Table of Contents

Owning a home in California comes with hefty costs, but the mortgage interest deduction (MID) offers a financial lifeline. By reducing taxable income through mortgage interest deductions, homeowners can save thousands on taxes. However, with evolving federal and state regulations, navigating this benefit isn't always straightforward. Understanding the limits, eligibility rules, and potential tax implications is crucial, especially in a high-cost state like California. With smart tax planning, homeowners can make the most of their deductions and avoid missing out on valuable savings.

Federal Mortgage Interest Deduction Limits

The mortgage interest deduction is a long-standing benefit under U.S. tax law. However, the Tax Cuts and Jobs Act (TCJA) of 2017 significantly altered its scope:

- Homeowners who purchased their property before December 15, 2017, can deduct interest on mortgage debt up to $1 million.

- For properties purchased after this date, the deduction applies only to mortgage debt up to $750,000.

- The deduction applies to primary and secondary residences but excludes investment properties.

- Home equity loan interest is deductible only if the loan was used for home improvements.

These federal limits set the foundation for California's own approach to mortgage interest deductions, which largely aligns with federal guidelines but has unique implications for high-cost areas.

California's Mortgage Interest Deduction Limits

California follows the federal framework for mortgage interest deductions, but its high real estate prices make this deduction particularly significant for many homeowners.

- Mortgage Cap: California allows deductions on mortgage interest up to $750,000 for loans taken after 2017, while pre-2017 loans can deduct up to $1 million.

- Home Equity Loan Restrictions: Interest on home equity loans is deductible only if the loan is used for home improvements, affecting those using equity for other financial needs.

- High Home Prices: California’s median home price exceeds $750,000 in many areas, meaning a large number of new homeowners cannot deduct all of their mortgage interest.

- Jumbo Loans Impact: Many California homeowners take out jumbo loans (exceeding $1,089,300 in high-cost areas), which limit deductibility beyond the federal cap.

- Property Tax Burden: The combination of high property taxes and the $10,000 SALT deduction cap reduces the overall tax benefit for many homeowners.

- Interest Rate Sensitivity: California's fluctuating mortgage rates directly affect interest payments, influencing the deduction amount homeowners can claim.

- Rental Market Differences: Since the MID applies only to primary and secondary residences, real estate investors must structure their financing carefully to maximize tax benefits.

With soaring home values and evolving tax laws, California homeowners must navigate these limits carefully to optimize their deductions and tax savings.

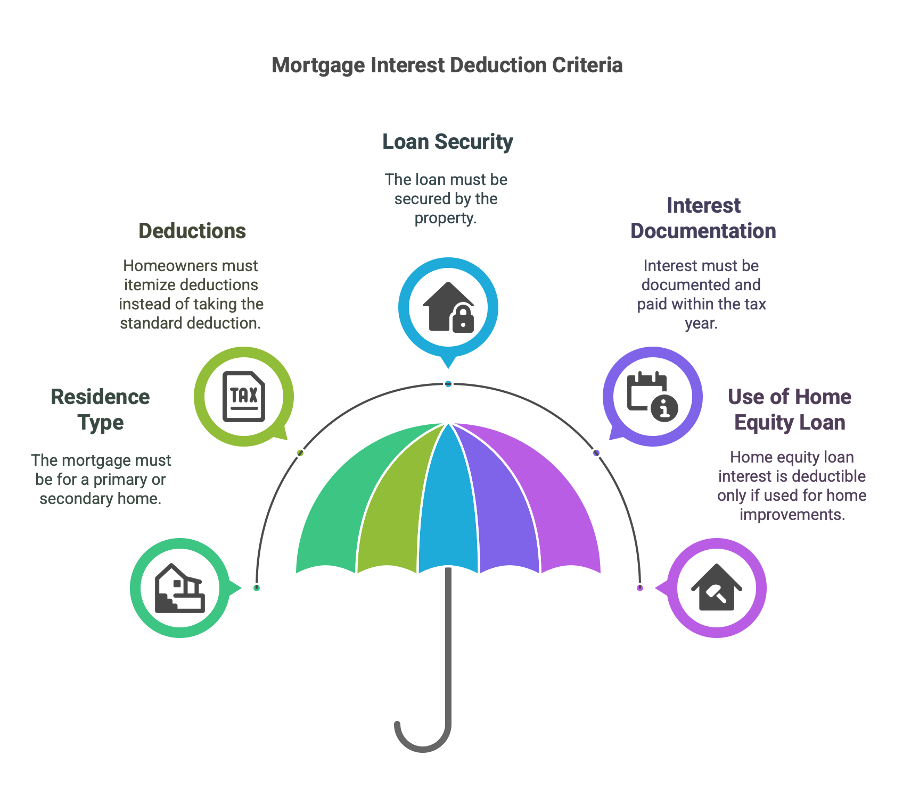

Eligibility Criteria for Claiming the Deduction

Not all homeowners qualify for the mortgage interest deduction, and understanding the requirements can help maximize savings. First, the home must be a primary or secondary residence—investment properties do not qualify. The taxpayer must also itemize deductions rather than taking the standard deduction, which makes the benefit more useful for those with high total deductions.

Additionally, the mortgage must be a secured loan, meaning the home serves as collateral. The interest paid on the loan during the tax year must be properly documented, typically through Form 1098 issued by the lender. For homeowners with home equity loans, the interest is deductible only if the funds were used specifically for home improvements.

Quick Eligibility Checklist:

- The mortgage must be for a primary or secondary residence.

- The homeowner must itemize deductions rather than taking the standard deduction.

- The loan must be secured by the property.

- The interest must be documented and paid within the tax year.

- Home equity loan interest is deductible only if used for home improvements.

How to Claim the Mortgage Interest Deduction in California

Claiming the mortgage interest deduction might seem complicated, but breaking it down into simple steps makes the process smooth and efficient. Follow these steps to ensure you get the most out of your tax savings:

Step 1: Get Your Form 1098

Your mortgage lender will send you Form 1098, which lists the total mortgage interest paid during the tax year. This document is essential for claiming the deduction.

Step 2: Decide Whether to Itemize or Take the Standard Deduction

If your total itemized deductions exceed the standard deduction ($13,850 for single filers and $27,700 for married joint filers in 2023), itemizing your deductions makes sense. If not, taking the standard deduction might be a better option.

Step 3: Fill Out Schedule A (Form 1040)

Use Schedule A of Form 1040 to report your mortgage interest and other itemized deductions. This is where you officially claim your deduction.

Step 4: Include Home Equity Loan Interest (If Applicable)

If you have a home equity loan, ensure that the interest is deductible—this applies only if the funds were used for home improvements.

Step 5: Keep All Necessary Records

Maintain records of mortgage payments, loan agreements, and Form 1098 to ensure compliance and be prepared in case of an IRS audit.

Following these steps will help you claim your mortgage interest deduction with confidence while maximizing your tax benefits.

Impact of the SALT Cap on California Homeowners

The state and local tax (SALT) deduction cap, introduced by the TCJA, significantly affects California homeowners:

- The SALT cap limits deductions for state and local property, income, and sales taxes to $10,000.

- Many California homeowners, especially those in high-tax areas, exceed this cap, reducing their ability to deduct mortgage interest effectively.

- The cap disproportionately affects homeowners with high-value properties, as they pay more in property taxes.

While efforts have been made to repeal or adjust the SALT cap, its presence continues to limit the overall tax benefits available to California homeowners.

Recent Changes and Future Outlook

The landscape of mortgage interest deductions is constantly evolving, with upcoming changes that could significantly impact California homeowners. The Tax Cuts and Jobs Act (TCJA) of 2017 imposed limits that may soon be revisited, and homeowners should be prepared for potential shifts.

- Expiration of Current Limits: The $750,000 mortgage interest deduction cap is set to expire in 2025. If no action is taken by Congress, the previous $1 million cap may return, allowing homeowners with larger mortgages to benefit more.

- Possible SALT Cap Modifications: The current $10,000 SALT deduction cap has been widely criticized, particularly in high-tax states like California. There is ongoing debate over whether it should be repealed or adjusted to provide relief for homeowners paying high property and state income taxes.

- California's Response: State lawmakers are actively exploring ways to counteract the effects of federal tax changes. Proposals such as state-level tax credits or workarounds for SALT deductions may come into play.

- Homeowner Strategy: With changes on the horizon, staying informed is key. Consulting a tax professional and proactively planning for potential shifts in mortgage deduction laws can help homeowners maximize their tax benefits.

Conclusion

The mortgage interest deduction remains a powerful tool for California homeowners looking to ease the financial burden of homeownership. However, with federal limits and the SALT cap restricting deductions, navigating the tax landscape can be complex. Knowing the eligibility requirements and deduction limits is crucial to making informed financial decisions and ensuring you’re not leaving money on the table.

As tax laws continue to evolve, staying ahead of changes can make a significant difference in your savings. That’s where professional guidance comes in. NSKT Global specializes in helping homeowners navigate the intricacies of tax deductions, ensuring they maximize benefits while staying compliant with IRS regulations. Whether it’s understanding new policies, optimizing deductions, or planning for future tax changes, expert advice can make all the difference in securing your financial future.

FAQs About Mortgage Interest Deduction in California

What is the maximum mortgage amount eligible for interest deduction in California?

Homeowners can deduct interest on mortgage debt up to $750,000 for loans taken after 2017 and up to $1 million for loans taken before 2017.

How does the federal mortgage interest deduction limit affect California homeowners?

Due to California's high home prices, many homeowners exceed the federal limit, reducing the deductible mortgage interest.

Can I deduct interest on a home equity loan in California?

Yes, but only if the loan was used for home improvements; using it for personal expenses does not qualify.

How do I claim the mortgage interest deduction on my California state tax return?

Use Form 540 and Schedule CA to report mortgage interest, ensuring deductions align with federal limits.

Are there income limits for claiming the mortgage interest deduction in California?

There are no direct income limits, but high-income homeowners may face restrictions due to the SALT cap and itemized deduction limitations.