Table of Contents

Being your own boss comes with a lot of freedom, you get to choose your work timings, vacations and family times. However, this freedom also comes with a significant responsibility that is often overlooked, and that is handling taxes on your own. In California, self-employed professionals must manage both state and federal tax obligations. From understanding self-employment tax to calculating payments and maximizing deductions, staying informed can help freelancers, independent contractors, and small business owners reduce their tax burden while avoiding penalties. With the right strategies, tax season doesn’t have to be overwhelming. Here’s everything you need to know.

Understanding Self-Employment Tax

Self-employment tax is essentially the price of being your own boss, covering Social Security and Medicare contributions. Unlike traditional employees, freelancers and business owners must pay both the employer and employee portions of these taxes. The total self-employment tax rate is 15.3%, broken down as:

- 12.4% for Social Security (on income up to an annually adjusted limit)

- 2.9% for Medicare (plus an additional 0.9% surtax on earnings exceeding $200,000 for individuals and $250,000 for married couples filing jointly)

Unlike W-2 employees, who split these costs with their employers, self-employed individuals bear the full burden. This makes understanding and budgeting for self-employment tax essential for financial success. Proper tax planning ensures you’re not caught off guard when tax season rolls around, helping you stay compliant while maximizing your earnings.

Federal Self-Employment Tax Obligations

Managing self-employment taxes may seem daunting, but understanding federal obligations can simplify the process. The IRS mandates that self-employed individuals report earnings and pay taxes accordingly, ensuring compliance and avoiding penalties. Whether you're a freelancer, contractor, or business owner, knowing your tax responsibilities helps you plan effectively and keep more of your hard-earned income.

The IRS requires self-employed individuals to report their earnings and pay taxes accordingly. Key points include:

- Filing Schedule SE (Form 1040): This form calculates self-employment tax, which is added to your federal income tax liability.

- Deduction for Self-Employment Tax: You can deduct half of your self-employment tax when calculating your adjusted gross income.

- Net Earnings Threshold: If your net earnings from self-employment are $400 or more, you must file a tax return and pay self-employment tax.

- Medicare Surtax: If your self-employment income exceeds the threshold, you’ll owe an additional 0.9% Medicare surtax.

California State Tax Obligations for the Self-Employed

California has some of the highest tax rates in the country, making it essential for self-employed individuals to stay informed and compliant. The state enforces strict tax laws, and failing to meet them can result in hefty penalties. Understanding your tax responsibilities ensures that your business runs smoothly and avoids unnecessary financial stress.

- State Income Tax: California’s progressive income tax rates range from 1% to 12.3% as of 2025, depending on earnings.

- Self-Employed Contributions to State Disability Insurance (SDI): While employees automatically contribute, self-employed individuals may choose to opt-in to receive disability benefits.

- California Franchise Tax Board (FTB) Requirements: Sole proprietors must report income on Form 540 and may need to make estimated tax payments if they expect to owe more than $500 in state taxes.

- Sales Tax Obligations: If selling goods or taxable services, obtaining a California Seller’s Permit and collecting sales tax is mandatory. The base sales tax rate is 7.25%, but local jurisdictions may add additional taxes, increasing it up to 10.25% in some areas.

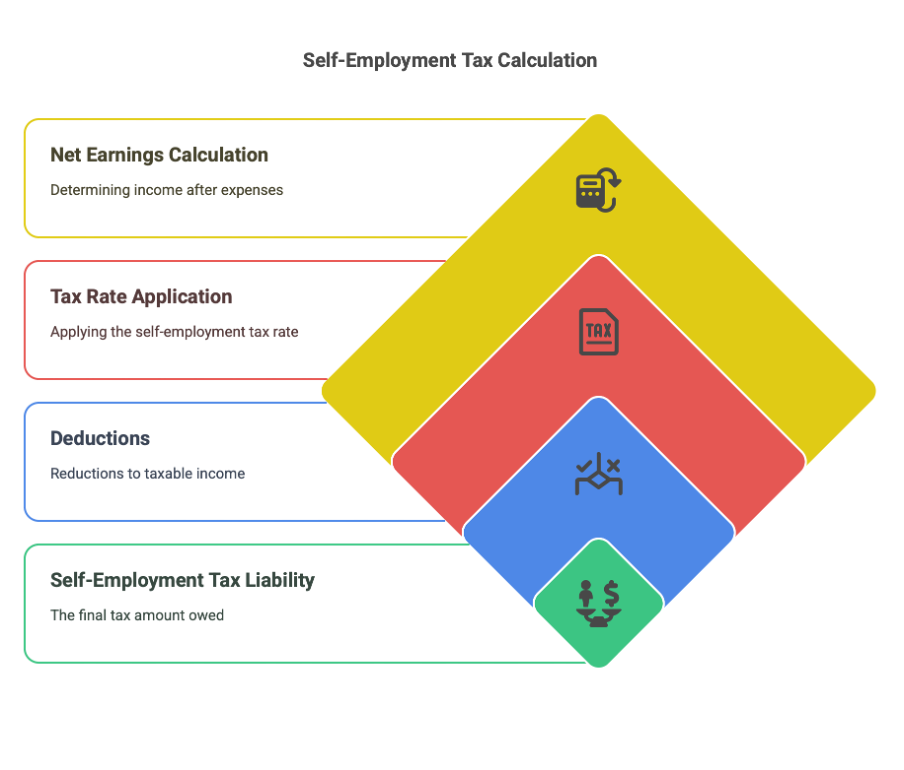

Calculating Your Self-Employment Tax

Calculating self-employment tax can feel overwhelming, but breaking it down into simple steps makes it manageable. By understanding how to determine net earnings, apply tax rates, and account for deductions, you can ensure compliance while minimizing your tax burden.

To determine your self-employment tax liability accurately, follow these detailed steps:

- Calculate Net Earnings: Begin by determining your total self-employment income for the year. Subtract all business-related expenses, such as office supplies, travel costs, and marketing expenses. The resulting amount is your net earnings, which serve as the base for tax calculations.

- Apply the Self-Employment Tax Rate: Multiply your net earnings by 92.35%—this adjustment accounts for the employer portion of FICA taxes that traditional employees do not pay. Then, apply the 15.3% self-employment tax rate, which consists of 12.4% for Social Security and 2.9% for Medicare.

- Consider the Social Security Wage Base: For 2025, the Social Security wage base is $176,100. Any income above this threshold is exempt from the 12.4% Social Security tax, but the 2.9% Medicare tax still applies to all earnings. If your income exceeds $200,000 (or $250,000 for married couples filing jointly), you must also pay an additional 0.9% Medicare surtax on the excess.

- Account for Deductions: To reduce your taxable income, you can deduct 50% of your self-employment tax. This deduction helps lower your overall federal income tax burden.

Quarterly Estimated Tax Payments

Self-employed individuals are responsible for paying their own taxes, as they don’t have an employer withholding taxes from their paychecks. To avoid a large tax bill at the end of the year, they must make quarterly estimated tax payments to both the IRS and the California FTB. These payments are due on the following dates:

- April 15, 2025 (Q1) – Covers income earned from January to March.

- June 16, 2025 (Q2) – Covers income earned from April to May.

- September 15, 2025 (Q3) – Covers income earned from June to August.

- January 15, 2026 (Q4 of the previous year) – Covers income earned from September to December.

Missing these deadlines can result in penalties and interest charges. To calculate estimated payments, determine your expected income for the year, apply the applicable federal and state tax rates, and divide the total tax owed by four. Using tax software or consulting a professional can help ensure accurate payments and compliance with tax laws.

Deductions and Credits to Reduce Tax Liability

Reducing your self-employment tax burden starts with maximizing deductions and credits. These deductions help lower your taxable income, ultimately reducing the amount of tax owed. Here are some key deductions self-employed individuals can claim:

- Home Office Deduction: If you use a dedicated space in your home exclusively for business, you can deduct a percentage of rent, mortgage interest, utilities, and internet costs based on the size of your office.

- Health Insurance Premiums: Self-employed individuals can deduct the cost of health, long-term care insurance for themselves, spouse, and dependents.

- Retirement Contributions: Contributions to tax-advantaged retirement accounts such as SEP IRAs, SIMPLE IRAs, or Solo 401(k)s help reduce taxable income while building long-term savings.

- Business Expenses: Essential business costs, including office supplies, marketing expenses, software subscriptions, and professional services, are deductible.

- Mileage Deduction: If you use your vehicle for business purposes, you can deduct mileage using the IRS standard rate or actual expenses such as gas and maintenance.

Filing Requirements and Deadlines

Filing taxes on time is essential for self-employed individuals to avoid penalties and interest charges. The IRS and California Franchise Tax Board (FTB) set strict deadlines for tax filings and payments. Missing these deadlines can lead to unnecessary financial burdens. Here are the key deadlines for 2025:

- April 15, 2025: The deadline to file your federal and California state tax returns. If you owe taxes, payment is also due on this date. If you need more time, you can file for an extension.

- Quarterly Estimated Tax Deadlines:

- April 15, 2025 – Covers income earned from January to March.

- June 17, 2025 – Covers income earned from April to May.

- September 16, 2025 – Covers income earned from June to August.

- January 15, 2026 – Covers income earned from September to December of the previous year.

- October 15, 2025: If you filed for an extension by April 15, this is the final deadline to submit your tax return.

It is highly recommended to file electronically for faster processing and to minimize errors. Using tax software or hiring a tax professional can ensure accuracy and compliance with all tax regulations.

Locations We Serve In California

How to Avoid Common Mistakes

Self-employed individuals often make mistakes that lead to tax penalties. Common errors include:

Not Making Estimated Tax Payments: This can result in underpayment penalties and interest.

Pro-Tip: Set calendar reminders for quarterly tax payments or automate payments through the IRS EFTPS system to avoid penalties.

Mixing Personal and Business Expenses: Keeping separate bank accounts and accurate records prevents IRS scrutiny.

Pro-Tip: Open a dedicated business bank account and use accounting software to track expenses in real time.

Overlooking Deductions: Not claiming eligible deductions can lead to higher tax liabilities.

Pro-Tip: Keep detailed records of all business-related expenses and consult a tax professional to ensure you maximize deductions.

Missing Deadlines: Late filings result in unnecessary fines and interest charges.

Pro-Tip: File early or use tax software with built-in deadline reminders to avoid last-minute stress.

Ignoring State Tax Requirements: Failing to comply with California’s tax laws can lead to additional penalties.

Pro-Tip: Check California's specific tax rules for self-employed individuals, including state franchise tax requirements, and plan accordingly.

Conclusion

Handling self-employment tax in California requires careful planning and adherence to federal and state tax laws. By understanding self-employment tax obligations, making quarterly payments, leveraging deductions, and staying compliant with filing deadlines, self-employed individuals can manage their tax responsibilities efficiently. Consulting a tax professional or using tax software can further streamline the process and help optimize tax savings.

NSKT Global offers expert tax guidance tailored for self-employed individuals. From helping you calculate estimated tax payments to maximizing deductions, their team ensures compliance while minimizing tax liabilities. Their professional services can save time, reduce errors, and provide peace of mind during tax season.

FAQs About Self-Employment Tax in California

- What is the current self-employment tax rate in California?

The self-employment tax rate is 15.3%, which includes 12.4% for Social Security (up to $176,100) and 2.9% for Medicare, with an additional 0.9% Medicare surtax for high earners.

- How do I calculate my net earnings for self-employment tax purposes?

Subtract all eligible business expenses from your total self-employment income to determine your net earnings.

- When are quarterly estimated tax payments due?

Quarterly estimated tax payments are due on April 15, June 16, September 15, and January 15 of the following year.

- Can I deduct business expenses to lower my self-employment tax?

Yes, you can deduct eligible business expenses such as office supplies, marketing costs, home office expenses, and travel to reduce your taxable income.

- What forms do I need to file for self-employment taxes in California?

You need to file Schedule SE (Form 1040) for federal self-employment tax and Form 540 for California state tax obligations.