Table of Contents

Curricular Practical Training (CPT) offers international students the opportunity to gain hands-on experience in their field of study while earning an income. However, many students overlook the tax implications of working in the U.S. on CPT. Without proper knowledge of tax laws, students may overpay taxes, miss out on potential refunds, or face compliance issues with the IRS.

Understanding tax residency status, filing obligations, and treaty benefits is crucial for ensuring accurate tax filing. Additionally, professional guidance can simplify the tax process, helping students avoid penalties and maximize their savings. Proper tax planning not only ensures compliance but also prepares students for future financial responsibilities in the U.S. tax system.

Understanding Curricular Practical Training (CPT)

CPT is a work authorization for F-1 students that allows them to gain practical experience related to their major. It must be an essential part of the curriculum and is often tied to internships, cooperative education programs, or other practical training.

Before starting employment, students must obtain authorization from their school’s Designated School Official (DSO). The DSO will ensure that the job aligns with the student’s academic program and issue a new Form I-20 reflecting CPT approval. CPT can be either part-time (up to 20 hours per week) during the academic year or full-time (more than 20 hours per week) during breaks.

Engaging in full-time CPT for 12 months or more can impact eligibility for Optional Practical Training (OPT) after graduation. Students who intend to use OPT should carefully plan their work experience duration.

Tax Residency Status: Resident vs. Nonresident Alien

Your tax obligations depend on your residency status for tax purposes. Most F-1 students are considered nonresident aliens for their first five calendar years in the U.S. This classification affects how their income is taxed and what deductions or credits they are eligible for.

After five years, students may become resident aliens if they meet the Substantial Presence Test, which evaluates the number of days spent in the U.S. in the current and past two years. Resident aliens are taxed like U.S. citizens and may qualify for additional tax benefits, whereas nonresident aliens face restrictions on deductions and credits.

How to Determine Residency Status:

- Nonresident Alien: If you have been in the U.S. for five years or less on an F-1 visa, you are considered a nonresident alien for tax purposes.

- Resident Alien: If you have stayed in the U.S. for more than five years and meet the Substantial Presence Test, you may be considered a resident for tax purposes.

Understanding your residency status is crucial, as it determines how much tax you owe and which tax forms you need to file.

Tax Obligations for Nonresident Aliens on CPT

As a nonresident alien working on CPT, you are required to pay federal and state income taxes on your earnings. The amount you owe depends on your income and the tax rates of the state where you work.

Key Tax Considerations:

- Social Security and Medicare taxes (FICA): Nonresident aliens on CPT are exempt from these taxes, meaning employers should not withhold them from paychecks. Informing your employer about this exemption is important to avoid incorrect deductions.

- Federal Income Tax Rates for 2024 (Taxes Filed in 2025):

|

Rate |

Income Brackets |

|

10% |

Up to $11,600 |

|

12% |

$11,601 to $47,150 |

|

22% |

$47,151 to $100,525 |

|

24% |

$100,526 to $191,950 |

|

32% |

$191,951 to $243,725 |

|

35% |

$243,726 to $609,350 |

|

37% |

$609,351 or more |

- If too much tax is withheld from your paycheck, you may be eligible for a refund after filing your tax return.

- If not enough tax is withheld, you may owe additional taxes when filing.

- Different states have varying tax rates, so it’s essential to check state tax requirements.

Essential Tax Forms for CPT Students

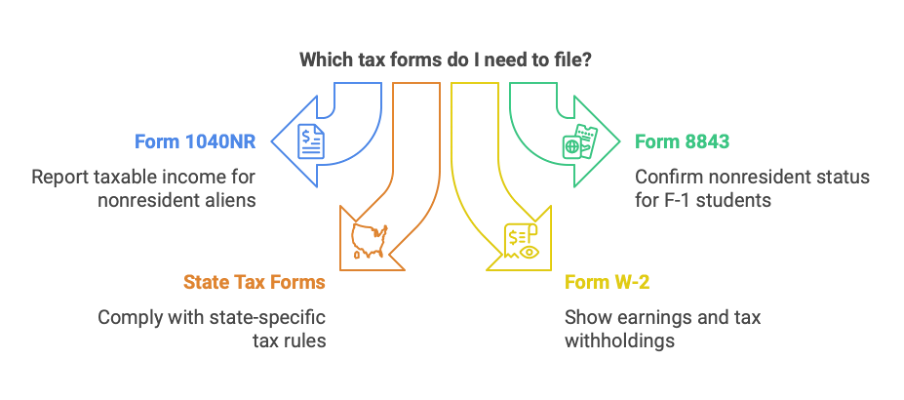

Filing taxes correctly is crucial for maintaining compliance and avoiding penalties. As a nonresident alien on CPT, you may need to file the following forms:

- Form 1040NR: Used to report taxable income for nonresident aliens.

- Form 8843: A required form for all F-1 students, even if they had no income, to confirm nonresident status.

- State Tax Forms: Each state has different tax rules, so check your state’s tax website to determine whether you need to file a state return.

- Form W-2: Issued by your employer to show your earnings and tax withholdings.

- Form 8233: If applicable, used to claim tax treaty benefits with your home country.

Claiming Tax Treaty Benefits

Many countries have tax treaties with the U.S. that reduce or eliminate certain taxes on CPT income. These treaties are designed to prevent double taxation and provide tax relief to international students. If your home country has a tax treaty in place, you may qualify for tax exemptions or reduced withholding rates, allowing you to retain more of your earnings.

How Tax Treaties Work:

- Tax treaties vary by country and specify what types of income are exempt or subject to lower tax rates.

- Some treaties fully exempt certain student earnings from taxation, while others provide a reduced tax rate.

- The IRS provides a list of current tax treaties, and it’s essential to check the specific provisions that apply to students from your country.

Steps to Claim Tax Treaty Benefits:

- Review the IRS tax treaty list to determine if your home country has an agreement with the U.S.

- Submit Form 8233 to your employer at the start of employment to claim treaty benefits. This prevents unnecessary tax withholding from your paycheck.

- Ensure your employer processes the exemption correctly to avoid overpayment.

- Report treaty exemptions when filing your tax return using Form 1040NR, ensuring that you claim the correct deductions and exemptions.

- Keep documentation of your treaty claim for future reference, as IRS audits may require proof of eligibility.

- Consult a tax professional if you are unsure about treaty eligibility or need assistance with filing, as incorrect filings can lead to IRS penalties.

Filing Deadlines and Penalties

Filing your tax returns on time is crucial to avoid penalties and maintain compliance with IRS regulations.

- Federal Tax Return Deadline: April 15, 2025, for income earned in 2024.

- Form 8843 Deadline: Also due by April 15, even if you have no income.

- Late Filing Penalties: Missing the deadline may result in fines, interest charges, and complications in future visa or Green Card applications.

Tips for Accurate Tax Filing

- Verify your tax residency before filing to determine whether you should use Form 1040NR or 1040 (for residents). Your residency status affects your tax obligations, deductions, and credits. Many F-1 students remain nonresident aliens for their first five years, but it’s essential to confirm this each tax season.

- Ensure proper tax withholding from your paycheck by checking your W-2 form. Employers sometimes withhold Social Security and Medicare taxes (FICA) from nonresident aliens in error. If these taxes were deducted, you should request a refund from your employer or file Form 843 to claim a refund from the IRS.

- Use tax preparation software such as Sprintax, which specializes in nonresident tax returns. Unlike general tax software, Sprintax ensures that nonresident students file the correct forms and claim eligible treaty benefits, reducing the risk of errors.

- Keep all tax documents like W-2s, 1042-S forms, and past tax returns for reference. These documents help ensure accuracy when filing your taxes and may be required if you need to amend your return or apply for future tax benefits.

- Claim treaty benefits if eligible to reduce tax liability and maximize refunds. Many countries have tax treaties with the U.S. that exempt certain earnings from taxation. If applicable, file Form 8233 with your employer to reduce tax withholding and claim exemptions on your tax return.

- File on time to avoid penalties and maintain a clean tax record for future immigration purposes. Late tax filings can result in fines and may impact future visa applications or Green Card eligibility. Mark key deadlines and ensure you complete your filing before April 15 each year.

Conclusion

Taxes as a CPT student may seem complex, but understanding your tax obligations ensures compliance with U.S. laws while maximizing potential refunds. By filing the correct forms, leveraging tax treaty benefits, and meeting deadlines, you can streamline the tax process and avoid unnecessary financial burdens.

NSKT Global specializes in helping international students navigate U.S. tax complexities. With expert guidance on tax residency, deductions, and treaty benefits, NSKT Global ensures that CPT students file accurately, avoid penalties, and maximize their tax savings. Whether you need assistance with tax preparation, filing, or refunds, NSKT Global provides tailored solutions to make the process seamless and stress-free.

FAQs About CPT Student Tax Obligations

Do CPT students need to file U.S. tax returns?

Yes, all F-1 students must file Form 8843, and those with CPT income must also file Form 1040NR.

Are CPT earnings subject to Social Security and Medicare taxes?

No, nonresident aliens are exempt from FICA taxes while on CPT. Employers should not deduct these taxes.

What is Form 8843, and do I need to file it?

Form 8843 is required for all F-1 visa holders, even if they have no income, to maintain compliance with IRS rules.

How can I benefit from tax treaties as a CPT student?

If your country has a tax treaty with the U.S., you may qualify for reduced or exempted tax on CPT earnings. Submit Form 8233 to your employer to claim benefits.

What happens if I don’t file my tax returns while on CPT?

Failure to file can result in penalties, loss of potential tax refunds, and issues with future visa or Green Card applications.