Table of Contents

Student loan forgiveness programs have provided much-needed financial relief to many borrowers across the United States, offering a way to eliminate a significant portion of education debt under certain conditions. These programs are particularly beneficial for individuals working in public service or those who qualify for income-driven repayment plans. For many, the idea of having their student loans forgiven can be a major step toward financial freedom, reducing the burden of monthly payments and freeing up resources for other financial goals.

However, while student loan forgiveness can offer substantial relief, it’s important to recognize that there are often tax implications associated with the forgiveness process. Depending on the specific forgiveness program, the amount of debt forgiven could be treated as taxable income by the IRS, leading to an unexpected tax bill. In other words, while borrowers may be able to reduce or eliminate their outstanding loans, they could face new financial challenges come tax season if they are not adequately prepared.

What Is Student Loan Forgiveness?

Student loan forgiveness refers to the cancellation of some or all of a borrower’s federal student loan debt after meeting specific qualifications or criteria. These programs are designed to alleviate the financial burden faced by borrowers, particularly those who work in public service or commit to making long-term, consistent payments under income-driven repayment plans.

Types of Student Loan Forgiveness Programs

There are two types of programs namely:

Public Service Loan Forgiveness (PSLF)program: Under PSLF, federal student loans are forgiven after the borrower has made 120 qualifying monthly payments while working full-time in government or eligible non profit jobs. The program is aimed at providing relief to those who dedicate their careers to serving the public, such as teachers, healthcare workers, and social workers.

Since July 1, 2023, several improvements have also been made to the regulations around PSLF qualifying payments:

- Late and lump sum payments can be PSLF eligible

- Certain periods of deferment or forbearance can be PSLF eligible

- Consolidation will no longer restart your PSLF clock. Instead, borrowers who consolidate loans with differing amounts of qualifying payments will receive a weighted average of PSLF credit after consolidating.

- Relaxed full-time employment requirements to make it easier for some contract employees and those who work at least 30 hours per week for a qualifying employer to receive PSLF credit.

Note: Veterinarians may qualify for PSLF if they work in positions such as academia (every U.S. veterinary teaching hospital is a 501c3 nonprofit), shelters, zoos, aquariums, state veterinarians, military veterinarians, working for the USDA veterinarians or any other federal government agency, other university research positions, lab animal medicine, many wildlife organizations, or teaching in veterinary technician programs (excluding private school programs), just to name a few.

Income-Driven Repayment (IDR) forgiveness: income-Driven Repayment (IDR) plans provide an option for federal student loan borrowers to make payments based on their income and family size rather than the standard fixed payments. These plans are designed to make loan repayment more affordable, especially for those with lower earnings relative to their debt.

One of the key benefits of IDR plans is loan forgiveness after 20 or 25 years of qualifying payments. The specific repayment period before forgiveness depends on the plan:

- PAYE & IBR (for new borrowers after July 1, 2014): 20 years

- REPAYE & ICR (and IBR for older borrowers): 25 years

Once the borrower reaches the required number of years, any remaining balance on their student loans is forgiven. However, under current tax laws, the forgiven amount may be considered taxable income, meaning borrowers might owe taxes on the forgiven portion unless policies change.

Who Qualifies for IDR Forgiveness?

- To qualify for forgiveness under IDR, a borrower must:

- Be enrolled in one of the four IDR plans

- Make regular, on-time monthly payments based on income and family size

- Continue to recertify their income and family size annually

- Complete 20 or 25 years of qualifying payments

This option is especially useful for borrowers with high loan balances compared to their income, as it provides an alternative to standard 10-year repayment plans.

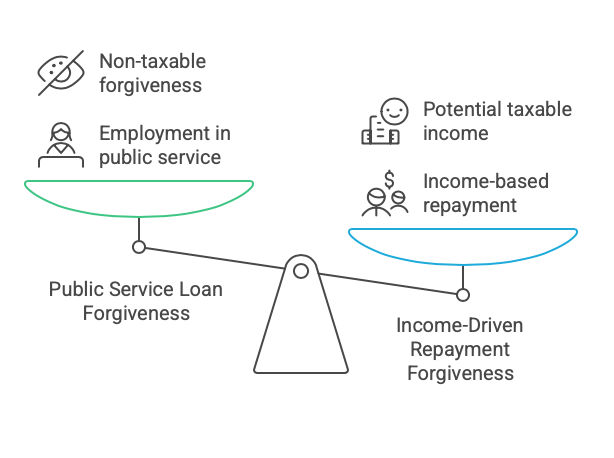

The two major differences between IDRF and PSLF.

- IDRF can be treated as taxable income. However, currently there is a tax exemption for anyone who receives student loan forgiveness between 2021 and 2025.

- IDRF does not require an application for forgiveness, rather it is automatically granted once you reach the maximum number of payments while using forgiveness-eligible repayment plans.

Comparing Student Loan Forgiveness

How Forgiven Student Loans Are Treated for Tax Purposes

Generally, when a debt is forgiven, the amount of the forgiven debt is treated as taxable income by the IRS. This means that, in most cases, borrowers may face a significant tax liability in the year their loan is forgiven. The forgiven amount is often considered income, which can push a borrower into a higher tax bracket, resulting in a larger tax bill.

For example,

If you had $50,000 in student loan debt forgiven, that $50,000 would be treated as taxable income for the year, and you would be required to pay income taxes on it. Depending on your income, this could mean owing a substantial amount in taxes, potentially in the tens of thousands of dollars, even though the debt has been erased. This can catch borrowers off guard, especially if they expected their debt relief to result in a clean slate without considering the tax consequences.

- Taxable Forgiveness: In most cases, loan forgiveness is viewed as taxable income, leading to a tax liability.

- Higher Tax Bracket: Forgiven amounts can push borrowers into a higher tax bracket, increasing the tax burden.

- Example Scenario: A $50,000 loan forgiveness could lead to a significant tax bill.

The American Rescue Plan Act of 2021

The act temporarily altered the tax treatment of student loan forgiveness. Under this legislation, any student loan forgiveness granted through December 31, 2025, is not considered taxable income. This means that borrowers receiving forgiveness under qualifying programs during this time will not face the typical tax consequences.

- Temporary Relief: Student loan forgiveness is tax-free through December 31, 2025, for qualifying programs.

- No Tax Bill: Borrowers will not be taxed on the forgiven loan amount during this period.

- Significant Relief: This provision provides considerable relief, as borrowers can take advantage of forgiveness without worrying about immediate tax bills.

Legislation and Updates Impacting Tax Implications

Recent legislative changes have had a significant impact on the tax treatment of student loan forgiveness, offering borrowers temporary relief from the tax liabilities that typically accompany forgiven debt. Prior to the American Rescue Plan of 2021, any forgiven student loans were treated as taxable income by the IRS. This often led to borrowers facing substantial tax bills in the year their loans were forgiven, sometimes pushing them into a higher tax bracket unexpectedly.

However, the American Rescue Plan, enacted in response to the COVID-19 pandemic, made important changes to this rule. Specifically, it temporarily exempted forgiven student loans from taxation for the period from 2021 through December 31, 2025. This means that any student loans forgiven during this time—whether through Public Service Loan Forgiveness (PSLF), Income-Driven Repayment (IDR) plans, or other qualifying programs—will not be taxed as income, offering significant financial relief to borrowers.

- Pre-2021 Rule: Prior to 2021, forgiven student loans were treated as taxable income.

- Temporary Tax-Free Period (2021-2025): The American Rescue Plan made student loan forgiveness tax-free through 2025.

- Relief for Borrowers: This temporary provision provides considerable relief, especially for borrowers who might otherwise face a large tax burden.

Note: after 2025, the tax treatment of forgiven loans is expected to revert to the previous rule unless new legislation is passed. This creates uncertainty for borrowers who may face unexpected tax consequences if forgiveness is granted after this period. Borrowers should stay informed about legislative updates to better prepare for future tax implications.After 2025, the tax-free status of forgiveness may expire unless extended by new laws.

Who Is Affected and What Are the Exceptions?

Most borrowers with federal student loans can potentially benefit from forgiveness programs, and many of these programs are designed to provide tax-free forgiveness for those who qualify. Generally, borrowers who participate in programs such as Public Service Loan Forgiveness (PSLF) or Income-Driven Repayment (IDR) plans can have their loans forgiven without facing a tax bill. The American Rescue Plan temporarily shields federal loan forgiveness from taxation through 2025, offering significant relief to those qualifying for these programs.

- Tax-Free Forgiveness: Federal loans forgiven under PSLF or IDR plans are not subject to taxes through December 31, 2025.

However, there are exceptions that borrowers should be aware of. For example, private student loans or forgiveness through non-federal programs do not qualify for the same tax-free treatment. If you have private loans, any forgiven balance may still be considered taxable income by the IRS.

- Private Loans: Forgiveness of private student loans may be taxable, as these loans fall outside federal law.

- Non-Federal Programs: Forgiveness from non-federal programs may still be taxable based on the terms of the agreement.

Additionally, while the American Rescue Plan provides tax-free forgiveness for federal loans, this does not apply to private loans. Borrowers with private loans should consult a tax advisor to understand their specific tax obligations.

Planning for the Tax Implications

Given the potential tax liabilities tied to student loan forgiveness, planning ahead is essential. Borrowers should work with tax professionals to estimate how forgiven loans will impact their taxes in the year of forgiveness. One option to minimize the tax impact is to adjust income withholding. By increasing your withholding throughout the year, you can set aside more funds for taxes, lessening the burden when forgiveness occurs. For self-employed borrowers, adjusting estimated tax payments can help balance out the tax bill. Here are two ways you can do it:

- Increase Withholding: Adjust your income withholding to save for taxes ahead of time.

- Adjust Estimated Payments: If self-employed, update your estimated payments to cover the forgiven loan tax liability.

Another strategy is to time your forgiveness. If possible, aim to qualify for forgiveness in a year when your income is lower, thus reducing the tax burden by keeping you in a lower tax bracket. target a low-income year for forgiveness to minimize tax impact. Finally, staying informed about legislative changes is crucial, as new laws may affect tax treatment. Consult with your tax advisor regularly to stay on top of any changes.

How NSKT Global Can Help

Student loan forgiveness can offer significant financial relief, but it’s important to understand the tax implications. Forgiven loans are generally treated as taxable income, which may result in a large tax bill. However, the American Rescue Plan temporarily exempts federal loan forgiveness from taxes through 2025. Planning is key to minimizing tax consequences. By working with tax professionals, borrowers can estimate tax liabilities, adjust withholding, and strategize forgiveness during lower-income years. Staying informed about legislative changes is also crucial.

NSKT Global specializes in helping borrowers navigate the complexities of student loan forgiveness and its tax implications. Our experts provide tailored strategies to reduce tax liabilities and maximize the benefits of loan forgiveness. Whether you need guidance on adjusting withholding or planning for future tax changes, NSKT Global is here to help you make informed decisions and optimize your financial outcomes.

FAQs

- Is forgiven student loan debt considered taxable income?

Yes, in most cases, forgiven student loan debt is considered taxable income by the IRS. - How do recent legislative changes affect the taxation of student loan forgiveness?

The American Rescue Plan temporarily makes federal student loan forgiveness tax-free through 2025. - Are there any programs where student loan forgiveness is not taxed?

Federal forgiveness programs like PSLF and IDR are tax-free through 2025 due to the American Rescue Plan. - What should borrowers do to prepare for potential tax liabilities after forgiveness?

Borrowers should consult a tax professional, adjust income withholding, and plan for tax payments based on forgiveness timing. - How can I get professional advice on managing the tax impact of student loan forgiveness?

You can seek expert guidance from professionals like NSKT Global, who specialize in tax strategies related to student loan forgiveness.