and financial penalties down the road.

The Basics: U.S. Citizenship-Based Taxation

Unlike most countries that only tax residents on income earned within their borders, the United States practices citizenship-based taxation. This means that as a U.S. citizen or green card holder, you're required to file a U.S. tax return reporting your worldwide income regardless of where you live or work. This unique approach to taxation makes the U.S. one of only two countries in the world (along with Eritrea) that taxes its citizens on global income regardless of residency status.

Filing Requirements for Expats

Even if you live entirely outside the U.S., you must file a federal tax return if your total income exceeds certain thresholds. For the 2025 tax year, single filers generally need to file if their gross income is at least $14,600, while married filing jointly is $29,200. These thresholds may change annually.

Importantly, expats receive an automatic filing extension until June 15, with the possibility of extending further until October 15. However, if you owe taxes, interest still accrues from the regular April deadline.

Taxes to expect while working abroad

As a U.S. citizen, your worldwide income is subject to taxation. However, due to tax treaties and specific expat tax benefits, most Americans living and working abroad do not have a tax liability to the IRS. Nonetheless, it's important to remember that even if no taxes are owed, you are still required to file an annual tax return.

Your tax obligations while working abroad may include:

- U.S. federal income tax on worldwide income

- Foreign country income tax (depending on local laws)

- Potentially state income tax (depending on your state of residency)

- Self-employment tax if you're self-employed

Foreign Earned Income Exclusion (FEIE)

The Foreign Earned Income Exclusion is the primary tax benefit for Americans working abroad. For the 2025 tax year, the FEIE allows qualified individuals to exclude up to $126,500 of foreign earnings from their U.S. taxable income.

It's important to understand that this exclusion applies only to earned income – salaries, wages, commissions, bonuses, professional fees, and self-employment income. It does not apply to passive income such as dividends, interest, capital gains, pensions, or rental income.

Qualification Tests

To qualify for the FEIE, you must meet either:

Bona Fide Residence Test

- You must establish residence in a foreign country

- The residence must be uninterrupted and include an entire tax year

- Temporary visits to the U.S. are allowed but must not exceed 35 days in a calendar year to avoid scrutiny

- Your intention must be to live in the foreign country indefinitely

Physical Presence Test

- You must be physically present in a foreign country for at least 330 full days during a period of 12 consecutive months

- These days don't need to be consecutive

- The 12-month period can begin on any day, not necessarily January 1

- Travel days when you're in transit between countries generally don't count as days present in a foreign country

Claiming the FEIE

To claim this exclusion, you must file Form 2555 with your U.S. tax return. This is a detailed form that requires documentation of your foreign residence or physical presence and calculation of the portion of your income that qualifies for exclusion.

Foreign Tax Credit (FTC)

The Foreign Tax Credit allows you to offset your U.S. tax liability on the income taxes paid to foreign governments, helping to prevent double taxation. This credit can be particularly valuable for expats living in countries with tax rates higher than those in the U.S.

For instance, if you paid $15,000 in foreign taxes, you could reduce your U.S. taxes by the same amount. This helps expats avoid double taxation on the same income.

Qualifying Taxes

Not all foreign taxes qualify for the credit. Generally, the foreign tax must:

- Be a tax on income (not sales tax, VAT, or property tax)

- Be imposed on you as a taxpayer

- Be a legal and actual foreign tax liability

- Not be a payment for a specific economic benefit

Limitations and Carryovers

The IRS limits the FTC to the U.S. tax that would apply to the same income. If you pay more in foreign taxes than your U.S. liability on that income, you may be able to carry the excess credits forward for up to 10 years or back for one year.

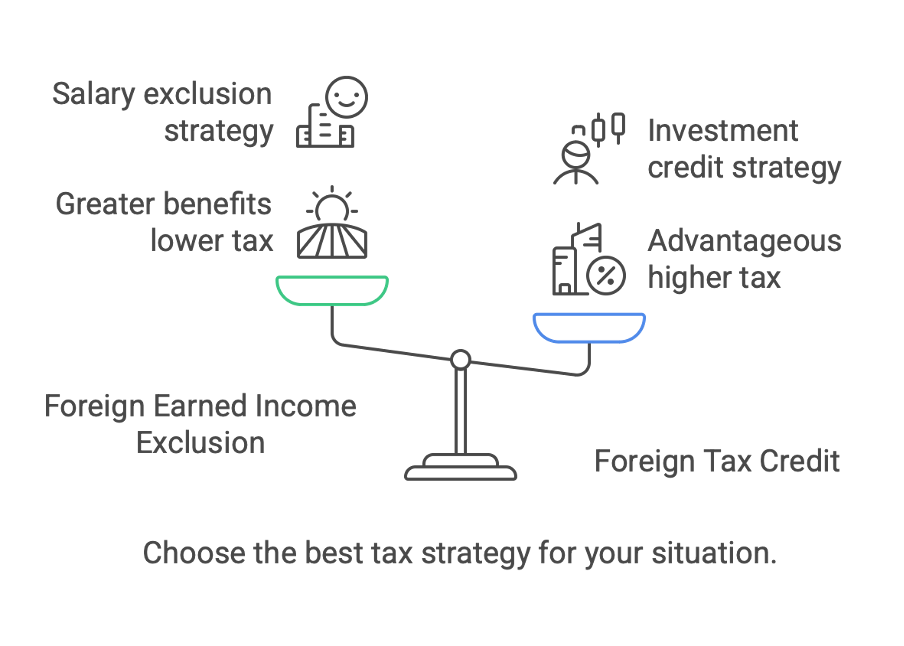

FEIE vs. FTC: Strategic Choices

You cannot use both the FEIE and FTC on the same income, though you can apply them to different income types. For example, you might use the FEIE for your salary and the FTC for investment income.

The optimal strategy depends on your specific situation:

- If you live in a country with lower tax rates than the U.S., the FEIE often provides greater benefits

- If you're in a higher-tax country, the FTC may be more advantageous

- If you earn significantly more than the FEIE limit, a combination approach might work best

Foreign Housing Exclusion and Deduction

The Foreign Housing Exclusion (for employees) or Deduction (for self-employed individuals) allows you to exclude or deduct certain housing expenses above a base amount from your taxable income.

If you rent an apartment or a house in another country, you can deduct certain expenses from your US taxes, recognizing that housing costs can be significantly higher in some foreign locations.

Qualifying Expenses

Eligible housing expenses include:

- Rent or fair market value of employer-provided housing

- Utilities (excluding telephone and internet)

- Real property insurance

- Residential parking fees

- Furniture rental

- Necessary repairs and maintenance

Non-qualifying expenses include:

- Mortgage payments and interest

- Home purchase costs

- Domestic help

- Television subscriptions

- Home improvements that increase property value

Calculation and Limitations

The housing benefit is limited to 30% of the maximum FEIE amount for the year. However, the IRS recognizes that some locations have much higher housing costs and publishes a list of high-cost locations with higher limits.

The base amount (minimum housing costs that aren't excludable) is typically 16% of the FEIE limit. For 2025, this base amount would be $20,800.

TAX-FREE HAVENS: Several countries, including Bahrain, Monaco, and the Bahamas, impose no income tax whatsoever. While many expats strategically relocate to these jurisdictions to minimize their global tax burden, remember that U.S. citizenship-based taxation still applies. You must continue filing U.S. returns, though you can potentially eliminate U.S. tax liability by using the Foreign Earned Income Exclusion rather than the Foreign Tax Credit (since you'll have no foreign taxes to credit).

Tax Forms Expats Need to Know

Managing expat taxes requires familiarity with several specific IRS forms, which include:

Essential Tax Forms for Every Expat

- Form 1040: This is used to report your worldwide income.

- Schedules 1, 2, and 3: Additional forms for reporting extra income, taxes, and credits, respectively.

- Form 2555: Allows you to claim the Foreign Earned Income Exclusion, potentially excluding up to $126,500 (2024) of foreign earnings from U.S. taxation.

- Form 1116: Provides a dollar-for-dollar credit for foreign taxes paid, preventing double taxation on the same income.

Foreign Account Disclosure Requirements

- Form 8938 (FATCA): Required for reporting foreign financial assets exceeding certain thresholds (starting at $200,000 for single expats).

- FinCEN Form 114 (FBAR): Filed separately from your tax return when foreign accounts total more than $10,000 at any point during the year.

Specialized Forms for Complex Situations

- Form 5471: Required if you own shares in a foreign corporation or serve as an officer or director.

- Form 8621: Needed for ownership in foreign mutual funds and other Passive Foreign Investment Companies.

- Form 3520: Used to report foreign trusts, large foreign gifts, and certain foreign retirement accounts.

Working with a tax professional who specializes in expat taxation can help navigate these complex reporting requirements.

FBAR and FATCA Requirements

Foreign Bank Account Report (FBAR)

Who Must File

You must file FinCEN Form 114 (FBAR) if:

- You're a U.S. person (citizen, resident, entity)

- You have a financial interest in or signature authority over foreign financial accounts

- The aggregate value of these accounts exceeded $10,000 at any time during the calendar year

What Accounts Count

Reportable accounts include:

- Bank accounts (checking, savings)

- Securities accounts (brokerage)

- Certain foreign retirement accounts

- Foreign mutual funds

- Foreign-issued life insurance with cash value

Filing Process

Unlike tax returns, FBARs must be filed electronically through the Financial Crimes Enforcement Network's BSA E-Filing System. The deadline is April 15, with an automatic extension to October 15.

Foreign Account Tax Compliance Act (FATCA)

Form 8938 Requirements

FATCA requires filing Form 8938 if foreign financial assets exceed:

- $50,000 on the last day of the tax year or $75,000 at any time during the year for single filers living in the U.S.

- $100,000 on the last day of the tax year or $150,000 at any time during the year for married couples filing jointly and living in the U.S.

- $200,000 on the last day of the tax year or $300,000 at any time during the year for single filers living abroad

- $400,000 on the last day of the tax year or $600,000 at any time during the year for married couples filing jointly and living abroad

Differences from FBAR

While there's overlap, FATCA reporting:

- Is filed with your tax return

- Has higher thresholds

- Includes a broader range of assets (such as foreign stock, partnership interests, etc.)

- Carries different penalties

Consequences of Non-Compliance

The penalties for failing to file these information returns can be severe:

- FBAR non-filing penalties range from $10,000 for non-willful violations to the greater of $100,000 or 50% of account balances for willful violations

- FATCA Form 8938 penalties start at $10,000 and can increase by $10,000 increments (up to $50,000) for continued failure after IRS notification

Special Considerations for Self-Employed Expats

Self-Employment Tax Obligations

While employment income may be excluded through the FEIE, self-employed Americans abroad generally remain subject to self-employment tax (15.3% covering Social Security and Medicare taxes). This creates a significant tax burden that employed expats might avoid.

Totalization Agreements

The U.S. has signed totalization agreements with about 30 countries to eliminate dual Social Security taxation and address gaps in benefit eligibility. If you're self-employed in a country with such an agreement, you may be exempt from U.S. self-employment tax.

Business Structure Considerations

Self-employed expats might benefit from different business structures:

- Creating a foreign corporation might help in certain situations

- Being employed by your own foreign corporation can sometimes reduce self-employment tax

- S corporations may offer tax advantages in some cases

Foreign Earned Income Exclusion for Business Income

Self-employed individuals can still claim the FEIE on their business income, but the calculation becomes more complex. Only the portion representing reasonable compensation for services (not return on capital) qualifies for the exclusion.

Retiring Abroad Taxes

When retiring abroad, you will still have to file (and potentially pay) US taxes on your worldwide income. This includes:

- Pensions

- Social Security benefits

- Investment Income

- Retirement accounts

Retirement Account Considerations

In some cases, a tax-free foreign retirement account won't be tax-free under US law. Different countries have different agreements with the US regarding the tax treatment of retirement accounts and pension distributions.

Social Security Benefits

Many retirees abroad still receive their Social Security benefits. Depending on the country you live in, your benefits may be subject to different tax treatment both by the US and your country of residence.

Tax Treaties and Retirement Income

The US has tax treaties with many countries that may offer special provisions for retirees. These can affect how your retirement income is taxed and may help prevent double taxation.

Required Minimum Distributions

US retirement accounts like traditional IRAs and 401(k)s still require minimum distributions after age 72, regardless of where you live. Failing to take these distributions can result in significant penalties.

State Taxes

Each state has its own rules for determining tax residency. Common factors include:

- Maintaining a permanent home in the state

- Time spent in the state during the tax year

- Location of bank accounts and investments

- Voter registration and driver's license

- Family ties and business connections

States with Aggressive Tax Policies

Some states are particularly reluctant to relinquish their tax claims on former residents:

- California considers anyone who leaves the state for "temporary or transitory purposes" to still be a resident

- New York and Virginia have similar approaches

- Massachusetts and New Jersey also have strict residency rules

Tax-Friendly States for Expats

Before moving abroad, establishing residency in a tax-friendly state can provide significant advantages:

- States with no income tax: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming

- States that only taxes interest and dividends: New Hampshire

- States that honor foreign earned income exclusions: Most states, but verify individual state rules

Breaking State Tax Residency

To successfully break state tax residency, you typically need to:

- Sell or rent out your home in the state

- Obtain a driver's license in your new location

- Register to vote in your new location

- Move bank accounts and financial relationships

- Document your permanent intention to leave

Planning for Expat Taxes

Pre-Departure Tax Planning

Before leaving the U.S., consider these tax planning steps:

- Establish residency in a tax-friendly state

- Understand the tax treaty (if any) between the U.S. and your destination country

- Research local tax obligations in your new country

- Consider timing your departure to maximize tax benefits

- Organize your financial affairs to simplify reporting

Retirement Considerations

Living abroad creates unique retirement planning challenges:

- Foreign retirement accounts may not receive the same tax treatment as U.S. accounts

- Some retirement accounts might trigger additional reporting requirements

- Social Security benefits may be taxed differently depending on your residence

- Roth IRA and 401(k) distributions might not be tax-free in your country of residence

Investment and Banking Strategy

Develop an investment strategy that accounts for your expat status:

- Some U.S. financial institutions close accounts for non-U.S. residents

- Many foreign investment opportunities may be classified as Passive Foreign Investment Companies (PFICs), which carry unfavorable tax treatment

- Consider simplifying your financial portfolio to reduce compliance burden

For those considering renouncing U.S. citizenship to escape tax obligations, be aware of the "exit tax" that applies to "covered expatriates" (those with net worth over $2 million or average annual net income tax above approximately $178,000 for the past five years).

Conclusion

While U.S. expats do have tax obligations on foreign income, various exclusions, credits, and deductions often mean that many Americans abroad end up owing little or no U.S. tax. However, filing requirements remain, and the complexity of international tax situations means that professional guidance is usually a worthwhile investment.

The key to managing expat taxes successfully lies in understanding your obligations, planning proactively, maintaining good records, and working with tax professionals who specialize in expat taxation. By taking these steps, you can focus on enjoying your international experience rather than stressing about tax compliance.