Table of Contents

The rise of cryptocurrency has brought significant positive changes in the financial landscape, but it has also become a breeding ground for fraudulent activities. Revenue in 2024 from crypto scams was at least $9.9 billion, although the figure could rise to a record high of $12.4 billion once more data becomes available, it said to Chainanalysis. This surge in fraud highlights the growing complexity and risks within the crypto ecosystem. With its decentralized nature, cryptocurrencies like Bitcoin, Ethereum, and altcoins offer both financial freedom and a veil of anonymity, making them attractive to criminals.

Forensic accountants have become critical in the fight against crypto crime, using cutting-edge blockchain analytics and chain analysis tools to trace transactions, expose fraud, and secure valuable evidence for law enforcement agencies. These experts are not only tracing stolen funds but also unmasking fraudulent schemes, money laundering operations, and tax evasion activities. As the digital economy continues to expand, forensic accountants play a vital role in safeguarding financial integrity by providing transparency in an otherwise opaque system.

What is Cryptocurrency and Blockchain?

Cryptocurrency refers to a digital or virtual currency that uses cryptography for security, making it resistant to counterfeiting. The most prominent cryptocurrency is Bitcoin, but there are thousands of others, such as Ethereum, Litecoin, and Ripple. Cryptocurrencies operate on blockchain technology, which is a decentralized ledger that records transactions across multiple computers. This technology ensures that the data is immutable, transparent, and public, making it a double-edged sword. While the blockchain’s transparency is useful for legitimate purposes, it also opens the door for illicit activities.

Blockchain allows anyone to view the transaction history of crypto addresses. However, it is pseudonymous, meaning that while transaction details are visible, the identities behind the addresses are not. This combination of public transparency and private identity is what forensic accountants must navigate to track fraudulent activities effectively.

Scenarios Where Forensic Experts are Employed for Tracking Crypto Fraud

Forensic accountants are often called upon in a variety of situations to track cryptocurrency fraud, these include:

- Money Laundering: When illicit funds are moved through various crypto wallets and exchanges to obscure their origin, forensic accountants are employed to trace the funds back to the source, helping authorities dismantle money laundering operations.

- Ponzi Schemes and Fraudulent ICOs: In the world of cryptocurrency, Ponzi schemes and fraudulent initial coin offerings (ICOs) are common. Forensic accountants are crucial in investigating these schemes, tracing investments, and identifying the flow of funds.

- Theft and Cybercrime: When cryptocurrencies are stolen through hacking or other illicit means, forensic accountants work with law enforcement to track the stolen funds, uncover the identities of the hackers, and recover the assets.

- Tax Evasion: Tax authorities often employ forensic accountants to track crypto transactions to uncover hidden income or assets. These experts help identify discrepancies in tax filings and trace undeclared crypto wealth.

- Investigating Fraudulent Transactions: In some cases, forensic accountants are called in to investigate fraudulent transactions involving crypto payments, often linked to scams or fake businesses. By analyzing the blockchain, they can trace the funds and help victims recover their losses.

How Does The Forensic Process Work?

Forensic accountants employ a range of advanced tools and methodologies to track crypto transactions and uncover fraud. Let’s break down how forensic accounting professionals operate:

- Blockchain Explorers: Forensic accountants start their investigations with blockchain explorers, which allow them to navigate the public ledger and search for transaction histories tied to specific crypto addresses. Blockchain explorers can display details like wallet balances, transaction amounts, timestamps, and even the path funds take across various wallets.

- Chain Analysis Tools: These specialized software platforms are designed to analyze blockchain data at scale. Popular tools like Chainalysis, CipherTrace, and Elliptic are used to map relationships between different wallets, identify patterns, and highlight potential illicit activities. These tools help forensic accountants link multiple addresses, detect suspicious fund flows, and even uncover the movement of funds through mixers or anonymous exchanges.

- Address Tagging and Cluster Analysis: Forensic experts use address tagging to label wallet addresses associated with known criminal organizations or individuals. This process helps track the movement of illicit funds. Additionally, cluster analysis groups together addresses that may belong to the same individual or entity, making it easier to detect patterns of suspicious activity across a network of wallets.

- Cross-referencing Exchange Data: Cryptocurrency exchanges are subject to Know Your Customer regulations, which require them to gather personal information from users. Forensic accountants can cross-reference blockchain transactions with exchange data to identify the real-world individuals behind crypto wallets. This process helps create a clearer picture of fraudulent activity.

- Transaction Pattern Analysis: By studying transaction patterns, forensic accountants can uncover suspicious behavior. For example, large, rapid movements of funds or patterns of mixing may signal illegal activities. AI-driven tools also flag abnormal activity based on preset thresholds, such as unusually high trading volumes or abnormal patterns of deposit and withdrawal.

- Tracing Fiat Conversions: One key aspect of tracking cryptocurrency fraud is following the conversion of digital assets to fiat currency. Since most illicit activities involve converting crypto to traditional money, forensic accountants trace these conversion points, whether they happen through peer-to-peer (P2P) platforms, centralized exchanges, or physical transactions.

How Forensic Accountants Overcome Challenges in Tracking Crypto Transactions

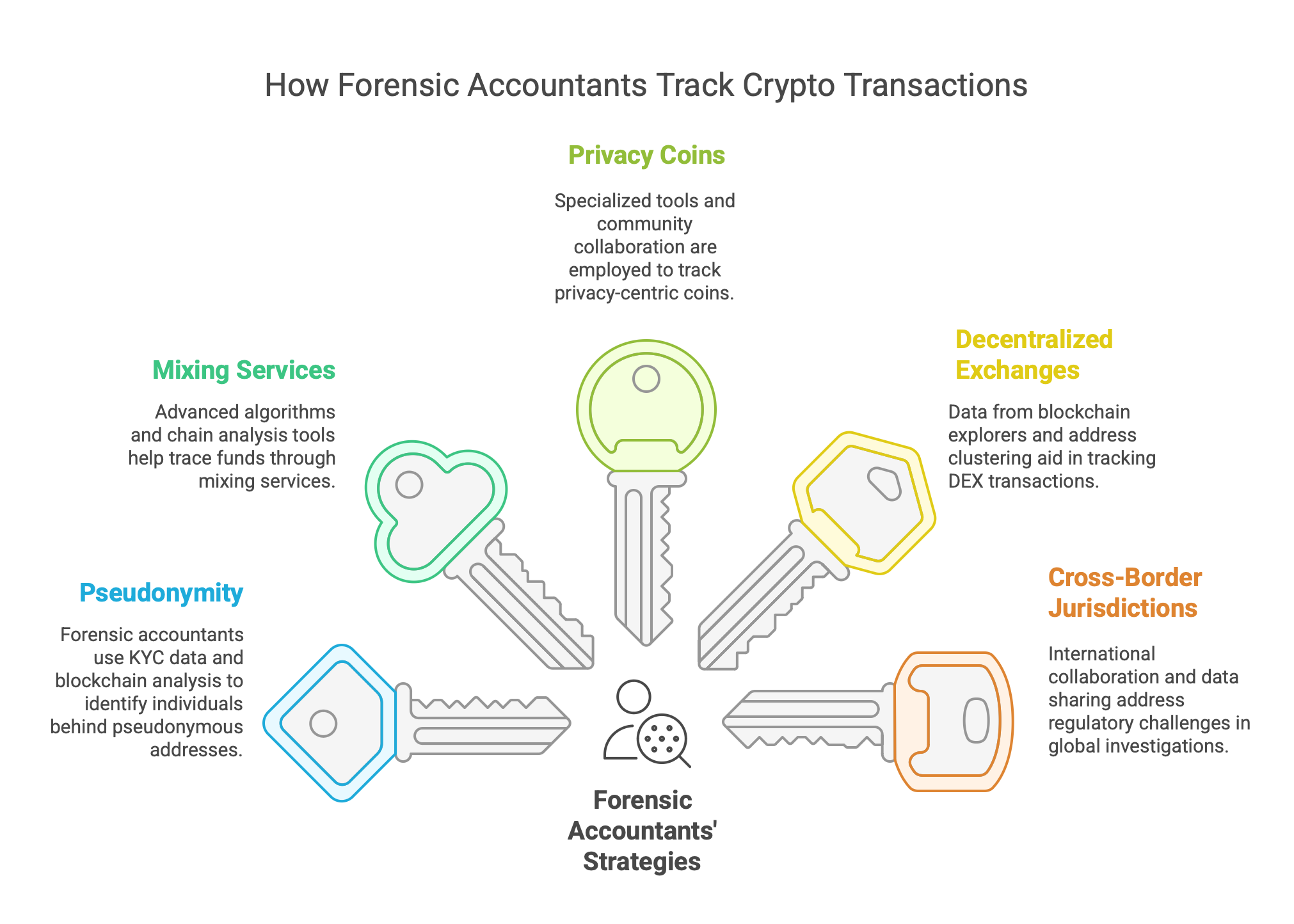

While the tools and techniques are highly effective, forensic accountants face several significant challenges when tracking crypto transactions. Here’s how they overcome them:

- Pseudonymity: Since blockchain addresses are pseudonymous, identifying the people behind them is one of the biggest challenges. Forensic accountants overcome this by collaborating with cryptocurrency exchanges, leveraging KYC data to match blockchain activity with real-world identities. Additionally, blockchain analysis tools often link addresses that share transaction patterns, helping narrow down potential suspects.

- Mixing and Tumbling Services: These services obfuscate the flow of funds by mixing crypto from different users and redistributing it, making tracing difficult. Forensic accountants counter this by using advanced algorithms designed to track transactions even through mixing services. Some chain analysis platforms are equipped with features to trace funds that pass through such services, identifying the "starting point" of mixed funds.

- Privacy Coins: Coins like Monero and Zcash are designed to be privacy-centric and obscure transaction details using advanced cryptographic methods. Although tracking these can be extremely challenging, forensic accountants use specialized tools and collaborate with blockchain communities to try and reverse-engineer these encrypted transactions. In some cases, forensic accountants may rely on exchanges that offer support for privacy coins to help track transactions in the real world.

- Decentralized Exchanges (DEXs): Unlike centralized exchanges, DEXs don't require users to provide personal information. This makes tracing transactions more complicated. Forensic accountants use data from blockchain explorers and address clustering to track funds as they move between DEXs and other platforms, often requiring a mix of on-chain and off-chain data.

- Cross-Border Jurisdictions: Cryptocurrencies operate globally, and this cross-border nature complicates investigations. Different countries have varying regulations on crypto transactions, which can slow down the process. To overcome this, forensic accountants often collaborate internationally with law enforcement agencies, sharing data and coordinating efforts to track cross-border illicit activities.

Conclusion

Forensic accountants play a crucial role in uncovering fraud in the world of cryptocurrency. By utilizing advanced tools like blockchain explorers, chain analysis software, and transaction pattern analysis, these experts help identify and track illicit activities. Despite challenges such as pseudonymity, mixing services, and privacy coins, forensic accountants continue to evolve their techniques, ensuring that crypto fraud is detected and exposed. As the cryptocurrency landscape grows, the expertise of forensic accountants will be vital in keeping the digital economy secure.

NSKT Global offers specialized services to address the complexities of tracking cryptocurrency transactions and uncovering fraud. With a team of experienced forensic accountants and blockchain experts, NSKT Global employs state-of-the-art tools and methodologies to trace digital assets across blockchain networks. Their expertise extends to investigating fraudulent transactions, identifying patterns in money laundering activities, and recovering stolen funds. By providing comprehensive and transparent analysis, NSKT Global ensures that businesses and law enforcement agencies can navigate the complexities of the crypto world with confidence. Our tailored solutions can help you mitigate risks, stay compliant, and safeguard your assets in an increasingly digital financial landscape.

FAQs About Tracking Crypto Transactions

What are blockchain explorers, and how do they help forensic accountants?

Blockchain explorers are tools that allow forensic accountants to view and analyze blockchain transactions. They provide detailed information about the movement of funds between addresses, helping investigators trace suspicious activity.

How do chain analysis tools work to link crypto transactions?

Chain analysis tools use algorithms to trace the flow of funds across different crypto wallets and exchanges. These tools can identify patterns in transactions, helping forensic accountants link seemingly unrelated addresses to a single entity or individual.

What challenges do forensic accountants face when tracing cryptocurrencies?

The main challenges include pseudonymity, the use of mixing services, decentralized exchanges, privacy coins, and cross-border regulations. Forensic accountants must use a combination of on-chain and off-chain data, and often collaborate internationally to overcome these hurdles.

How does KYC information from exchanges support crypto investigations?

KYC (Know Your Customer) data helps forensic accountants link crypto transactions to real-world individuals. This information is critical for connecting addresses on the blockchain with specific users, aiding investigations into fraudulent activities.

What future trends may improve the tracking of crypto fraud?

Advancements in AI, machine learning, and blockchain analytics will continue to improve the ability of forensic accountants to track crypto transactions. Additionally, increasing regulatory oversight and international collaboration will make it easier to trace cross-border crypto fraud.