Table of Contents

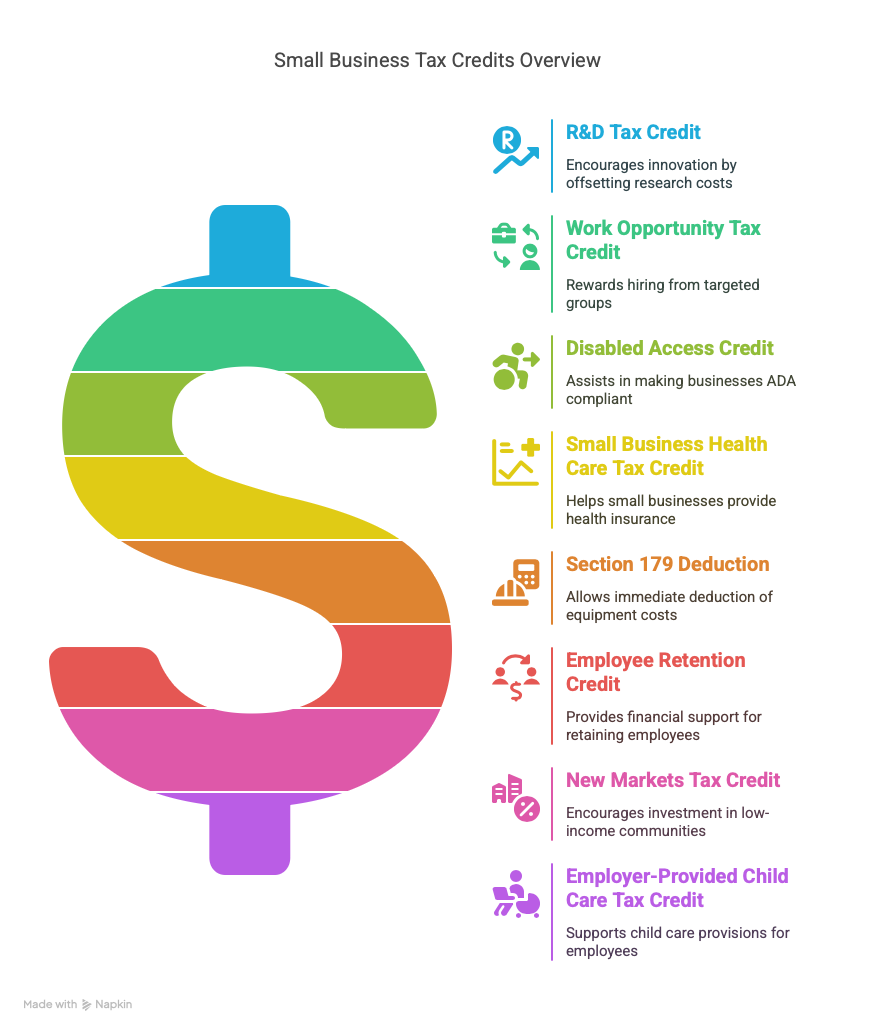

Running a small business comes with financial challenges, but tax credits can provide significant relief, reducing your tax burden and freeing up funds for growth. Unlike deductions, which lower taxable income, tax credits directly reduce the amount of taxes owed, often making them more valuable. In 2025, small businesses can take advantage of a variety of tax credits designed to incentivize innovation, hiring, sustainability, and employee benefits.

Tax credits can significantly impact a business’s bottom line, allowing owners to reinvest in operations, employees, and expansion. However, navigating tax laws and eligibility requirements can be complex. Business owners should familiarize themselves with available credits and seek professional guidance to maximize savings and ensure compliance.

1. Research and Development (R&D) Tax Credit

The R&D Tax Credit is designed to encourage businesses to invest in innovation. This credit is particularly beneficial for small businesses that engage in developing new products, refining processes, or enhancing software technologies. Many business owners mistakenly believe that only high-tech firms qualify, but companies in manufacturing, engineering, and even food production may be eligible. The credit helps businesses offset research costs and reinvest in continuous improvement.

Eligibility:

- Developing or improving a product, process, or software.

- Engaging in technical research that eliminates uncertainty.

- Experimenting with new designs, prototypes, or formulations.

Benefits:

- A percentage of qualifying R&D expenses can be credited directly against taxes owed, reducing overall tax liability and freeing up capital for reinvestment in further innovation.

- Startups with less than $5 million in revenue can use up to $250,000 of the credit to offset payroll taxes, helping early-stage companies manage labor costs while continuing to grow.

- Encourages small businesses to take risks and innovate without the fear of excessive financial burdens, fostering a competitive edge in their industries.

- Can be applied retroactively, allowing businesses to claim credit for past qualifying R&D expenditures, which can provide additional financial relief.

- Helps businesses remain compliant with evolving industry standards by funding research that enhances efficiency, sustainability, and competitiveness.

2. Work Opportunity Tax Credit (WOTC)

The WOTC rewards businesses that hire employees from targeted groups facing employment barriers, including veterans, long-term unemployed individuals, and individuals receiving government assistance. This tax credit not only reduces an employer’s tax liability but also helps create a more inclusive workforce, supporting individuals who may otherwise struggle to find stable employment. Employers benefit from both financial incentives and an expanded talent pool.

Eligibility:

- Hiring from designated groups such as veterans, ex-felons, and Supplemental Nutrition Assistance Program (SNAP) recipients.

- The employee must work at least 120 hours in the first year.

Benefits:

- Credit ranges from $2,400 to $9,600 per eligible employee, depending on the target group they belong to and their hours worked.

- Employers must file Form 8850 with the IRS within 28 days of hiring an eligible worker to qualify.

- Reduces hiring costs and helps businesses invest in workforce development while benefiting from tax incentives.

- Encourages long-term employment by offering credits for hiring individuals who may otherwise face barriers to securing stable jobs.

3. Disabled Access Credit

This credit assists small businesses in making their facilities accessible to disabled individuals, including customers and employees. It helps offset costs associated with meeting Americans with Disabilities Act (ADA) requirements, making it easier for small businesses to accommodate a wider range of customers and employees while complying with legal standards.

Eligibility:

- Businesses with total revenue under $1 million or fewer than 30 full-time employees.

- Expenses must be for ADA-compliant modifications like ramps, door widenings, or accessible restrooms.

Benefits:

- Covers 50% of eligible expenses between $250 and $10,000.

- Maximum credit of $5,000 per year.

- Helps businesses comply with ADA requirements while avoiding potential legal penalties.

- Enhances accessibility, allowing businesses to serve a wider customer base, including disabled individuals.

- Improves workplace inclusivity, making it easier to hire and retain employees with disabilities.

4. Small Business Health Care Tax Credit

Small businesses providing health insurance to employees may qualify for this credit, which helps offset premium costs. Offering health benefits can improve employee retention, attract talent, and enhance workplace satisfaction. This credit is especially beneficial for small employers that struggle with the financial burden of offering competitive health insurance plans.

Eligibility:

- Businesses with fewer than 25 full-time equivalent employees.

- Average employee wages below $60,000 (adjusted annually).

- Employer must pay at least 50% of premiums for a qualified health plan through the Small Business Health Options Program (SHOP).

Benefits:

- Credit covers up to 50% of premium contributions for up to two consecutive years, reducing the financial burden of offering health benefits.

- Helps small businesses attract and retain employees by making health insurance more affordable.

- Improves employee satisfaction and productivity, as workers with health coverage tend to have better overall well-being and job stability.

- Can be combined with other deductions to further reduce healthcare-related expenses for the business.

5. Section 179 Deduction

While technically a deduction rather than a credit, the Section 179 provision allows businesses to deduct the full cost of qualifying equipment purchases in the year they are made, rather than depreciating them over time. This tax advantage encourages small businesses to invest in essential tools and technology that boost productivity and efficiency.

Eligibility:

- Business must purchase qualifying equipment, including machinery, computers, and vehicles used for work purposes.

- The deduction limit for 2025 is expected to be around $1.2 million.

Benefits:

- Immediate tax savings, improving cash flow, which can be reinvested into business operations or expansion.

- Applies to both new and used equipment purchases, offering flexibility in acquiring essential tools and technology.

- Encourages businesses to modernize operations with up-to-date machinery, improving productivity and efficiency.

- Reduces financial strain on small businesses by allowing full deductions in the year of purchase rather than spreading costs over time.

6. Employee Retention Credit (ERC)

The ERC, originally created during the COVID-19 pandemic, has been extended in modified forms for businesses retaining employees during economic hardships. This credit serves as a financial buffer for businesses experiencing slowdowns, allowing them to maintain their workforce and avoid layoffs.

Eligibility:

- Businesses experiencing revenue declines or other financial hardships.

- Employers who continue paying employees during a temporary closure.

Benefits:

- Credit of up to $7,000 per employee per quarter, helping businesses maintain cash flow during economic downturns.

- Can be applied retroactively for eligible wages paid in previous years, allowing businesses to recover previously unclaimed benefits.

- Provides significant payroll cost relief, enabling businesses to retain valuable employees and avoid layoffs.

- Helps stabilize operations during periods of uncertainty, ensuring businesses remain operational and competitive in challenging economic conditions.

7. New Markets Tax Credit (NMTC)

This credit encourages investment in low-income communities by providing financial incentives to businesses expanding in these areas. It is designed to stimulate economic growth, job creation, and infrastructure development in underprivileged communities.

Eligibility:

- Business must operate in a qualified low-income community.

- Investments must be made through a certified Community Development Entity (CDE).

Benefits:

- Up to 39% of the investment amount is credited over seven years, significantly reducing long-term tax liabilities for investors.

- Encourages economic development in underserved areas by attracting business investments and job opportunities.

- Provides an incentive for businesses to expand into low-income communities, helping to revitalize local economies.

- Can be used in conjunction with other tax credits and incentives to maximize financial benefits for businesses investing in qualifying areas.

8. Employer-Provided Child Care Tax Credit

Businesses that provide on-site child care or financial assistance for employees’ child care costs may qualify for this credit. Supporting working parents not only reduces employee turnover but also improves overall job satisfaction and productivity.

Eligibility:

- Employers offering child care services or subsidies for employees.

- Services must meet state licensing requirements.

Benefits:

- Covers 25% of child care facility expenditures plus 10% of resource and referral costs, easing the financial burden of providing child care support.

- Maximum credit of $150,000 per year, allowing businesses to make meaningful investments in child care services.

- Enhances employee retention and productivity by reducing child care-related stress and absenteeism among working parents.

- Strengthens workplace culture and employer reputation by demonstrating a commitment to employee well-being and work-life balance.

- Can be used in combination with other employee benefits to create a more attractive compensation package.

9. Energy-Efficient Commercial Buildings Deduction

Businesses investing in energy-efficient upgrades to their buildings may claim this deduction, helping reduce utility costs while benefiting from tax savings. Implementing energy-efficient solutions can lead to long-term operational cost reductions while supporting sustainability initiatives.

Eligibility:

- Upgrades must meet IRS energy efficiency requirements.

- Improvements include HVAC systems, insulation, and solar energy installations.

Benefits:

- Up to $5 per square foot deduction for qualifying upgrades, reducing overall project costs and increasing return on investment.

- Encourages sustainable business practices and long-term savings by lowering energy consumption and utility bills.

- Enhances property value by making buildings more energy-efficient and attractive to potential buyers or tenants.

- Helps businesses comply with evolving environmental regulations, reducing the risk of fines and penalties.

- Contributes to a greener environment, improving corporate social responsibility and brand reputation.

Conclusion

Tax credits offer small businesses a direct way to reduce tax liabilities and reinvest in growth. Whether for hiring, innovation, health care, or sustainability, these incentives can provide substantial financial relief.

Maximizing these benefits requires understanding eligibility and filing requirements. Seeking professional tax guidance ensures compliance and helps businesses take full advantage of available credits. Proper planning can lead to significant savings, improved cash flow, and long-term financial stability.

NSKT Global specializes in helping small businesses navigate tax credit complexities. Our experts provide tailored strategies to optimize savings, ensure compliance, and streamline tax processes, allowing business owners to focus on growth and success.

FAQs About Small Business Tax Credits

What is the maximum amount claimable under the R&D Tax Credit?

The maximum credit varies, but eligible businesses can claim up to 20% of qualified R&D expenses, with startups able to offset up to $250,000 in payroll taxes.

How does a business qualify for the Work Opportunity Tax Credit?

A business qualifies by hiring employees from targeted groups (e.g., veterans, long-term unemployed, or individuals on government assistance) and filing IRS Form 8850 within 28 days of hire.

What expenses are covered by the Disabled Access Credit?

The credit covers 50% of eligible expenses ($250–$10,000) for ADA-compliant modifications, such as ramps, widened doorways, accessible restrooms, and sign language interpreters.

Can I claim the Small Business Health Care Tax Credit if I have more than 25 employees?

No, only businesses with fewer than 25 full-time equivalent employees and average wages below $60,000 qualify for this credit.

How does the Section 179 Deduction differ from standard depreciation?

Section 179 allows businesses to deduct the full cost of qualifying equipment in the year of purchase, while standard depreciation spreads deductions over multiple years.