Table of Contents

The United States tax system presents unique complexities for nonresident taxpayers that can significantly impact financial outcomes. Navigating these intricacies requires specialized knowledge of international tax regulations, treaty provisions, and filing requirements that differ substantially from those applicable to U.S. citizens and residents.

For international students, foreign professionals, investors, and others with nonresident status, understanding these distinctions is not merely about compliance, it's about optimizing potential refunds and avoiding unnecessary tax burdens. With proper planning and knowledge, nonresidents can legally minimize their U.S. tax liability while ensuring full compliance with Internal Revenue Service (IRS) regulations.

Understanding Your Tax Obligations as a Nonresident

As a nonresident in the United States, your tax obligations differ significantly from those of US citizens and residents. Generally, nonresidents are taxed only on their US based income, which can include earnings while being in the country. The IRS cannot tax income you earned in your home country or other foreign locations.

It's crucial to correctly determine your tax residency status, as this affects your filing requirements and tax liability. You're considered a US resident for tax purposes if you have a Green Card or meet the Substantial Presence Test (at least 31 days in the current year and 183 days over the past three years). Students on F, J, M, or Q visas have special considerations and may be exempt from this test for a certain period.

Even if you didn't earn US income, you may still need to file Form 8843 to maintain your nonresident status. This is particularly important for those in the US under F, J, M, or Q immigration statuses, regardless of age or income received.

Filing the Correct Tax Forms: 1040-NR Explained

Nonresidents must file Form 1040-NR (U.S. Nonresident Alien Income Tax Return) rather than the standard Form 1040 used by US citizens and residents. This form is specifically designed to account for the unique tax situation of nonresidents.

When filing Form 1040-NR, you'll need to report all US earned income, including:

- Wages and salaries earned in the US

- Scholarships and fellowships (taxable portions)

- Investment income from US sources

- Rental income from US properties

- Profits from cryptocurrency trading on US exchanges

It's important to note that you cannot use standard tax preparation softwares as these platforms don't support Form 1040-NR. Instead, specialized services like NSKT Global are designed specifically for nonresidents and support e-filing, which can accelerate your refund processing.

Leveraging Tax Treaties to Reduce Your Tax Burden

One of the most significant advantages available to nonresidents is the potential benefit from tax treaties between the US and their home countries. The United States has established tax treaties with numerous countries to prevent double taxation and provide certain tax advantages to nonresidents.

These treaties can offer various benefits, including:

- Reduced tax rates on certain types of income

- Exemptions for specific income categories

- Special provisions for students, teachers, and researchers

To claim treaty benefits, you must have either a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN). On your tax return, you'll need to identify the specific treaty article that applies to your situation and provide documentation to support your claim.

For example, students from India may be eligible for specific deductions, while students from south korea and canada might qualify for certain tax credits that are typically unavailable to other nonresidents.

Key Deductions and Credits for Nonresidents

The Tax Cuts and Jobs Act significantly limited the deductions available to nonresidents. However, several important tax benefits remain accessible:

State and Local Tax Deduction: You can deduct state and local taxes paid in the state where you worked. This can be particularly valuable in high-tax states.

Education Expenses: If you're a student at a US educational institution, you may deduct qualified educational expenses paid out of pocket, but only up to the amount of any grant or scholarship you received.

Tax Credits: While most tax credits are unavailable to nonresidents, certain exceptions exist. While the residents of South Korea and Mexico, and the students from India may be eligible for child tax credits or credits for other dependents under specific circumstances.

Social Security and Medicare Tax Refunds: Individuals holding F-1, J-1, M-1, or Q visas generally qualify for exemption from Social Security and Medicare tax withholding. Should your employer have erroneously deducted these taxes from your compensation, you are entitled to reclaim these funds by submitting Form 843 to the Internal Revenue Service for a refund.

Cryptocurrency and Investment Considerations: If you've traded cryptocurrency on US exchanges or received investment income, be aware that these are subject to a 30% tax rate for nonresidents. However, applicable tax treaties may reduce this rate.

Keeping Accurate Records to Support Your Tax Return

Maintaining organized tax records is crucial for nonresidents. The IRS may request additional documentation to verify your status, income, and claimed deductions or credits. Keep digital or physical copies of:

- Previous tax returns

- W-2 forms from employers

- 1099 forms for other income

- Scholarship and fellowship documentation

- Receipts for educational expenses

- Documentation of your visa status

- Records of days present in the US (for Substantial Presence Test calculations)

- Bank statements showing income deposits

- Investment transaction records, including cryptocurrency trades

Having these documents readily available not only makes the filing process smoother but also ensures you're prepared in case of an audit or if you need to file an amended return later.

Important Tax Filing Deadlines for 2025

Understanding and meeting tax deadlines is essential to avoid penalties and interest. Key deadlines for nonresidents in 2025 include:

- April 15, 2025: Filing deadline for nonresidents who are physically present in the states or self-employed individuals.

- June 15, 2025: Extended filing deadline for nonresidents who are outside the US on April 15

If you need additional time, you can request an extension, but remember that an extension to file is not an extension to pay. Any taxes owed must still be paid by the deadline to avoid penalties.

If you miss the filing deadline, don't panic, but act quickly. The IRS charges 5% of taxes due for each month or partial month that a return is late. However, it's still important to file as soon as possible especially if you're due a refund.

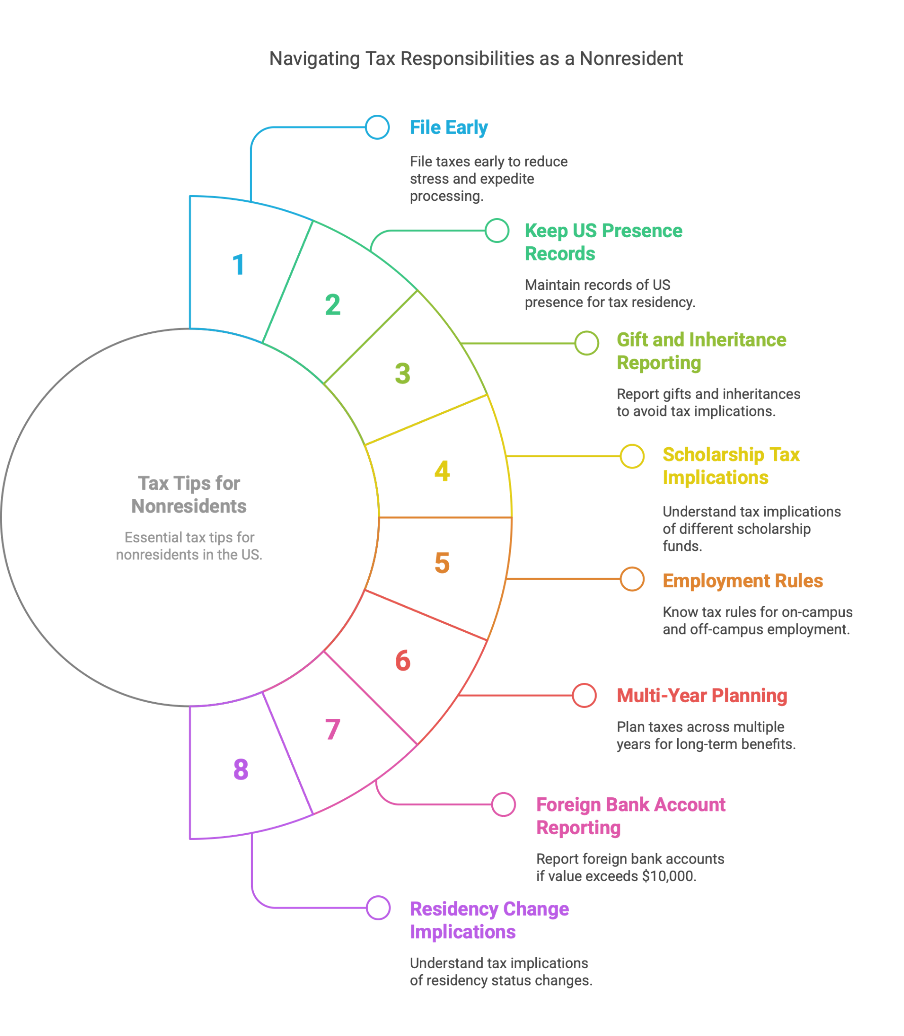

Most Valuable Tax Tips for Nonresidents

- File Early to Reduce Stress: Don't wait until the deadline approaches. Filing early not only reduces anxiety but ensures your return is processed quickly, especially if you're expecting a refund.

- Keep Records of Your US Presence: Maintain a calendar of your days in the United States, as this can be crucial for determining your tax residency status and substantiating your claims.

- Be Cautious with Gift and Inheritance Reporting: Gifts and inheritances may have tax implications depending on the amount and your relationship with the donor.

- Know the Tax Implications of Scholarships: Not all scholarship money is treated equally. Funds used for tuition and required fees are often tax-exempt, while amounts covering room and board are typically taxable.

- Understand On-Campus vs. Off-Campus Employment Rules: Different tax rules apply to on-campus and off-campus employment for students, affecting both income tax and potential exemptions from Social Security and Medicare taxes.

- Consider Multi-Year Tax Planning: If you'll be in the US for several years, consider how actions taken in one tax year might affect your future tax situations.

- Report Foreign Bank Accounts If Required: Depending on your circumstances, you may need to report foreign bank accounts through the Foreign Bank Account Report (FBAR) if the aggregate value exceeds $10,000 at any time during the year.

- Understand How Residency Changes Affect Taxes: If your status changes from nonresident to resident (or vice versa) during the tax year, special rules called "dual-status alien" provisions may apply.

- Recover Wrongly Withheld Social Security and Medicare Taxes: If you're on an F-1, J-1, M-1, or Q visa and had these taxes incorrectly withheld, file Form 843 to claim a refund that could amount to 7.65% of your earnings.

- File Even If You've Left the US: You can still claim a tax refund after departing the United States. Don't leave your money behind by failing to file.

- Get Your SSN or ITIN Early: You need one of these to file a return and claim treaty benefits. Apply well in advance of tax season to avoid delays.

- File an Amended Return If Mistakes Are Found: If you discover errors after filing, don't worry. You can file an amended return to correct mistakes and potentially claim additional refunds.

How NSKT Global Can Help Nonresidents

Given the complexity of US tax laws for nonresidents, professional assistance can be invaluable. Specialized tax preparation services from NSKT Global for nonresidents offer several advantages:

- Ensuring you file the correct forms

- Identifying all applicable deductions and credits

- Determining eligibility for tax treaty benefits

- Preparing state tax returns (which have different requirements than federal returns)

- E-filing capabilities to speed up processing and refunds

- Assistance with amended returns if errors are discovered

Our services are specifically designed for nonresident tax preparation and can guide you through the entire process, from determining your residency status to e-filing your completed return.

Conclusion

Maximizing your tax refund as a nonresident requires understanding your unique tax situation, filing the correct forms, and taking advantage of all applicable deductions, credits, and treaty benefits. By staying organized, meeting deadlines, and seeking specialized assistance when needed, you can navigate the 2025 tax season confidently and ensure you're not leaving money on the table. Remember that even if you've already left the United States, you can still file your tax return and claim any refund you're entitled to receive.

FAQs About Maximizing Your US Tax Refund as a Nonresident

What tax forms do nonresidents need to file for a US tax refund?

Non Residents typically file Form 1040-NR for federal taxes. If you didn't earn any US income, you may only need to file Form 8843 to document your presence in the US. Some nonresidents may also need to file state tax returns depending on where they lived or worked.

How do tax treaties help reduce taxes for nonresidents?

Tax treaties between the US and other countries can provide reduced tax rates, exemptions for certain types of income, and special provisions for students and researchers. To claim these benefits, you'll need an SSN or ITIN and must cite the specific treaty article that applies to your situation on your tax return.

What deductions and credits can non residents claim?

Nonresidents can typically deduct state and local taxes paid and qualified educational expenses (up to the amount of scholarships received). Most tax credits are unavailable to nonresidents, though exceptions exist for nationals of certain countries. Nonresidents on F, J, M, or Q visas who had Social Security and Medicare taxes incorrectly withheld can also file for refunds of these amounts.

When is the tax filing deadline for nonresidents in 2025?

Nonresidents in the US must file by April 15, 2025. Those outside the US on the filing date have until June 15, 2025. Extensions are available but any taxes owed must still be paid by the original deadline to avoid penalties.

How can a tax professional help maximize my refund?

Tax professionals specializing in nonresident taxation can ensure you're filing the correct forms, claiming all applicable deductions and treaty benefits, and meeting all deadlines. They can also assist with state tax returns and help you recover incorrectly withheld taxes, potentially resulting in a larger refund.