Table of Contents

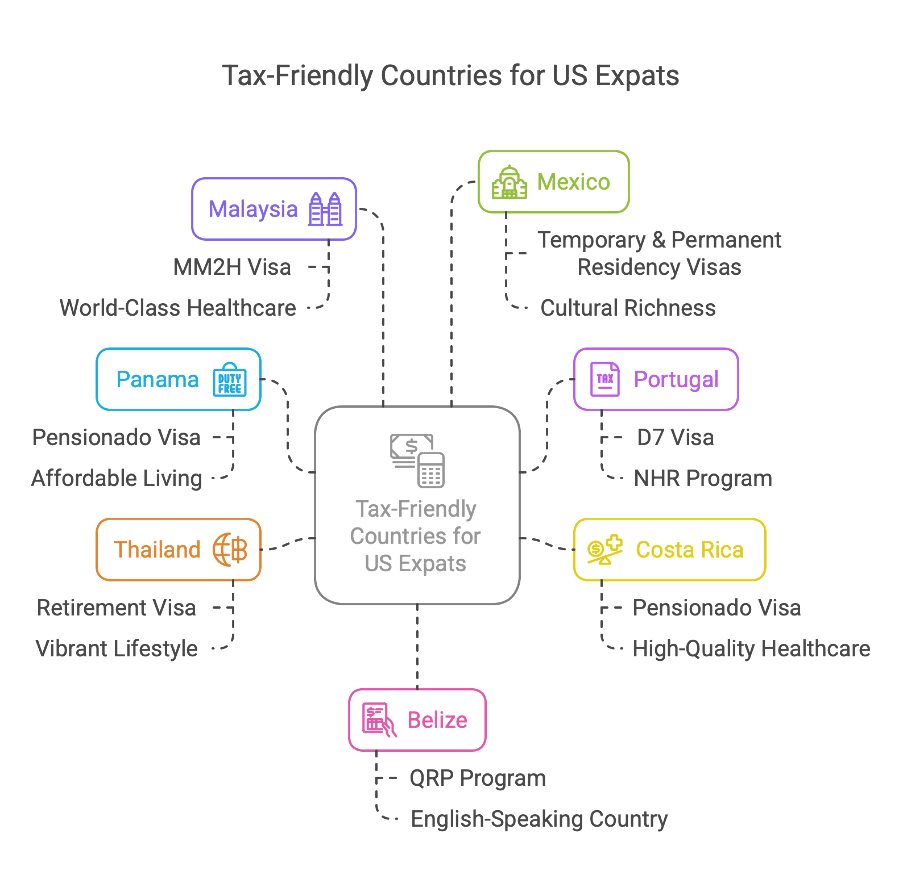

Retirement is the perfect time to embrace adventure, explore new cultures, and make the most of hard-earned savings. For US expats, choosing the right destination isn’t just about scenery and lifestyle, it’s also about smart financial planning. Some countries offer enticing tax benefits that allow retirees to keep more of their income, whether from pensions, Social Security, or investments. From tropical beaches to historic European cities, the right tax-friendly destination can make retirement both financially secure and fulfilling.

What Makes a Country Tax-Friendly for US Expats?

Not all countries are created equal when it comes to taxation, especially for US expats. Some nations impose high taxes on foreign income, while others provide exemptions that allow retirees to keep more of their hard-earned money. A tax-friendly country typically provides significant advantages that help retirees preserve their income and savings, ensuring financial stability and a more comfortable retirement lifestyle.

Read more: The Ultimate Guide to the U.S. Taxes for Expats

Key Features of Tax-Friendly Countries:

- No Tax on Foreign Income: Some countries do not tax income earned outside their borders, including US pensions and Social Security benefits.

- Tax Treaties with the US: Countries with tax treaties may offer reduced withholding rates, preventing double taxation.

- Low or No Wealth Taxes: Many tax-friendly destinations have minimal or no taxation on wealth, inheritance, or capital gains.

- Affordable Cost of Living: A lower cost of living can further enhance financial security, ensuring expats get the most out of their retirement funds.

- Residency and Visa Benefits: Countries with retirement visas and tax incentive programs for expats make it easier to establish long-term residency.

1. Panama: No Tax on Foreign Income

Key Facts:

- Top Cities: Panama City, Boquete, Coronado

- Visa Options: Pensionado Visa

- Living Costs: From $1,200 per month

- Number of US Expats: 25,000+

Panama is a well-known retirement haven with a territorial tax system, meaning only local income is taxed. With a stable economy, warm climate, and strong expat community, it is a top choice for retirees looking to stretch their savings. The country’s Pensionado Program is one of the most attractive retirement programs globally, offering discounts on healthcare, travel, and entertainment.

Benefits for Retirees:

- No Tax on Foreign Earnings: US retirees living in Panama are not taxed on income earned outside the country, including pensions and Social Security.

- Affordable Lifestyle: Low property taxes, inexpensive healthcare, and reduced utility costs make it a great option for retirees looking to maximize their income.

- Excellent Healthcare: Panama has a mix of public and private hospitals, with affordable healthcare services.

- Residency Perks: Pensionado Visa holders receive discounts on utility bills, airfare, entertainment, and medical expenses.

2. Portugal: Attractive NHR Tax Program

Key Facts:

- Top Cities: Lisbon, Porto, Algarve

- Visa Options: D7 Visa (Retirement Visa), NHR Program

- Living Costs: From $1,800 per month

- Number of US Expats: 10,000+

Portugal offers a mix of European charm, modern infrastructure, and tax-friendly policies. Its warm Mediterranean climate, rich history, and high safety rankings make it an ideal destination for retirees. The country is home to picturesque coastal towns, vibrant cities, and a welcoming expat community. Portugal’s efficient public transport system, affordable healthcare, and relatively low living costs compared to other Western European countries further enhance its appeal.

Benefits for Retirees:

- Foreign Pensions Taxed at 10%: Under the Non-Habitual Resident (NHR) program, foreign pension income is taxed at a flat rate of 10% for ten years, providing significant tax savings. Portugal also does not impose wealth, inheritance, or gift taxes.

- High Quality of Life: Portugal offers a relaxed pace of life, excellent public and private healthcare, and a strong sense of community.

- Low Property Prices: Compared to other European destinations, Portugal provides affordable housing options, particularly in regions like the Algarve and Porto.

- Residency Advantages: The D7 visa provides an easy pathway to residency, requiring proof of passive income rather than employment, making it accessible for many retirees.

3. Costa Rica: Low Taxes and Affordable Living

Key Facts:

- Top Cities: San José, Tamarindo, Atenas

- Visa Options: Pensionado Visa

- Living Costs: From $1,500 per month

- Number of US Expats: 50,000+

Costa Rica is a paradise for retirees seeking a low-cost, high-quality lifestyle in a beautiful natural setting. Known for its political stability, biodiversity, and warm hospitality, the country attracts expats worldwide. With its laid-back culture, stunning beaches, and lush rainforests, Costa Rica offers a unique balance of adventure and relaxation. The cost of living is significantly lower than in the US, and everyday expenses, including groceries, transportation, and healthcare, are highly affordable.

Benefits for Retirees:

- No Tax on Foreign Income: Pensions and Social Security benefits are not taxed, making it easier to stretch retirement savings.

- Pensionado Visa: Requires proof of at least $1,000 monthly income, granting residency along with discounts on entertainment, healthcare, and travel.

- High-Quality Healthcare: Costa Rica boasts a top-rated public and private healthcare system, offering world-class medical care at a fraction of US costs.

- Strong Expat Community: Popular areas like Atenas and Tamarindo have well-established expat communities, making the transition to life abroad smooth and enjoyable.

- Eco-Friendly Lifestyle: Costa Rica prioritizes sustainability, offering clean air, fresh food, and an overall healthier way of living.

4. Thailand: Expat-Friendly Tax Policies

Key Facts:

- Top Cities: Bangkok, Chiang Mai, Phuket

- Visa Options: Retirement Visa

- Living Costs: From $1,200 per month

- Number of US Expats: 30,000+

Thailand is one of the most affordable and culturally rich destinations for retirees. With its welcoming locals, warm climate, and modern amenities, Thailand provides an excellent balance between comfort and adventure. Whether retirees prefer the bustling energy of Bangkok, the cooler mountains of Chiang Mai, or the tropical beaches of Phuket, the country offers something for everyone. The cost of living is significantly lower than in the US, making Thailand ideal for those looking to maximize their retirement funds.

Benefits for Retirees:

- No Tax on Foreign Pensions: Thailand does not tax foreign retirement income unless it is remitted in the same year.

- Affordable Living: Rent, food, and daily expenses are far cheaper than in Western countries, allowing retirees to maintain a comfortable lifestyle on a modest budget.

- Top-Tier Healthcare: Thailand is home to world-class private hospitals, many of which are internationally accredited and staffed by English-speaking doctors at a fraction of US healthcare costs.

- Vibrant Lifestyle: Retirees can enjoy beautiful beaches, historic temples, a thriving street food culture, and a rich social scene, making every day feel like an adventure.

5. Malaysia: No Tax on Foreign Pensions

Key Facts:

- Top Cities: Kuala Lumpur, Penang, Johor Bahru

- Visa Options: Malaysia My Second Home (MM2H) Visa

- Living Costs: From $1,300 per month

- Number of US Expats: 20,000+

Malaysia is a top choice for retirees due to its low cost of living, modern infrastructure, and tax-friendly policies. Its Malaysia My Second Home (MM2H) program provides a long-term visa for expats who meet financial requirements, making it one of the most accessible destinations for retirement. Malaysia’s rich multicultural heritage, excellent healthcare system, and strong expat communities further enhance its appeal.

Benefits for Retirees:

- No Tax on Foreign Pensions: Malaysia does not tax foreign-sourced income, allowing retirees to keep more of their earnings.

- Affordable Living: Housing, transportation, and daily expenses are significantly lower than in Western countries.

- World-Class Healthcare: Malaysia offers high-quality healthcare at a fraction of US costs, with private hospitals catering to expats.

- Residency Perks: The MM2H visa grants multiple-entry residency for up to 10 years, with the option to renew.

- Vibrant Lifestyle: With its mix of beaches, urban centers, and nature retreats, Malaysia offers a diverse and enjoyable retirement experience.

6. Mexico: Tax Benefits and Proximity to the US

Key Facts:

- Top Cities: Mérida, Puerto Vallarta, San Miguel de Allende

- Visa Options: Temporary & Permanent Residency Visas

- Living Costs: From $1,400 per month

- Number of US Expats: 1.5 million+

Mexico is one of the most popular retirement destinations for US expats, offering a low cost of living, excellent healthcare, and a vibrant culture. With its close proximity to the US, retirees can easily visit family or return home when needed. From the colonial charm of San Miguel de Allende to the beachside paradise of Puerto Vallarta, Mexico provides a variety of living options for different lifestyles.

Benefits for Retirees:

- No Tax on Foreign Retirement Income: Mexico does not tax US pensions, Social Security, or investment income, allowing retirees to maximize their savings.

- Affordable Cost of Living: Housing, groceries, and transportation are significantly cheaper than in the US, making it possible to maintain a comfortable lifestyle on a modest budget.

- Excellent Healthcare: Mexico is home to world-class private hospitals, highly trained doctors, and affordable healthcare services at a fraction of US costs. Many hospitals in major cities cater specifically to expats.

- Retirement Visas: Both Temporary and Permanent Residency visas are available, with relatively simple application processes.

- Cultural Richness & Warm Climate: Retirees can enjoy historic towns, lively festivals, delicious cuisine, and sunny weather year-round.

7. Belize: Simple Tax System for Expats

Key Facts:

- Top Cities: Ambergris Caye, Placencia, Cayo District

- Visa Options: Qualified Retired Persons (QRP) Program

- Living Costs: From $1,600 per month

- Number of US Expats: 10,000+

Belize is a top choice for US retirees looking for a simple tax system, an English-speaking environment, and a laid-back Caribbean lifestyle. With its warm climate, beautiful beaches, and relaxed atmosphere, Belize provides an ideal setting for those seeking an affordable yet fulfilling retirement. The country's Qualified Retired Persons (QRP) Program offers special tax incentives, making it even more attractive for expats.

Benefits for Retirees:

- No Tax on Foreign Income: Belize does not tax pensions, Social Security, or foreign investment income, allowing retirees to keep more of their earnings.

- QRP Program Perks: Retirees with a minimum monthly income of $2,000 can enjoy duty-free imports on personal goods and a permanent residency pathway.

- English-Speaking Country: As the only English-speaking nation in Central America, Belize makes it easier for US retirees to adapt without language barriers.

- Tropical Lifestyle: Retirees can enjoy year-round warm weather, beautiful beaches, and vibrant marine life, making Belize a paradise for outdoor lovers.

Conclusion

Retiring abroad can be a dream come true, but choosing the right destination is key to maximizing financial security and quality of life. A tax-friendly country allows expats to keep more of their income, enjoy a lower cost of living, and access excellent healthcare while embracing a new lifestyle. Whether you’re drawn to stunning beaches, historic cities, or vibrant expat communities, there’s a perfect destination waiting for you.

Navigating international tax laws and residency requirements can be challenging, but NSKT Global is here to help. Our team of experts provides personalized tax planning, compliance guidance, and investment strategies to ensure a smooth transition into your ideal retirement. With the right planning, your dream retirement can be stress-free and financially rewarding.

FAQs About Tax-Friendly Countries for US Expats

Which country is the best for US retirees seeking low taxes?

Panama, Portugal, and Malaysia are among the best choices due to their no-tax policies on foreign income.

Do US expats still have to pay taxes to the IRS while living abroad?

Yes, US citizens must file taxes annually with the IRS, but they may qualify for exemptions like the Foreign Earned Income Exclusion (FEIE).

How does Panama’s Pensionado Program benefit retirees?

It offers permanent residency, tax breaks, and discounts on healthcare, utilities, and travel for retirees with a steady pension income.

What is Portugal’s Non-Habitual Resident (NHR) tax program?

The NHR program allows qualifying expats to pay a reduced 10% tax on foreign pension income for ten years.

Can US retirees access healthcare in tax-friendly countries?

Yes, many tax-friendly countries offer high-quality public and private healthcare at significantly lower costs than in the US.