Table of Contents

Filing taxes in the U.S. as a nonresident alien can feel confusing, especially if you have little to no income. However, one form you shouldn’t overlook is Form 8843. Whether you're an international student, teacher, or trainee on a temporary visa, filing this form is essential for maintaining your nonresident tax status and avoiding potential complications with the IRS or immigration authorities. Many visa holders mistakenly assume they don’t need to file if they didn’t earn income, but skipping Form 8843 can cause issues down the road. Understanding what this form does, who needs to file it, and how to complete it correctly can help ensure you remain compliant with U.S. tax laws while protecting your visa status.

What is Form 8843, and Who Needs to File It?

Form 8843 is a crucial document for nonresident aliens who want to maintain the correct tax and immigration status in the U.S. While it’s not a tax return, it serves as proof that you are exempt from the substantial presence test, which determines whether you qualify as a tax resident. Filing this form ensures that you are taxed only on U.S.-sourced income instead of being subject to worldwide taxation like U.S. residents.

Who Must File Form 8843?

Here’s a list of individuals who typically file Form 8843:

- A student on an F, J, M, or Q visa

- A teacher or trainee on a J or Q visa

- A professional athlete temporarily in the U.S. for competitions

- A dependent or spouse of a visa holder in the categories above

Even if you have zero income, filing Form 8843 is essential. It helps you stay compliant with tax laws, avoids issues with future visa renewals, and ensures you don’t face unnecessary IRS scrutiny.

Why Form 8843 is Important for Nonresident Aliens

1. Establishing Nonresident Tax Status

Filing Form 8843 is the key to maintaining your nonresident tax status in the U.S. The IRS uses this form to determine whether you should be taxed only on your U.S.-sourced income, rather than your global income like a resident. Without filing it, you may be mistakenly classified as a resident for tax purposes, which could result in higher taxes and unnecessary complications.

2. Visa and Immigration Compliance

Your tax filings impact more than just your finances, they can also affect your immigration status. When applying for visa extensions, work permits, or even a green card, U.S. immigration authorities may check your tax records. Failure to file Form 8843 could raise red flags, potentially delaying or complicating future applications. Staying compliant with tax regulations ensures a smoother immigration process.

3. Avoiding Tax Errors and Penalties

While there are no direct fines for not filing Form 8843, an incorrect tax filing can trigger IRS audits or lead to unnecessary back-and-forth with tax authorities. If you accidentally misclassify your residency status, you may be required to pay additional taxes or face complications in future filings. Submitting Form 8843 correctly helps prevent these issues and keeps your records in good standing.

Step-by-Step Instructions for Completing Form 8843

How to Fill Out Form 8843: Step-by-Step Breakdown

Form 8843 consists of several sections, but not all of them will apply to every filer. The sections you need to complete depend on your specific visa category and circumstances. Below is a breakdown of each section to help you fill out the form correctly.

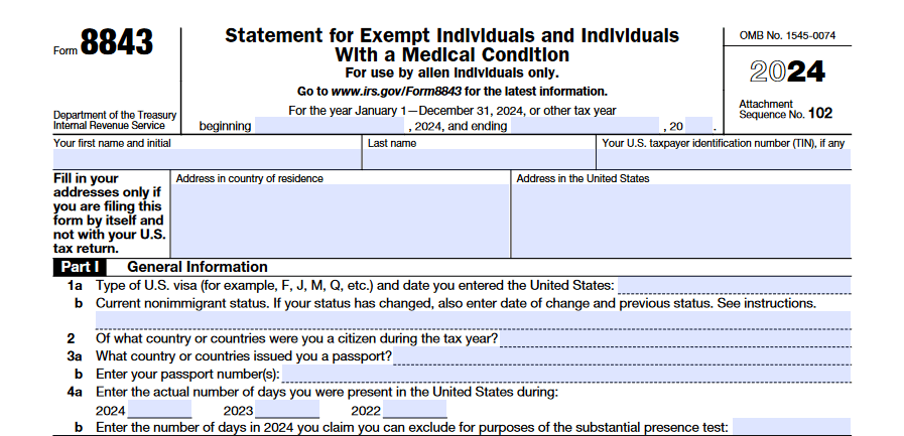

Part 1: General Information

This section applies to all filers and requires basic personal details to establish your nonresident status. Ensure the information matches your passport and visa records to avoid discrepancies.

You will need to provide:

- Personal details – Your full name (as it appears on your passport).

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) – If you have been assigned one, you must include it. However, most nonresident aliens filing Form 8843 do not need an SSN or ITIN unless they are dependents on a U.S. tax return.

- Visa type – Such as F-1, J-1, M-1, or Q-1.

- Current nonimmigrant status – If your visa status has changed since entering the U.S., you must also provide the date the change was approved.

- Days of presence in the U.S. – Enter the total number of days you were physically present in the U.S. for the past three years, including the tax year for which you are filing. This helps determine your eligibility for the substantial presence test.

Accurately completing this section ensures the IRS correctly classifies your residency status for tax purposes.

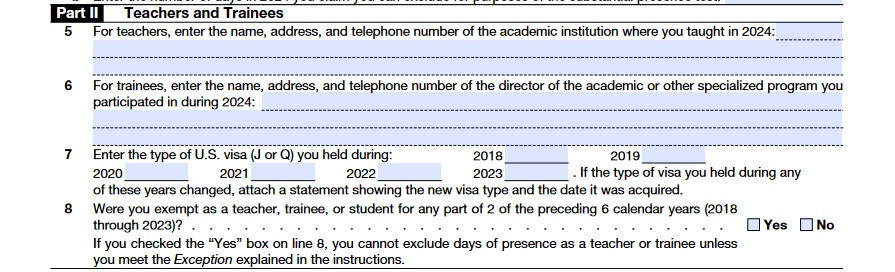

Part 2: Teachers and Trainees (J or Q Visa Holders)

If you are in the U.S. as a teacher or trainee on a J or Q visa, you must complete Part 2. You will be required to:

- Provide the name and address of the academic institution or program sponsor.

- Indicate the duration of your stay and program participation.

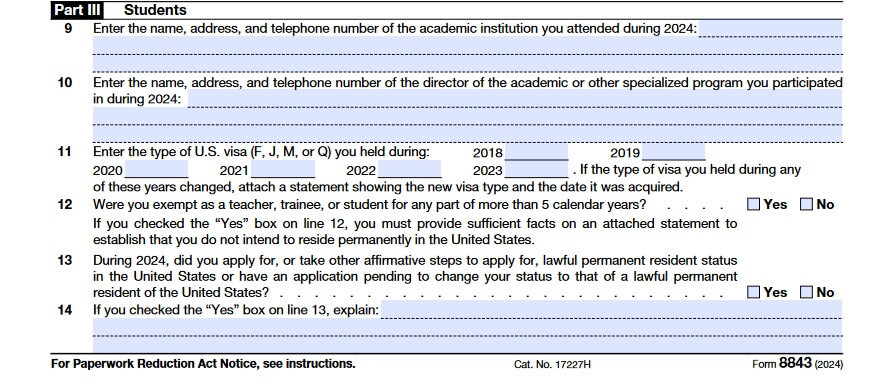

Part 3: Students (F, J, M, or Q Visa Holders)

If you are an international student on an F, J, M, or Q visa, this section applies to you. Here’s what you need to include:

- The name and address of your school, college, or university.

- Your designated school official (DSO) or program sponsor details.

- Additional information about your academic status and eligibility for the exemption from the substantial presence test.

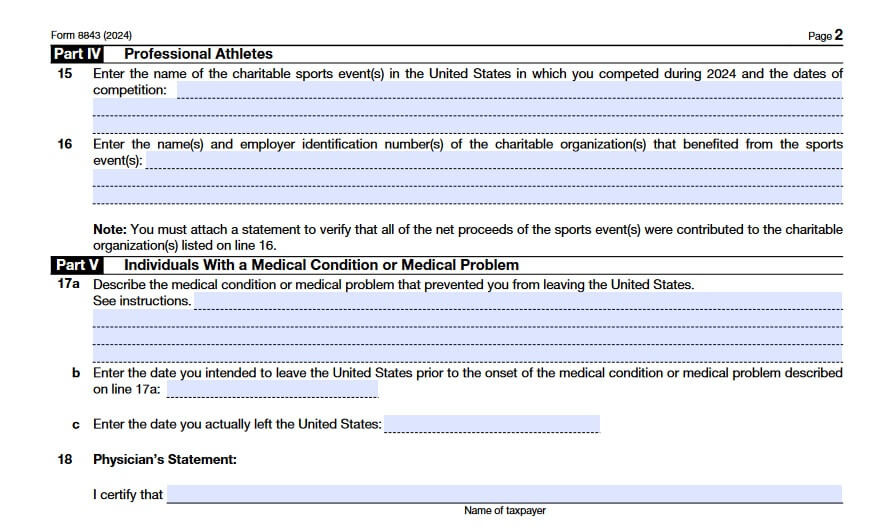

Part 4: Professional Athletes

This section applies only to athletes who are in the U.S. temporarily for competitions. Most international students and trainees will not need to fill out this part.

Part 5: Individuals with a Medical Condition or Medical Problem

This section is for individuals who were unable to leave the U.S. due to a medical condition. If you were present in the U.S. beyond your visa duration for medical reasons, you may need to complete this section and provide documentation supporting your claim.

Final Steps

- Double-check your information for accuracy, ensuring all dates, visa details, and presence in the U.S. are correctly recorded.

- Sign and date the form before submission. Unsigned forms will not be processed.

- Submit the form according to your situation – Either as a standalone form if you have no income or attached to your tax return (Form 1040-NR) if you earned U.S.-sourced income.

Filing Form 8843 correctly is essential for maintaining your nonresident tax status and avoiding unnecessary tax complications. If you need assistance, NSKT Global can help streamline the process, ensuring accuracy and compliance with IRS regulations.

Where and How to Submit Form 8843

If You Have No Income

If you did not earn any income in the U.S. but are required to file Form 8843, you must mail it separately to the IRS. Since you are not submitting a full tax return, ensure the form is completed accurately and signed before mailing it to:

Department of the Treasury, Internal Revenue Service Center, Austin, TX 73301-0215, USA

Make a copy of the form for your records before mailing, as you may need it for future reference, especially for visa renewals or other immigration-related matters.

If You Earned U.S. Income

If you received any U.S.-sourced income during the tax year, Form 8843 must be included with your federal tax return (Form 1040-NR). In this case, follow these steps:

- Complete Form 1040-NR – This is the tax return form for nonresident aliens who earned income in the U.S.

- Attach Form 8843 – Once you have filled out Form 8843, attach it to your completed 1040-NR form.

- Submit by the Deadline – The deadline for filing is April 15 if you earned income. If you have no taxable income, the deadline is June 15.

Mail the completed tax return, along with Form 8843, to the address specified on the Form 1040-NR instructions, which may vary based on whether you are enclosing a payment.

Common Mistakes to Avoid When Filing Form 8843

1. Not Filing When Required

Many nonresident aliens mistakenly believe that if they have no income, they don’t need to file Form 8843. However, this form is mandatory for individuals on F, J, M, or Q visas, even if they have zero earnings. Neglecting to submit Form 8843 could impact future visa renewals, green card applications, or work permit requests. Keeping a record of tax compliance is crucial for maintaining a good standing with both the IRS and immigration authorities.

2. Providing Incorrect Visa or Residency Details

Errors in visa type, entry dates, or the number of days spent in the U.S. can create inconsistencies in your tax records. The IRS and immigration agencies use this data to determine your tax residency, and mistakes could result in delays or unwanted scrutiny. Double-check all details before submission and refer to your I-94 arrival/departure record to ensure accuracy.

3. Forgetting to Sign the Form

An unsigned Form 8843 is considered invalid and will not be processed by the IRS. This seemingly minor oversight can cause unnecessary delays and may require you to resubmit the form, prolonging the entire process. Always review your form before mailing it to ensure it is signed and dated correctly.

4. Submitting the Form Late

While there are no direct penalties for late filing, failing to submit Form 8843 on time can create compliance issues, especially for visa holders planning future applications. The deadline is April 15 if you have income and June 15 if you have no taxable earnings. Mailing your form early ensures it reaches the IRS before the deadline, reducing stress and avoiding last-minute problems.

Conclusion

Filing Form 8843 is a crucial step in protecting your tax and immigration status. Whether you’re a student, teacher, or athlete on a temporary visa, ensuring you submit this form correctly and on time can help you avoid unnecessary complications down the road. Staying compliant with tax laws means fewer surprises when it comes to visa renewals and future U.S. tax filings.

If you need expert assistance, NSKT Global can help you navigate tax complexities with ease. Our team specializes in tax compliance for nonresident aliens, ensuring that your forms are filed accurately and on time. From understanding tax residency rules to handling IRS paperwork, we provide the guidance you need to stay compliant and stress-free.

FAQs About Filing Form 8843

Who is required to file Form 8843?

Any nonresident alien on an F, J, M, or Q visa, including students, teachers, trainees, and their dependents, must file Form 8843.

Do I need to file Form 8843 if I had no income in the U.S.?

Yes, all eligible nonresident aliens must file Form 8843, even if they have no income.

What is the deadline for submitting Form 8843?

The deadline is April 15 if you earned income and June 15 if you had no taxable income.

Can I file Form 8843 electronically?

No, Form 8843 must be printed, signed, and mailed to the IRS.

What happens if I fail to submit Form 8843 on time?

While there are no direct penalties, failing to file may impact your visa status and future tax compliance.