Table of Contents

Tax season can be a daunting time for businesses, but understanding tax write-offs can help reduce taxable income and save money. By identifying eligible expenses and implementing strategic planning, business owners can optimize their deductions and enhance profitability. This comprehensive guide will explain business tax write-offs, highlight eligible expenses, and offer actionable strategies to maximize deductions.

What are Business Tax Write-Offs?

A business tax write-off refers to an expense that the IRS allows to be deducted from your taxable income, reducing the amount of tax owed. To qualify, these expenses must be both "ordinary" and "necessary" for operating your business.

Ordinary Expenses- An "ordinary" expense is one that is common and accepted in your specific industry. For instance, purchasing office supplies, such as pens, paper, and printers, would be considered ordinary for most businesses. Similarly, if you run a restaurant, ingredients and kitchen equipment fall under this category as they are typical and expected costs in the food service industry.

Necessary Expenses- A "necessary" expense is one that is helpful and appropriate for your business to function effectively. For example, a digital marketing agency may find high-speed internet and design software essential for its daily operations. While the expense does not have to be indispensable, it should contribute directly to your business’s success or efficiency.

Understanding these definitions is crucial because not all business-related costs automatically qualify as write-offs. Personal expenses, for instance, cannot be deducted unless they have a clear and justifiable business purpose. The IRS provides guidelines to help business owners determine which expenses meet the criteria, and misclassification can lead to penalties or audits.

Types of Business Expenses Eligible for Write-Offs

Business expenses vary widely, but many can be written off. Below are some of the most common categories:

|

Category |

Examples |

Key Considerations |

|

Operating Expenses |

Rent, utilities, office supplies |

Directly related to business operations and well-documented |

|

Employee Costs |

Salaries, health benefits, bonuses |

Maintain accurate payroll and benefits records |

|

Marketing & Advertising |

Social media, website, promotional ads |

Clearly tied to business activities |

|

Business Travel |

Airfare, hotels, meals |

Keep detailed itineraries and receipts |

|

Professional Services |

Accountant fees, software subscriptions |

Invoice and payment records are essential |

|

Depreciation |

Equipment, vehicles, office furniture |

Follow IRS schedules |

|

Charitable Contributions |

Donations to IRS-approved charities |

Retain receipts and ensure the organization is qualified |

It’s essential to consult IRS guidelines or a tax professional to confirm that specific expenses qualify for deductions.

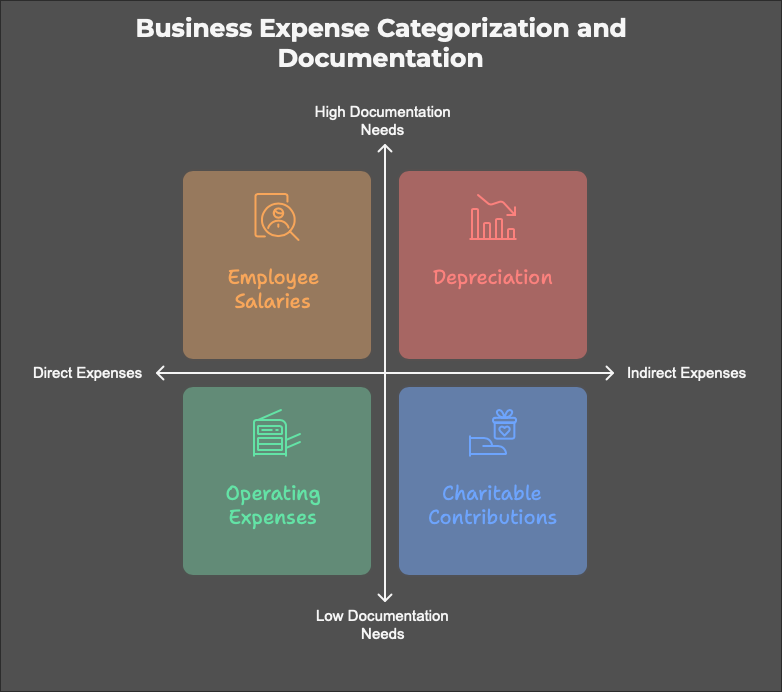

Additionally here’s you can create a chart to simplify your write-off calculations. It can help you understand the level of documentation and categorize the write-offs

Special Considerations for Maximizing Deductions

Home Office Deduction

If you use part of your home exclusively for business purposes, you may qualify for the home office deduction. This applies to both homeowners and renters.

- Deduction Methods:

- Simplified Method: Deduct $5 per square foot, up to a maximum of 300 square feet.

- Regular Method: Deduct a portion of your actual home expenses (e.g., mortgage, utilities, insurance) based on the percentage of your home used for business.

- Key Consideration: Maintain clear records and ensure the space is exclusively used for business.

Business Use of a Car

If you use a vehicle for business purposes, you can deduct related expenses, either by:

- Standard Mileage Rate: Deduct a set rate per mile driven for business purposes (e.g., 67 cents per mile in 2024).

- Actual Expense Method: Deduct actual expenses, including gas, repairs, insurance, and depreciation.

- Key Consideration: Keep a detailed mileage log and receipts for all car-related expenses.

Charitable Contributions

Donations made to qualified charitable organizations can be deducted on your tax return, subject to certain rules and limitations.

- Cash Contributions: Deduct up to 60% of your adjusted gross income (AGI) for cash donations.

- Non-Cash Contributions: Deduct the fair market value of donated items, such as clothing or household goods. Ensure the items are in good condition.

- Mileage for Charitable Activities: If you drive for charitable purposes, you can deduct a standard mileage rate (e.g., 14 cents per mile in 2024).

Key Consideration: Keep records of all donations, including receipts or acknowledgment letters from the charity, and document the value of any non-cash contributions.

Depreciation

Depreciation allows you to recover the cost of certain assets used in your business over time. This deduction applies to property such as vehicles, equipment, or buildings.

- Types of Depreciation:

- Straight-Line Depreciation: Spreads the deduction evenly over the useful life of the asset.

- Accelerated Depreciation (e.g., MACRS): Allows larger deductions in the early years of the asset's life.

- Key Consideration: Ensure the asset is used for business purposes and maintain detailed records of its use and purchase.

Healthcare Expenses

Certain out-of-pocket healthcare expenses may be deductible if they exceed a specific percentage of your adjusted gross income (AGI).

- Qualified Expenses: Includes payments for medical services, prescription medications, health insurance premiums (if not paid pre-tax), and medical equipment.

- Threshold for Deduction: Only the portion of expenses exceeding 7.5% of your AGI is deductible.

- Health Savings Accounts (HSAs): Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free. For 2024, the HSA contribution limits are $4,150 for individuals with self-only coverage and $8,300 for families. An additional $1,000 catch-up contribution is allowed for individuals aged 55 or older.

- Key Consideration: Maintain detailed receipts and records of all medical expenses to substantiate your deductions

Key Strategies to Maximize Tax Write-Offs

- Plan Business Expenses Strategically

Timing is critical. For example, consider making large purchases toward the end of the fiscal year to maximize write-offs for that tax period. By aligning expenses with the tax calendar, you can potentially reduce taxable income and improve cash flow.

Pro Tip: Monitor upcoming expenses and plan discretionary spending, such as equipment upgrades, to align with tax-saving opportunities.

- Take Advantage of Home Office Deductions

If you run your business from home, you can claim deductions for a portion of your rent, utilities, and maintenance costs. Ensure the space is exclusively used for business purposes. The deduction can significantly reduce overhead expenses for small business owners.

Pro Tip: Measure the square footage of your home office to accurately calculate the deductible percentage and avoid overestimations that might raise red flags during audits.

- Use Tax Software or Hire Professionals

Invest in tax preparation software or consult an accountant to ensure you’re claiming every eligible deduction. These tools can also help you track and categorize expenses accurately throughout the year. Professionals can provide insights on complex deductions you might otherwise overlook.

Pro Tip: Use cloud-based accounting software that integrates with your business accounts for real-time tracking and streamlined tax preparation.

- Separate Personal and Business Finances

Maintaining separate bank accounts and credit cards for your business simplifies expense tracking and minimizes the risk of errors or audits. Clear financial boundaries ensure accurate reporting and easier reconciliation.

Pro Tip: Open a dedicated business credit card that offers rewards or cash back for business-related spending to maximize financial benefits.

- Leverage Retirement Plans

Contributions to employee retirement plans or your own self-employed retirement accounts can qualify for tax deductions. These contributions not only reduce taxable income but also support long-term financial security for you and your team.

Pro Tip: Explore tax-advantaged retirement accounts like SEP IRAs or 401(k)s, which offer higher contribution limits for small business owners.

Common Mistakes to Avoid When Claiming Write-Offs

Claiming tax write-offs is a valuable strategy for reducing your business's taxable income, but it requires precision and adherence to IRS guidelines. Mistakes in this process can lead to audits, disallowed deductions, or even penalties. By understanding the common pitfalls and taking proactive measures, you can maximize deductions while staying compliant. Below, we highlight frequent errors businesses make and how to avoid them.

- Mixing Personal and Business Expenses: Only the business portion of an expense can be deducted. For example, if a vehicle is used for both personal and business purposes, only the business-related mileage is deductible.

- Failing to Keep Proper Documentation: Receipts, invoices, and bank statements are essential for verifying deductions. Lack of proper documentation can lead to disallowed claims during an audit.

- Overestimating Deductions: Claiming non-qualifying expenses as write-offs can trigger red flags with the IRS. Ensure that all deductions are legitimate and fall within allowable guidelines.

- Neglecting Depreciation Rules: Some assets must be written off over time rather than as a lump sum. Failing to follow depreciation guidelines can result in penalties.

Record-Keeping Best Practices for Accurate Deductions

Good record-keeping simplifies tax preparation and protects you in case of an audit. Here are some best practices:

- Organize Receipts: Keep physical or digital copies of all receipts. Use tools like expense management apps to scan and categorize receipts systematically, ensuring they are accessible and easy to retrieve.

- Maintain Expense Logs: Record details of specific expenses, such as mileage logs for business travel, dates, and purposes of client meetings, or locations of business-related meals. This level of detail can substantiate deductions and provide clarity if audited.

- Automate Expense Tracking: Use accounting software to automatically track and categorize expenses. Automation minimizes manual errors and saves time, ensuring that no deductible expenses are overlooked.

- Reconcile Accounts Monthly: Review and compare your bank statements with your accounting records at the end of each month. Regular reconciliation helps identify discrepancies early and ensures your records remain accurate throughout the year.

Impact of Tax Write-Offs on Business Profitability

Effective use of tax write-offs can significantly impact your business’s bottom line. By reducing taxable income, you retain more revenue for reinvestment or growth initiatives. However, it’s important to balance deductions with overall financial health. Over-reliance on write-offs may reduce profits on paper, which could impact your ability to secure financing or attract investors. Here are key impact points of tax write-offs:

- Enhanced Cash Flow for Reinvestment

Tax write-offs allow businesses to keep more of their earnings by reducing taxable income. This retained cash flow can be redirected into areas like hiring, marketing, or upgrading equipment, fostering business growth. Effective write-offs can also provide the financial flexibility needed to weather economic downturns or seize new opportunities.

- Increased Competitive Edge

By minimizing tax liabilities, businesses can allocate resources toward activities that drive innovation or customer acquisition. For example, funds saved through write-offs can be used to enhance product offerings or improve service quality, giving businesses an edge over competitors.

- Potential Risks to Financial Standing

While tax write-offs reduce taxes owed, excessive deductions may portray reduced profitability on financial statements. This can make it challenging to attract investors, secure loans, or meet the requirements of potential business partnerships. Striking the right balance between tax savings and profitability is critical.

- Long-Term Tax Planning Benefits

Strategically planning write-offs over multiple fiscal years can create stability in cash flow management. For instance, spreading out the depreciation of large assets ensures consistent deductions, preventing significant fluctuations in taxable income.

Conclusion

Business tax write-offs are a powerful tool for reducing taxable income and saving money. By understanding eligible expenses, implementing strategic planning, and maintaining accurate records, you can maximize deductions and boost profitability. Whether you’re a small business owner or a seasoned entrepreneur, investing time in understanding tax write-offs is a step toward financial efficiency.

FAQs

What is the difference between a tax write-off and a tax credit?

A tax write-off reduces taxable income, while a tax credit directly lowers the amount of taxes owed.

Which small business expenses are most commonly overlooked for write-offs?

Expenses like home office use, software subscriptions, and professional development often go unnoticed.

Can personal expenses ever qualify as business tax deductions?

Only if the expense has a clear business purpose and is properly allocated between personal and business use.

How can technology help in tracking deductible business expenses?

Apps and software can automate tracking, categorization, and documentation of expenses, ensuring accuracy and compliance.

Are there limits on how much a business can write off annually?

While most deductions don’t have strict limits, some categories, like business interest expenses or meal costs, have caps or restrictions as per IRS rules.