Table of Contents

People often think earning money from intellectual property can be rewarding, but they forget that this earning comes with tax responsibilities, especially in California. Whether it’s royalties from books, music, patents, or natural resources, the state has specific rules that determine how much you owe. The taxation process depends on factors like residency, income source, and applicable deductions. Understanding these rules can help you stay compliant, reduce liabilities, and make informed financial decisions to protect your earnings.

How California Defines Royalty Income

Royalty income refers to the payments you receive when others use your intellectual property or natural resources. It is a common source of income for inventors, artists, authors, and landowners. California categorizes royalties as taxable income, and whether they are considered passive or active depends on how they are managed.

Some common sources of royalty income include:

- Patents, copyrights, and trademarks: Payments for the use of protected intellectual property.

- Books, music, and software: Royalties from creative works like novels, songs, and digital applications.

- Oil, gas, and mineral rights: Compensation for the extraction of natural resources.

- Licensing agreements: Earnings from granting permission to use a product, service, or brand.

Typically, California treats royalty income as passive earnings. However, if you actively engage in managing or promoting your intellectual property, the state may classify it as business income, which could be subject to self-employment tax.

Taxation of Royalty Income for California Residents

California residents must pay taxes on all income, including royalties, regardless of where they are earned. Since California follows a progressive tax system, royalty earnings are subject to different tax brackets based on total income. Additionally, deductions may be available for certain expenses related to generating royalty income, helping to reduce taxable income.

Locations We Serve In California

Key Tax Considerations:

- Worldwide Taxation: Royalty income earned both inside and outside California is fully taxable.

- Progressive Tax Rates: Higher earnings are taxed at higher rates based on California’s tax brackets.

- Reporting Requirements: Royalties are reported on state tax returns using Schedule D (Capital Gains and Losses) or Schedule C (Profit or Loss from Business) if considered part of a business.

- Deductible Expenses: Legal fees, production costs, and other necessary expenses related to generating royalties may be deductible.

Taxation of Royalty Income for Nonresidents

Nonresidents are subject to California tax only on royalty income derived from sources within the state. If intellectual property or natural resources generate revenue through use in California, that portion of income is taxable. Nonresidents receiving royalty payments may also face withholding requirements based on their earnings.

Key Tax Considerations:

- Taxable Royalties: If intellectual property is used in California, royalties are subject to state taxation.

- Withholding Requirements: California-based companies paying royalties to nonresidents may need to withhold taxes.

- Reporting Obligations: Nonresidents must file Form 540NR (California Nonresident or Part-Year Resident Income Tax Return) to report and pay taxes on their California-sourced royalty income.

Determining the Source of Royalty Income

California determines the source of royalty income based on where the intellectual property or natural resources generate revenue, rather than where the owner resides. This distinction is essential because it directly impacts tax liability, especially for nonresidents earning royalties from California-based sources. If royalties stem from intellectual property usage, natural resource extraction, or licensing agreements involving California, they are subject to the state’s taxation laws. Understanding these rules helps taxpayers ensure compliance and avoid unnecessary tax payments. The key factors in determining royalty income source include:

- Location of Intellectual Property Use: Royalties are taxed in the state where the intellectual property (e.g., patents, trademarks, copyrights) is used, not where the owner lives.

- Extraction Site of Natural Resources: If royalties come from oil, gas, or minerals extracted within California, they are considered California-sourced income and are taxable by the state.

- State-Specific Licensing Agreements: When a licensing agreement applies to multiple states, only the portion of income attributed to California usage is subject to state tax.

Understanding these distinctions is crucial for both residents and nonresidents to correctly report and pay taxes while avoiding overpayment or penalties.

California Royalty Income Tax Rates

California taxes royalty income at the same progressive rates as ordinary income, which range from 1% to 13.3%. Factors that influence tax liability include:

- Total taxable income

- Filing status (single, married, etc.)

- Applicable deductions or credits

Since California does not have a separate capital gains tax rate, royalties classified as capital gains will still be taxed at the ordinary income tax rates.

Withholding Requirements for Royalty Payments

California enforces specific withholding requirements on royalty payments made to nonresident individuals and businesses without a physical presence in the state. These regulations ensure the collection of taxes on income sourced from California. Nonresidents may request a reduction or exemption from withholding under certain conditions.

Key Withholding Rules:

- Standard Withholding Rate: A 7% withholding tax applies to payments or distributions of California source income to nonresidents when the total payments exceed $1,500 in a calendar year.

- Filing Requirements for Businesses: Entities making royalty payments must file Form 592, Resident and Nonresident Withholding Statement, to report withheld amounts.

- Requesting a Lower Withholding Rate: Nonresidents can apply for a reduced rate or exemption by submitting Form 588, Nonresident Withholding Waiver Request, to the Franchise Tax Board (FTB).

Understanding and complying with these withholding requirements is crucial for both payers and recipients to avoid penalties and ensure proper tax reporting.

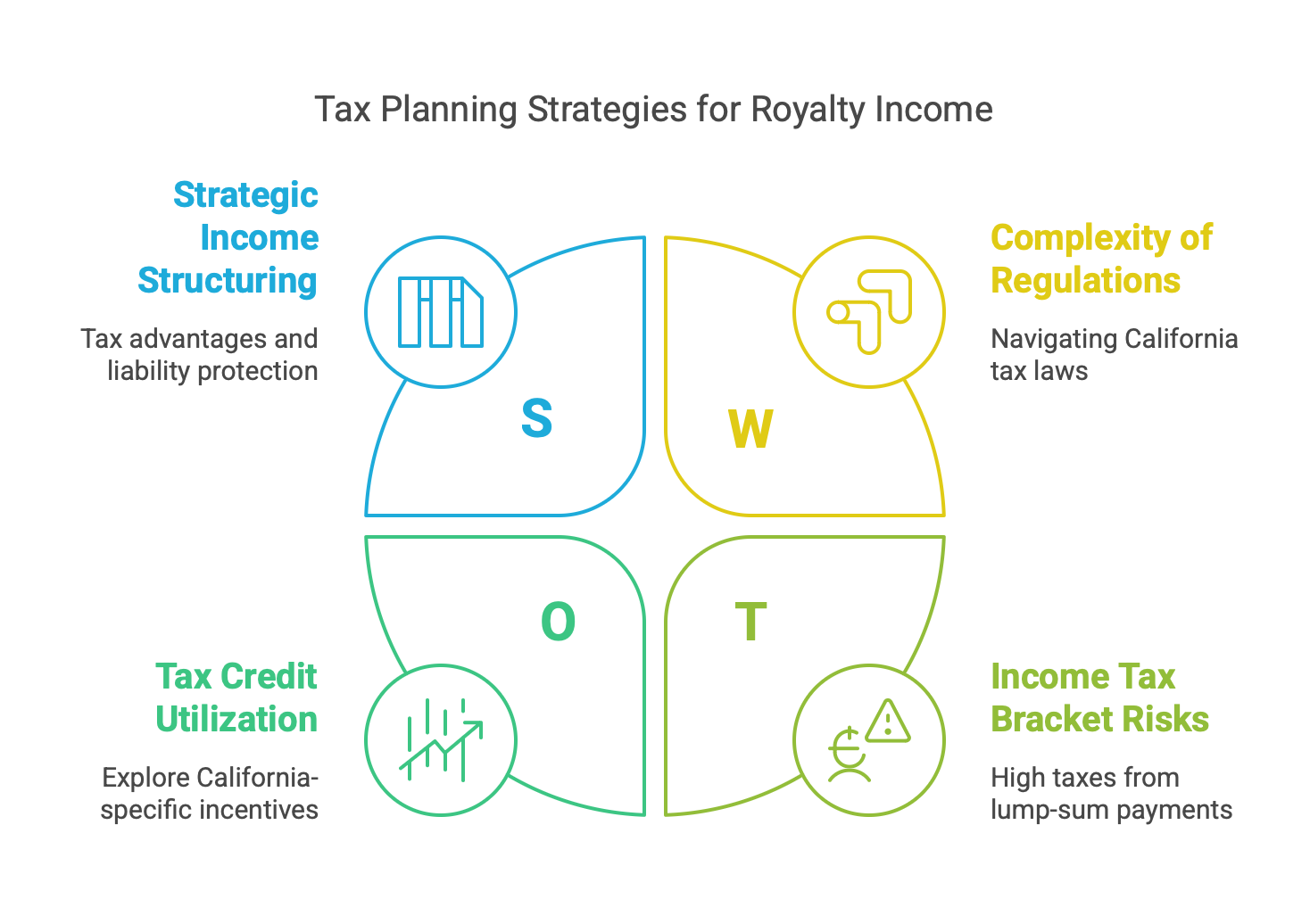

Tax Planning Strategies for Royalty Income

Effective tax planning can help minimize tax liability and maximize earnings from royalty income. By strategically managing income, expenses, and tax credits, individuals and businesses can reduce their overall tax burden while ensuring compliance with California tax laws. Below are key strategies to optimize royalty income taxation:

Structuring Income: Consider shifting royalty income to a business entity such as an LLC or S corporation. This may provide tax advantages, including lower tax rates, liability protection, and potential deductions for business-related expenses.

Deducting Expenses: Maintain detailed records of business expenses directly related to generating royalty income. These may include legal fees, marketing costs, production expenses, and administrative costs. Claiming these deductions can significantly lower taxable income.

Using Tax Credits: Explore California-specific tax credits, such as research and development (R&D) credits or other incentives available to content creators, inventors, and patent holders. These credits can help offset tax liabilities and increase after-tax earnings.

Deferring Income: Negotiating licensing agreements that spread payments over multiple years can help avoid higher tax brackets in a single year, leading to lower overall tax rates. Spreading income can also improve cash flow management.

Seeking Professional Advice: Given California’s complex tax regulations, working with a tax professional or accountant can ensure proper tax planning, compliance, and maximization of deductions and credits.

Conclusion

Navigating California’s royalty income tax laws can be complex, but understanding the rules can help you keep more of your earnings while staying compliant. Whether you are a resident or nonresident, proper tax planning is essential to avoid unnecessary liabilities and maximize deductions. Strategic approaches like structuring income, leveraging tax credits, and deferring payments can significantly reduce your tax burden.

At NSKT Global, our team of experienced tax professionals can help you optimize your royalty income tax strategy, ensure compliance with California tax laws, and identify opportunities for deductions and credits. Whether you’re an artist, inventor, or business owner, we provide tailored tax solutions to help you minimize liabilities and maximize profitability. Let us handle the complexities so you can focus on growing your income.

FAQs About California Royalty Income Tax

How does California define royalty income for tax purposes?

California defines royalty income as payments received for the use of intellectual property (e.g., patents, copyrights, trademarks) or natural resources.

Do nonresidents have to pay California taxes on royalties?

Yes, nonresidents must pay California taxes on royalties earned from intellectual property or resources used within the state.

What tax rates apply to royalty income in California?

Royalty income is taxed at California’s progressive income tax rates, ranging from 1% to 13.3%, based on total taxable income.

Are there any withholding requirements for royalty payments?

Yes, a 7% withholding tax applies to royalty payments exceeding $1,500 annually to nonresidents without a California presence.

How can I minimize my tax liability on royalty income?

Taxpayers can reduce liability by deducting expenses, structuring income through a business entity, using tax credits, and deferring income where possible.