Table of Contents

Imagine a business environment where your entrepreneurial dreams can flourish with protection, flexibility, and strategic advantages. This is the essence of forming a Limited Liability Company (LLC) in Florida – a journey that transforms your business vision into a structured, legally recognized entity.

The process of opening an LLC is more than a mere administrative task. It represents a profound commitment to creating a robust, accountable business structure that offers personal asset protection while providing remarkable operational flexibility.

Navigating the LLC Formation Process

Forming a Limited Liability Company (LLC) is a structured process that demands meticulous planning and attention to detail. Unlike basic business registrations, LLC formation involves strategic decision-making, comprehensive documentation, and a focus on long-term compliance.

Step 1: Comprehensive Information Collection

The first step in the LLC formation process is gathering and organizing all necessary information. A carefully chosen business name is essential to reflect your brand while meeting legal requirements. You also need to outline detailed member information, clearly define the purpose of the business, and draft a robust operating agreement that specifies governance and ownership structures. Additionally, designating a registered agent to handle official correspondence is a critical part of the setup.

Step 2: Dynamic Reporting and Compliance

The responsibilities of forming an LLC do not end with registration. Ongoing compliance is vital to maintain the company’s legal standing. This includes accurate record-keeping, filing annual reports, and updating membership information as changes occur. Each state has specific regulations, and adhering to them is crucial to avoid penalties or dissolution.

Step 3: Technological and Procedural Considerations

Modern LLC formation benefits significantly from leveraging advanced tools and systems. Implementing digital record-management solutions can streamline documentation and ensure accuracy. Clear internal governance protocols help manage roles and responsibilities effectively, while robust processes for updating and maintaining records enable smooth adaptation to evolving regulatory requirements.

Step 4: A Strategic and Dynamic Approach

LLC formation is not merely an administrative task—it is a foundational step that sets the tone for the business’s operational success. By focusing on detailed documentation, maintaining compliance, and integrating modern technological solutions, businesses can establish a strong and adaptable framework to support their growth.

Forming an LLC in Florida involves several key forms that must be accurately completed and submitted to comply with state regulations. Below is a breakdown of the essential forms and their purposes to guide you through the process:

Steps to Form LLC in Florida

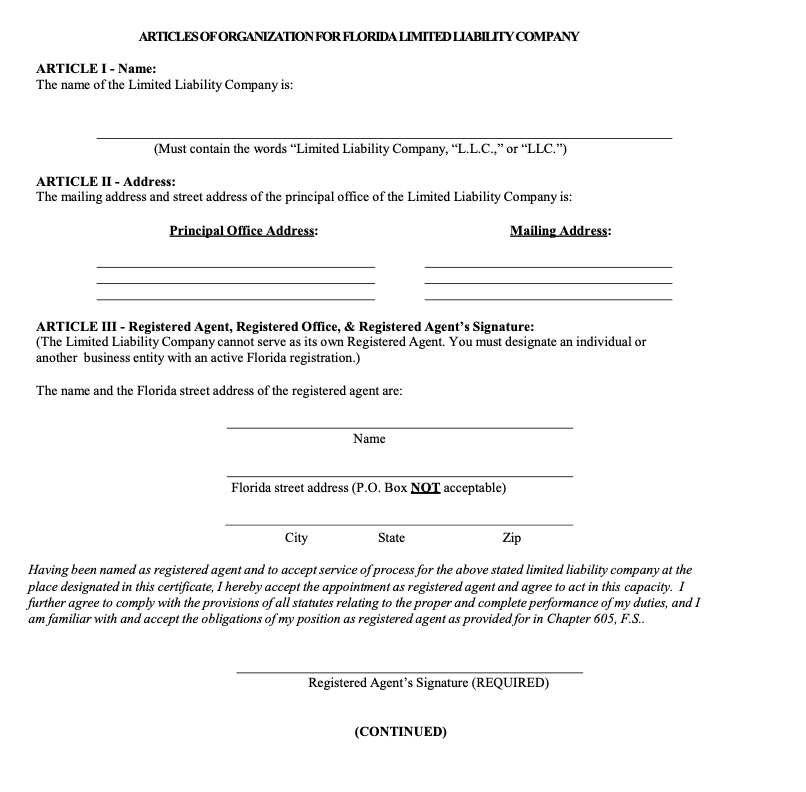

1. Articles of Organization

- Purpose: This is the primary document that officially registers your LLC with the state of Florida.

Details to fill:

Limited Liability Company Name (Section Reference: s.605.0201(1), F.S.)

- What to Fill: Enter the full name of your LLC.

- "Limited Liability Company," LLC, or L.L.C.

- For professional LLCs: "Professional Limited Liability Company," P.L.L.C., or PLLC.

Tip: Use the Florida Division of Corporations name search tool to confirm availability.

Principal Place of Business Address (Section Reference: s.605.0201(1)(b), F.S.)

- What to Fill: Provide the physical street address of the LLC’s principal office.

- Must be a street address (no P.O. Boxes allowed).

Mailing Address (if applicable) (Section Reference: s.605.0201(1)(b), F.S.)

- What to Fill: If your mailing address is different from your principal place of business, enter the mailing address here.

- A P.O. Box is acceptable in this section.

Registered Agent Name and Address (Section Reference: s.605.0201(1)(c) & s.605.0113(3), F.S.)

- What to Fill:

- Enter the full name of the registered agent.

- Provide the physical street address of the registered agent’s office in Florida.

- A P.O. Box is not allowed here.

- Registered Agent’s Signature:

- The registered agent must sign to confirm acceptance of their role.

- If filing online, the registered agent must type their name as an electronic signature.

Tip: If using a professional service, attach their signed consent form.

Limited Liability Company Purpose (Section Reference: s.605.0201(1)(d), F.S.)

- What to Fill:

- For Professional LLCs: State the specific professional purpose (e.g., law practice, medical services).

- For non-professional LLCs: This section is optional, but you may include a general business purpose for clarity.

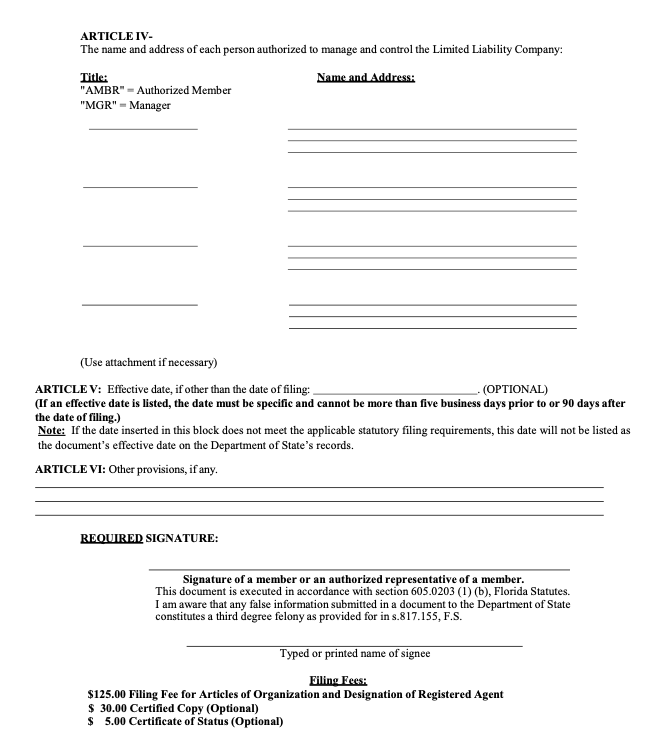

Manager/Authorized Representative (Optional) (Section Reference: s.605.0201(1)(e) & s.605.0102(8), F.S.)

- What to Fill:

- List the names and street addresses of the LLC’s Managers (MGR) or Authorized Representatives (AR).

- A Manager is someone designated to manage a manager-managed LLC.

- An Authorized Representative is someone authorized to act on behalf of the LLC for filings.

Tip: Do not list members in this section.

Effective Date (Section Reference: s.605.0201(1)(f), F.S.)

- What to Fill:

- Specify an effective date if you want the LLC’s existence to begin on a date other than the filing date.

- The effective date can be up to 5 business days prior to filing or up to 90 days after filing.

- For LLCs formed between October 1 and December 31, consider setting January 1 as the effective date to avoid filing an annual report the following year.

Signature of Authorized Representative (Section Reference: s.605.0201(1)(g), F.S.)

- What to Fill:

- At least one authorized representative must sign the Articles of Organization.

- If filing online: Type the authorized representative’s name as an electronic signature.

Tip: Signing confirms the accuracy and compliance of the submitted information.

Correspondence Name and Email (Section Reference: Administrative Requirement)

- What to Fill:

- Enter the name and valid email address for correspondence.

- This email will receive the filing acknowledgment, certification, and all future notifications.

Optional Add-Ons (Not Required)

- Certificate of Status

- Fee: $5.00

- Provides official proof of the LLC’s current status and compliance.

- Certified Copy

- Fee: $30.00

- Includes a filed-stamped copy of the Articles of Organization for record-keeping purposes.

Annual Report Notice (Section Reference: s.605.0212(1), F.S.)

- Requirement:

- All LLCs must file an Annual Report every year to maintain an active status.

- Filing period: January 1 to May 1.

- Failure to file results in administrative dissolution.

Summary Table of Sections and Information:

|

Section |

Details to Provide |

Reference |

|

LLC Name |

Unique name with "LLC" or "PLLC" |

s.605.0201(1), F.S. |

|

Principal Place of Business Address |

Physical street address (no P.O. Box) |

s.605.0201(1)(b), F.S. |

|

Mailing Address |

Optional, if different (P.O. Box allowed) |

s.605.0201(1)(b), F.S. |

|

Registered Agent Name & Address |

Name, physical address, and signature of the agent |

s.605.0201(1)(c), F.S. |

|

Purpose (Professional LLCs only) |

Single professional purpose (e.g., accounting, law) |

s.605.0201(1)(d), F.S. |

|

Manager/Authorized Representative |

Names and addresses of managers or authorized representatives |

s.605.0201(1)(e), F.S. |

|

Effective Date |

Optional; specify date within allowed range |

s.605.0201(1)(f), F.S. |

|

Signature of Authorized Representative |

Signature of at least one authorized representative |

s.605.0201(1)(g), F.S. |

|

Correspondence Email |

Valid email for official notifications |

Administrative Rule |

By following these section references and filling out the necessary details, you can ensure that your Florida LLC Articles of Organization comply fully with state law.

How to File:

- Online: Use the Florida Division of Corporations’ website: https://efile.sunbiz.org/scripts/coretype.exe

- Mail: Send the completed form to the provided address on the Florida Department of State’s website.

Reference image:

2. Registered Agent Designation

Purpose: Appoints a registered agent to receive legal and state-related documents.

Sections to Fill and Details:

- Registered Agent Name:

- Provide the full name of the individual or business entity serving as the registered agent.

- Physical Address:

- Enter the street address where the agent can receive documents during business hours. P.O. boxes are not allowed.

- Agent Consent:

- If the registered agent is an individual or a professional service, they must provide a signed consent form acknowledging their role.

Note: The Registered Agent Designation is typically included within the Articles of Organization form but must be completed carefully.

3. Operating Agreement

Purpose: Defines the internal structure, management, and rules for the LLC. While not required by Florida law, it is strongly recommended.

Sections to Fill and Details:

- Member Roles and Responsibilities:

- Specify each member’s role (e.g., managing member, silent investor) and their responsibilities.

- Ownership Structure:

- Define ownership percentages or contributions for each member.

- Profit and Loss Distribution:

- Outline how profits and losses will be shared among members (e.g., proportional to ownership).

- Decision-Making Protocols:

- Clarify voting rights and how decisions will be made (e.g., majority vote, unanimous agreement).

- Member Addition/Removal Procedures:

- Establish the process for adding or removing LLC members.

- Dissolution Guidelines:

- Provide steps to dissolve the LLC if necessary.

Keep this document in your LLC’s records for internal use.

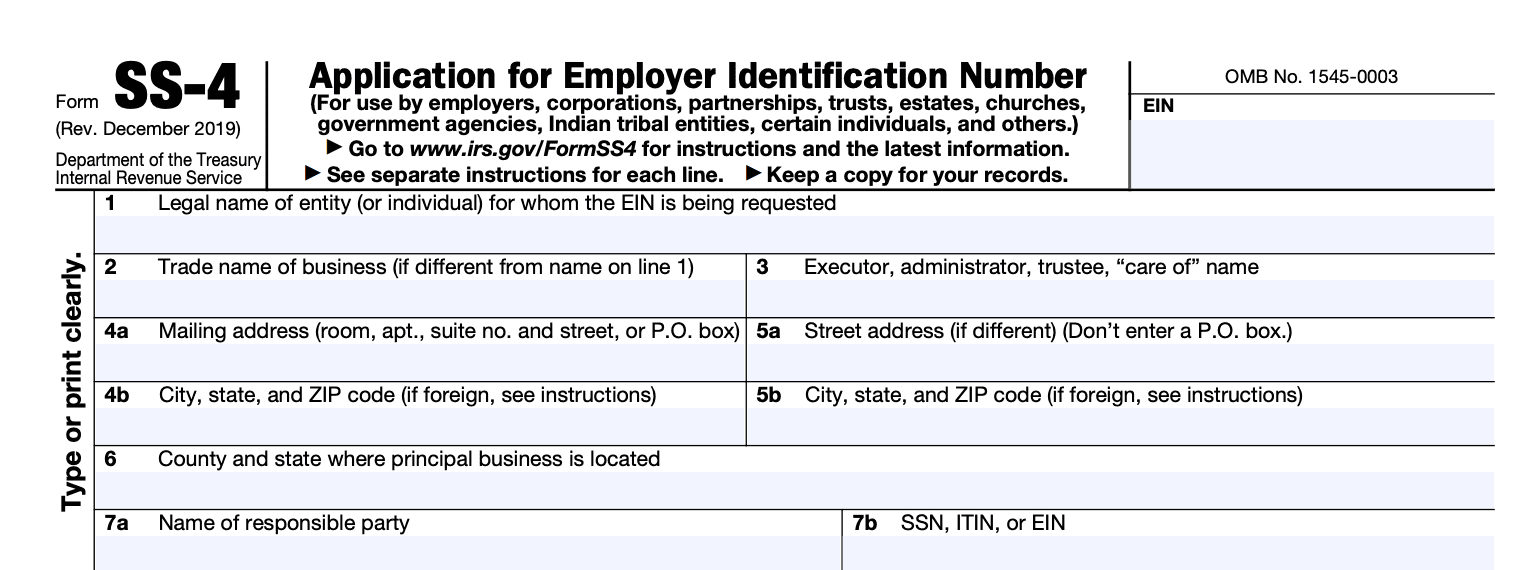

4. Employer Identification Number (EIN) Application (Form SS-4)

Purpose: Obtains a federal tax ID number required for hiring employees, opening a business bank account, and filing taxes.

Sections to Fill and Details:

- LLC Name and Address

- Provide the official name and mailing address of your LLC.

- Responsible Party

- Include the name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) of the LLC’s responsible party (typically the owner or managing member).

- Type of Entity

- Select "Limited Liability Company (LLC)".

- Reason for Applying:

- Indicate why you’re applying (e.g., starting a new business).

- Business Activities

- Provide a brief description of your business activities or industry.

- How to File

- Apply online via the IRS website (immediate EIN issuance) Or mail the completed Form SS-4 to the IRS.

Filing Fee: None.

5. Business Licenses and Permits

- Purpose: Ensures compliance with local and state regulations based on the nature of your business.

- Details Required: Depends on your industry, but common licenses include a general business license, sales tax permit, and zoning permits.

- How to Apply: Check with local county and city authorities for specific requirements.

By completing these essential forms and staying up-to-date with annual compliance requirements, you can successfully establish and maintain your LLC in Florida. Proper documentation and timely submissions are crucial for avoiding penalties and ensuring your business operates smoothly under state law.

Compliance for Filing Annual Report

Annual Report

The Annual Report form is an online-only document filed through the Florida Division of Corporations. This form ensures that the state's records remain accurate and up-to-date regarding your LLC. Below is a detailed breakdown of the form's sections, the information required, and additional considerations.

LLC Name

- Purpose: Confirm your LLC's current legal name as registered with the Florida Division of Corporations.

- What to Do:

- Verify the LLC name already displayed on the form.

- If you need to change the name of the LLC, you cannot do so via the Annual Report. You must file Articles of Amendment separately.

Principal Place of Business

- Purpose: Update or confirm the physical location of your LLC's main office.

- What to Do:

- Enter the physical street address (no P.O. Boxes allowed).

- Include:

- Street address

- City

- State

- ZIP code

Mailing Address (If Applicable)

- Purpose: Provide a separate mailing address if it differs from the principal business address.

- What to Do:

- A P.O. Box is allowed here.

- Include:

- Street/P.O. Box

- City

- State

- ZIP code

Registered Agent Information

- Purpose: Confirm or update the Registered Agent who accepts legal documents on behalf of your LLC.

- Details Required:

- Registered Agent Name: Must be an individual or a registered business entity.

- Registered Agent Address:

- Physical street address in Florida (no P.O. Boxes allowed).

- Consent of Registered Agent:

- If changing the Registered Agent, the new agent must consent to the appointment.

- Consent is typically verified electronically when submitting the form.

Names and Addresses of Managers or Authorized Representatives (Optional)

- Purpose: Update or confirm management information if applicable.

- What to Do:

- List individuals or entities with managerial roles, such as:

- Managers (MGR): Individuals managing a manager-managed LLC.

- Authorized Representatives (AR): Individuals authorized to act on the LLC’s behalf.

- Include:

- Full name of the manager or representative

- Physical street address (no P.O. Box allowed)

Note:

- You do not need to list LLC members.

- This section is optional, but many banks and agencies may require it for their records.

Federal Employer Identification Number (EIN)

- Purpose: Provide the LLC's EIN for tax and employment purposes.

- What to Do:

- Enter the EIN as issued by the IRS.

- If the LLC does not yet have an EIN, you must apply for one using Form SS-4 on the IRS website.

Business Email Address

- Purpose: Provide a valid email address for official communication.

- What to Do:

- Enter an active and monitored email address.

- This email will receive:

- Filing confirmations

- Reminders for the next Annual Report deadline

- Other official notices

Tip: Keep this email address updated to avoid missing important notifications.

Certificate of Status (Optional)

- Purpose: Request an official Certificate of Status for the LLC.

- What to Do:

- Check the box if you want to receive a Certificate of Status, which confirms the LLC's active status.

- Fee: $5.00

- Payment Section

- Purpose: Submit the Annual Report filing fee.

- Details:

- Standard Filing Fee: $138.75

- Late Penalty: $400 if filed after May 1.

- Payment Methods:

- Credit card

- Debit card

- E-check

Confirmation of Information

- Purpose: Ensure all information is correct and up-to-date.

- What to Do:

- Review all sections for accuracy before submitting.

- Confirm that all updates reflect the current state of your LLC.

Where to File the Annual Report

The Annual Report must be filed online through the official Florida Division of Corporations website:

- Sunbiz.org

What Happens After Filing?

- Confirmation: You will receive a filing acknowledgment at the email address provided.

- Updated Records: The Division of Corporations updates your LLC’s information in their public records.

Certificate of Status (if requested): This document will be sent electronically or by mail, depending on your preference.

Practical Recommendations for Entrepreneurs

Starting an LLC requires more than just filing paperwork; it demands strategic planning and ongoing attention to detail. Here are some practical recommendations for entrepreneurs:

Conduct Comprehensive Business Planning: Begin by outlining your business goals, market analysis, and financial projections. A solid business plan not only provides direction but is also crucial for securing investors or loans.

Seek Professional Guidance: Consulting with legal and financial experts ensures that your LLC formation complies with all relevant laws and regulations. Professionals can help you navigate complex tax structures and minimize legal risks.

Invest in Robust Record-Keeping Systems: Implement a reliable system for tracking business documents, financial records, and compliance filings. This ensures smooth operations and helps you stay organized as your business grows.

Stay Informed About Regulatory Changes: Keep up to date with changes in state and federal laws that may affect your LLC. This can help you avoid costly penalties.

Develop a Long-Term Strategic Vision: Focus on the future by setting long-term goals for growth and sustainability, allowing your business to adapt as market conditions evolve.

Conclusion

Forming an LLC in Florida is more than a legal process – it's a strategic decision that positions your business for success. By approaching LLC formation with diligence, professionalism, and strategic thinking, entrepreneurs can create a solid foundation for their business ventures. The journey of LLC formation is continuous, representing an ongoing commitment to business excellence, legal protection, and strategic growth.

FAQs

- What are the accepted modes of payment?

Payment can be made online using credit or debit cards. For mailed submissions, checks or money orders payable to the Florida Department of State are accepted. - How can I file the necessary forms?

Forms can be filed online via the Florida Department of State’s website- https://efile.sunbiz.org/scripts/coretype.exe or submitted by mail to the designated address. - Will I receive confirmation that my filing was accepted?

Yes, confirmation is sent via email for online filings or by mail for paper submissions. Check your provided contact information for updates. - How do I sign the online form?

Online forms require electronic signatures, which involve typing your name and acknowledging the terms digitally before submission. - What are the fees for LLC formation in Florida?

The filing fee for Articles of Organization is $125. Additional fees may apply for annual reports and business licenses. - Where can I do a name search for my LLC?

Use the Florida Division of Corporations’ online database to search for name availability and ensure compliance with naming rules. - What is the important contact number for assistance?

For queries, contact the Florida Division of Corporations at (850) 245-6052 during business hours. - What is the correct mailing address for filing forms?

Send forms and payments to:

Division of Corporations

Florida Department of State

P.O. Box 6327, Tallahassee, FL 32314 - How long does it take to form an LLC in Florida? Online filings are processed within 2-3 business days, while mailed submissions may take 7-10 business days, depending on workload.