Table of Contents

In today’s complex financial environment, organizations face a myriad of challenges, with fraud being a significant concern that can lead to substantial financial losses and reputational damage. Forensic accounting has emerged as a vital tool in identifying, investigating, and preventing fraudulent activities. By integrating accounting expertise with investigative skills, forensic accountants play a crucial role in maintaining the integrity of financial systems.

What Is Forensic Accounting?

Forensic accounting is a specialized field that combines accounting, auditing, and investigative techniques to examine financial records for signs of fraud or financial misconduct. Often referred to as "financial detectives," forensic accountants meticulously analyze financial data to uncover discrepancies and reconstruct transactions to expose illicit activities.

Forensic accountants go beyond traditional accounting roles by providing litigation support, presenting financial evidence in court cases, and assisting law enforcement in financial crime investigations. Their expertise is crucial in detecting financial statement fraud, embezzlement, money laundering, and tax evasion. With a keen eye for detail and a deep understanding of financial regulations, forensic accountants bridge the gap between accounting and legal proceedings, ensuring that fraudulent activities are identified and addressed efficiently.

Key Techniques and Tools in Fraud Detection

Forensic accountants employ a variety of techniques and tools to detect fraud:

- Financial Ratio Analysis: By comparing financial ratios such as profitability, liquidity, and solvency against industry benchmarks, forensic accountants can identify anomalies that may indicate fraudulent activity. For instance, an unexpected decline in gross profit margin could signal potential issues.

- Data Analytics: Advanced technologies, including machine learning (ML), artificial intelligence (AI), and automation, are utilized to analyze large datasets. These tools help in detecting patterns, inconsistencies, or unusual transactions that may suggest fraud.

- Benford’s Law Analysis: This statistical method examines the frequency distribution of leading digits in numerical data. Deviations from the expected distribution can indicate manipulation or fabrication of financial information.

- Traceable Transactions: Forensic accountants meticulously track the flow of funds between accounts, departments, or entities to identify unauthorized or suspicious transactions.

- Interviews and Interrogations: Conducting interviews with employees and stakeholders helps gather insights and corroborate information, aiding in the reconstruction of events and identification of fraudulent activities.

The Role of Forensic Accountants in Fraud Detection

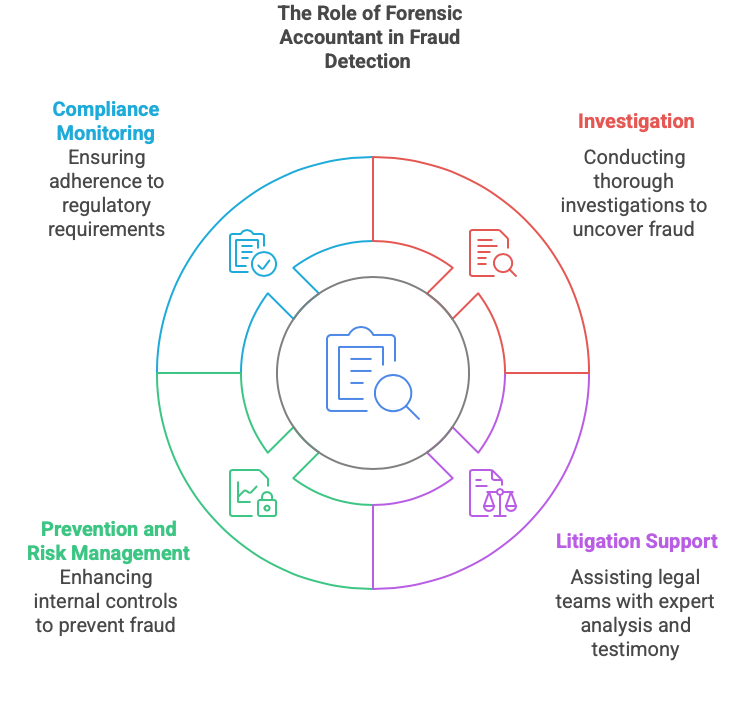

Forensic accountants serve as the frontline defenders against financial fraud. Their roles include:

- Investigation: Upon suspicion or detection of fraud, forensic accountants conduct thorough investigations to determine the extent of the fraud, identify perpetrators, and gather evidence.

- Litigation Support: They assist legal teams by providing expert analysis, preparing reports, and testifying in court to explain complex financial matters in an understandable manner.

- Prevention and Risk Management: By assessing an organization's internal controls and risk management systems, forensic accountants recommend improvements to prevent future fraudulent activities.

- Compliance Monitoring: Ensuring that organizations adhere to regulatory requirements and internal policies is another critical function, helping to mitigate the risk of fraud.

Their expertise is invaluable in navigating the complexities of financial data and legal standards, making them essential in maintaining organizational integrity.

Scenarios Where Forensic Accountants Should Be Employed

Forensic accountants are indispensable in various situations, including:

- Mergers and Acquisitions Due Diligence: Before companies undergo mergers or acquisitions, they must ensure that the financial health of the target company is accurately represented. Any hidden liabilities, inflated revenues, or misrepresented assets can lead to significant financial losses.

How forensic accountants help: They conduct a thorough review of financial statements, validate asset valuations, and examine contracts and regulatory compliance to ensure no financial discrepancies exist.

- Fraud Investigations: Companies and organizations may encounter instances of embezzlement, financial statement fraud, asset misappropriation, or accounting irregularities that raise suspicion of fraud.

How forensic accountants help: They employ forensic auditing techniques to track suspicious transactions, analyze financial records for inconsistencies, and conduct interviews with employees and stakeholders to gather evidence and establish fraud patterns.

- Litigation Support in Legal Disputes: In cases of financial disputes, companies or individuals may face lawsuits involving breach of contract, financial misrepresentation, shareholder disagreements, or financial losses due to fraudulent activities.

How forensic accountants help: They quantify financial damages, trace fund movements, prepare expert forensic reports, and testify in court to provide a clear and detailed financial analysis to support legal proceedings.

- Insurance Claims Assessment: Businesses and individuals often file insurance claims for losses due to property damage, business interruption, or employee theft. Insurance fraud, such as exaggerated claims, is a growing concern.

How forensic accountants help: They review financial statements, verify claim legitimacy, and ensure that insurance payouts correspond accurately to the financial impact of the damage.

- Divorce and Matrimonial Disputes: Financial disputes in divorce cases often arise due to hidden assets, income manipulation, and improper financial disclosures, which can significantly impact alimony and settlements.

How forensic accountants help: They analyze bank accounts, tax returns, business ownership structures, and financial statements to uncover concealed assets and ensure fair and equitable settlements.

- Tax Fraud and Evasion Investigations: Businesses and individuals may attempt to evade taxes by underreporting income, inflating expenses, or hiding taxable assets. Tax authorities often investigate suspected cases of tax fraud.

How forensic accountants help: They analyze tax records, detect financial discrepancies, track offshore accounts, and work alongside tax authorities to recover unpaid tax liabilities and impose legal consequences where applicable.

- Corporate Governance and Internal Control Audits: Organizations must ensure that their internal financial control systems are strong enough to prevent fraud, mismanagement, and regulatory violations.

How forensic accountants help: They assess internal financial policies, identify weak points in internal controls, and recommend corrective measures to enhance transparency and financial governance.

- Whistleblower and Employee Misconduct Investigations: Employees or insiders may report unethical financial practices, such as fraudulent billing, revenue misstatements, or money laundering.

How forensic accountants help: They independently verify whistleblower claims, trace financial misconduct, and provide organizations with unbiased reports that support corrective measures or legal action.

- Bankruptcy and Financial Distress Analysis: When businesses experience financial distress or file for bankruptcy, forensic accountants assess whether fraudulent activities contributed to their insolvency.

How forensic accountants help: They conduct forensic audits, identify misappropriated funds, uncover fraudulent financial reporting, and assist in asset recovery efforts to mitigate financial losses.

Employing forensic accountants in these scenarios ensures a thorough and objective analysis, aiding in informed decision-making and the resolution of complex financial issues.

Overcoming Common Challenges in Forensic Fraud Detection

Despite their critical role, forensic accountants face several challenges, along with strategies to overcome them:

- Complex Fraud Schemes: Fraudsters continually develop sophisticated methods, making detection more difficult. Forensic accountants counteract this by staying updated on emerging fraud techniques, utilizing advanced forensic tools, and collaborating with cybersecurity experts to identify and prevent financial crimes.

- Data Overload: The vast amount of financial data can be overwhelming, necessitating advanced tools and techniques for effective analysis. Forensic accountants leverage artificial intelligence (AI) and data analytics to filter and detect irregular patterns efficiently, allowing them to focus on high-risk transactions.

- Resource Constraints: Limited access to necessary tools, technology, or personnel can hinder the effectiveness of forensic investigations. To overcome this, forensic accountants prioritize automation in fraud detection, utilize forensic accounting software, and collaborate with multidisciplinary teams to enhance investigative capabilities.

- Legal and Regulatory Hurdles: Navigating different legal systems and regulatory environments, especially in multinational investigations, adds complexity to the process. Forensic accountants mitigate this by ensuring compliance with global financial regulations, staying updated on evolving laws, and working closely with legal experts to adapt strategies accordingly.

Addressing these challenges requires continuous learning, adaptation, and investment in advanced technologies and methodologies to enhance fraud detection and prevention efforts.

Future Trends in Forensic Accounting and Fraud Detection

The field of forensic accounting is evolving, with several trends shaping its future:

- Advanced Data Analytics: The integration of AI and ML algorithms enhances the ability to detect complex fraud patterns and anomalies in large datasets.

- Blockchain Technology: As blockchain adoption increases, forensic accountants will need to develop expertise in analyzing transactions within these decentralized ledgers.

- Cybersecurity Collaboration: With the rise of cyber fraud, collaboration between forensic accountants and cybersecurity professionals becomes essential to detect and prevent digital financial crimes.

- Regulatory Changes: Staying abreast of evolving regulations and standards will be crucial, as governments and regulatory bodies implement stricter measures to combat fraud.

Embracing these trends will equip forensic accountants to effectively address emerging challenges in fraud detection and prevention.

Conclusion

Forensic accounting plays an indispensable role in detecting, investigating, and preventing fraud within organizations. By employing a combination of financial expertise, investigative skills, and technological advancements, forensic accountants ensure financial transparency and regulatory compliance. As fraud schemes become increasingly complex, the demand for skilled forensic accountants will continue to grow, making their role more critical than ever.

FAQs About Forensic Accounting in Fraud Detection

- How does forensic accounting differ from traditional auditing in fraud detection?

Forensic accounting focuses on investigating financial discrepancies, fraud detection, and legal disputes, whereas traditional auditing primarily ensures financial statement accuracy and regulatory compliance. - What are some common techniques forensic accountants use to detect fraud?

Forensic accountants use data analytics, financial ratio analysis, Benford’s Law, and transaction tracing to uncover fraudulent activities. - How do forensic accountants maintain objectivity during an investigation?

They follow ethical guidelines, rely on data-driven analysis, and avoid personal biases to ensure objective and unbiased fraud investigations. - Can you provide examples of fraud cases that were solved using forensic accounting?

Cases such as the Enron scandal and Bernie Madoff’s Ponzi scheme were uncovered through forensic accounting, highlighting its significance in fraud detection.

5. What future trends are likely to impact forensic accounting and fraud detection?

Technologies like AI, blockchain, and enhanced regulatory frameworks are expected to shape the future of forensic accounting, making fraud detection more efficient and accurate.