Table of Contents

The dreaded tax deadline is approaching, but your financial documents are still scattered across your desk, important forms haven't arrived, or perhaps life has simply thrown unexpected curveballs your way. We've all been there. While the pressure to file on time mounts, there's a legitimate solution that many taxpayers overlook: filing for a state tax extension.

Unlike federal extensions that follow standardized procedures, state tax extensions operate under a patchwork of different rules, deadlines, and requirements that vary dramatically depending on where you live. This complexity often leads to confusion, missed opportunities, and unnecessary penalties for taxpayers already struggling with time constraints. From determining if you qualify to understanding payment requirements that still apply despite extended filing deadlines, we'll walk you through everything you need to know about postponing your state tax filing deadline properly and legally.

What is a State Tax Extension?

A state tax extension is a formal request to your state's tax authority for additional time to file your state income tax return beyond the standard deadline. Unlike a payment extension, it only provides extra time for paperwork completion, not for paying taxes owed. Most states grant extensions of 4-6 months, though requirements vary significantly between jurisdictions. Some states automatically approve extensions when federal extensions are granted, while others require separate applications through state-specific forms. Although extensions help avoid late-filing penalties, interest typically still accrues on unpaid taxes from the original due date.

When should you file a State tax extension?

While many understand the process for filing federal tax extensions, state tax extension rules often remain unclear, leading to penalties or missed opportunities. Common reasons for needing a state tax extension include:

- Time Constraints: You might not have enough time to complete your tax return by the deadline due to busy schedules, travel, or other commitments that make meeting the standard filing deadline difficult.

- Missing Documents: You may still be waiting for essential tax documents like W-2s, 1099s, or other income statements. This is particularly common for investments, partnerships, or if you've recently changed employers.

- Complex Tax Situations: If you have a complicated tax situation, such as business income, multiple income sources, investment properties, or significant deductions, you might need more time to accurately file your taxes and maximize legitimate tax advantages.

- Personal Circumstances: Life events like illness, family emergencies, natural disasters, or other unforeseen circumstances can prevent you from filing on time and qualify you for additional consideration.

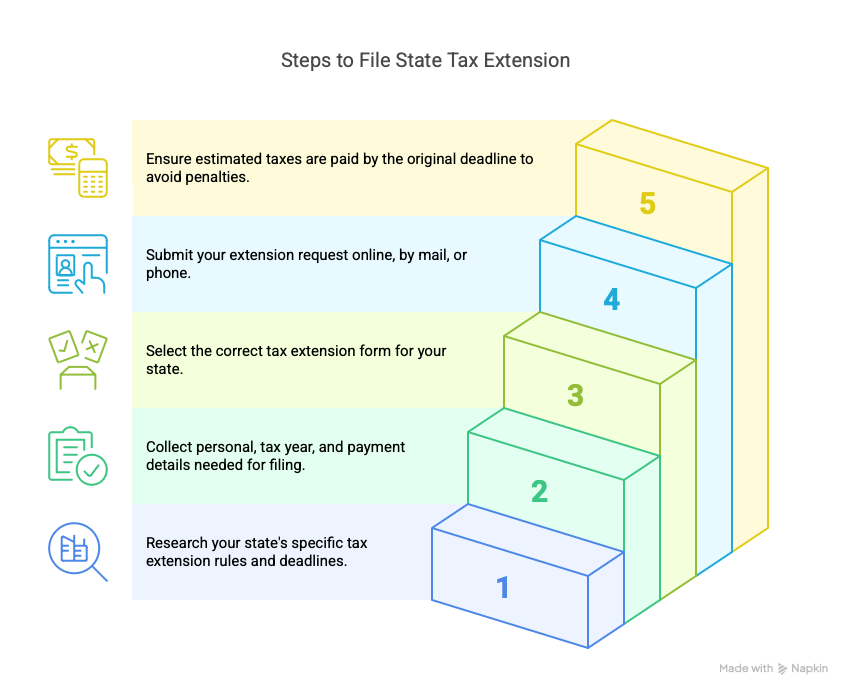

Steps to File a State Tax Extension

- Determine Your State's Extension Policy

Each state has its own rules and deadlines for filing tax extensions. Some states follow the federal tax deadline, while others have different dates. It's essential to check your state's tax authority website for specific details. For example, California residents can visit the California Franchise Tax Board, while New York residents should refer to the New York State Department of Taxation and Finance.

Some states grant automatic extensions if you've filed for a federal extension, while others require separate filings. Additionally, extension periods vary by state—most offer six months, but some provide shorter or longer timeframes. Research your state's specific requirements well before the deadline to avoid complications.

- Gather Necessary Information

To file for a state tax extension, you'll need the following information:

- Personal Information: Your Social Security number, full name, address, and other personal details including date of birth and filing status.

- Tax Year Information: Details about your tax year, including income sources and any deductions or credits you plan to claim. Having previous year's returns on hand can also be helpful.

- Estimated Tax Liability: If your state requires it, you may need to provide an estimate of your tax liability for the year. This typically requires calculating your approximate income, deductions, and credits to determine what you might owe.

- Payment Information: If you owe taxes, have your payment method ready, whether it's bank account information for direct debit or credit/debit card details for online payments.

- Choose the Right Form

Most states have a specific form for filing a tax extension. Common forms include:

- Form 4868: This is the federal form for an automatic six-month extension. Some states accept this form for state tax extensions as well, eliminating the need for separate state filings.

- State-Specific Forms: Many states have their own forms. For example, California accepts a federal extension, but New York requires Form IT-370, Georgia uses Form IT-303, and Massachusetts requires Form M-4868.

- Electronic Filing Systems: Some states have integrated extension requests into their online tax filing systems, allowing you to complete the process without dedicated forms.

Be sure to use the correct form version for your tax year, as forms and requirements may change annually.

- File Your Extension Request

You can file your state tax extension request in several ways:

- Online: Many states offer online filing options through their tax authority websites. This is often the quickest and most convenient method, providing immediate confirmation and reducing the risk of postal delays or lost paperwork.

- Mail: You can also mail your extension request form to the appropriate state tax authority. Be sure to check the mailing address and any additional requirements. Allow sufficient time for delivery, and consider using certified mail with return receipt for proof of timely filing.

- Phone: Some states allow you to file an extension by phone. This can be useful if you need immediate assistance or are unable to file online. Have all your information ready before calling to streamline the process.

- Tax Preparation Software: Most major tax software programs include options for filing state extensions alongside federal extensions, often simplifying the process by transferring information between forms.

- Pay Any Estimated Taxes

An important detail many taxpayers miss: a filing extension is not a payment extension. Even with an approved extension, taxes owed are typically still due by the original deadline. To avoid penalties and interest:

- Calculate your estimated tax liability as accurately as possible using available information

- Pay at least 90% of your final tax liability (requirements vary by state)

- Submit payment with your extension request or through your state's electronic payment system

- Keep records of all payments made, including confirmation numbers and receipts

Some states offer payment plans if you cannot pay the full amount due, but you must typically apply for these arrangements separately from your filing extension.

State-by-State Tax Extension Requirements

|

State Name |

Business Tax Extension |

Personal Tax Extension |

|

Alabama |

No State Specific Form. State automatically grants extension. |

No State Specific Form. State automatically grants extension. |

|

Alaska |

No State Specific Form. State accepts approved federal extension. |

None |

|

Arizona |

State accepts approved federal extension (or) Form 120 EXT, Form 141 AZ EXT |

State accepts approved federal extension (or) Form 204 |

|

Arkansas |

State accepts approved federal extension (or) Form AR1155, Form AR1055-PE, Form R1055-FE |

State accepts approved federal extension (or) Form AR1055-IT |

|

California |

No State Specific Form. State automatically grants extension. |

No State Specific Form. State automatically grants extension. |

|

Colorado |

No State Specific Form. State automatically grants extension. |

No State Specific Form. State automatically grants extension. |

|

Connecticut |

Form CT-1120EXT, Form CT-1065/CT-1120SI EXT, Form CT-1041 EXT |

State accepts approved federal extension (or) Form CT-1040-EXT |

|

Delaware |

State accepts approved federal extension (or) Form 1100-T EXT, Form 1100-P EXT, Form 400 EX |

State accepts approved federal extension (or) Form 200EX |

|

District of Columbia |

Form FR-120, Form FR-165 |

Form FR-127 |

|

Florida |

Form F-7004 |

None |

|

Georgia |

State accepts approved federal extension (or) Form IT-303 |

State accepts approved federal extension (or) Form IT-303 |

|

Hawaii |

No State Specific Form. State automatically grants extension. |

No State Specific Form. State automatically grants extension. |

|

Idaho |

No State Specific Form. State automatically grants extension. |

No State Specific Form. State automatically grants extension. |

|

Illinois |

No State Specific Form. State automatically grants extension. |

No State Specific Form. State automatically grants extension. |

|

Indiana |

No State Specific Form. State accepts approved federal extension. |

State accepts approved federal extension (or) Form IT-9 |

|

Iowa |

No State Specific Form. State automatically grants extension. |

No State Specific Form. State automatically grants extension. |

|

Kansas |

No State Specific Form. State automatically grants extension. |

No State Specific Form. State automatically grants extension. |

|

Kentucky |

Form 720-EXT, Form 740-EXT |

State accepts approved federal extension (or) Form 740EXT |

|

Louisiana |

State accepts approved federal extension (or) Form CIFT-620EXT, Form R6467S, Form R-6466 |

Form R-2868 |

|

Maine |

No State Specific Form. State automatically grants extension. |

No State Specific Form. State automatically grants extension. |

|

Maryland |

Form 500E, Form 510E, Form 504E |

State accepts approved federal extension (or) Form PV |

|

Massachusetts |

No State Specific Form. State automatically grants extension. |

Form M-4868 |

|

Michigan |

Form 4, Form 5301 (City of Detroit) |

State accepts approved federal extension (or) Form 4 |

|

Minnesota |

No State Specific Form. State automatically grants extension. |

No State Specific Form. State automatically grants extension. |

|

Mississippi |

Form 83-180, Form 80-106 |

State accepts approved federal extension (or) Form 80-106 |

|

Missouri |

State accepts approved federal extension (or) Form MO 7004, Form MO-60 |

State accepts approved federal extension (or) Form MO-60 |

|

Montana |

No State Specific Form. State automatically grants extension. |

No State Specific Form. State automatically grants extension. |

|

Nebraska |

State accepts approved federal extension (or) Form 7004N |

State accepts approved federal extension (or) Form 4868N |

|

Nevada |

None |

None |

|

New Hampshire |

No State Specific Form. State automatically grants extension. |

DP-59-A |

|

New Jersey |

Form CBT-200-T, Form CBT-206, Form NJ-630 |

State accepts approved federal extension (or) Form NJ-630 |

|

New Mexico |

State accepts approved federal extension (or) Form RPD-41096 |

State accepts approved federal extension (or) Form RPD-41096 |

|

New York |

State accepts approved federal extension (or) Form CT-5, Form CT-5.4, Form IT-370-PF |

Form NJ-630 |

|

North Carolina |

Form CD-419, Form D-410P |

State accepts approved federal extension (or) Form D-410 |

|

North Dakota |

State accepts approved federal extension (or) Form 101 |

State accepts approved federal extension (or) Form 101 |

|

Ohio |

State accepts approved federal extension. |

No State Specific Form. State automatically grants extension. |

|

Oklahoma |

State accepts approved federal extension (or) Form 504-C |

Form 504 |

|

Oregon |

State accepts approved federal extension |

State accepts approved federal extension (or) Form OR-40-EXT |

|

Pennsylvania |

State accepts approved federal extension (or) Form REV-853, Form REV-276 |

State accepts approved federal extension (or) Form REV-276 |

|

Rhode Island |

Form RI-7004 |

State accepts approved federal extension (or) Form RI-4868 |

|

South Carolina |

State accepts approved federal extension (or) Form SC-7004 |

State accepts approved federal extension (or) Form SC-4868 |

|

South Dakota |

None |

None |

|

Tennessee |

State accepts approved federal extension (or) Form 1410.1, Form 1410.2 |

State accepts approved federal extension (or) Form 1410.1 |

|

Texas |

State accepts approved federal extension (or) Form 05-130 |

State accepts approved federal extension (or) Form 05-130 |

|

Utah |

State accepts approved federal extension (or) Form TC-4868 |

State accepts approved federal extension (or) Form TC-4868 |

|

Vermont |

State accepts approved federal extension (or) Form IN-4868 |

State accepts approved federal extension (or) Form IN-4868 |

|

Virginia |

Form VA-4868 |

State accepts approved federal extension (or) Form VA-4868 |

|

Washington |

None |

None |

|

West Virginia |

State accepts approved federal extension (or) Form IT-7004 |

State accepts approved federal extension (or) Form IT-7004 |

|

Wisconsin |

State accepts approved federal extension (or) Form S-4868 |

State accepts approved federal extension (or) Form S-4868 |

|

Wyoming |

None |

Does a State Extension Affect Your Federal Return?

Filing a state tax extension doesn't automatically extend your federal tax deadline. These are entirely separate processes governed by different tax authorities. To extend both deadlines, you must file separate extension requests—Form 4868 with the IRS for federal taxes and your state's specific extension form with your state tax department.

Some states simplify this by automatically granting state extensions when federal extensions are approved, but this convenience doesn't work in reverse. The federal government never grants extensions based on state filings. Additionally, information requirements differ between federal and state extensions, with states often requesting more detailed financial estimates.

What Happens If You Miss the Extension Deadline?

Missing your extended state tax filing deadline triggers a cascade of consequences more severe than missing the original deadline. First, late-filing penalties typically range from 5% to 25% of unpaid taxes per month, depending on your state. These penalties compound with late-payment penalties that have likely been accumulating since the original deadline.

Additionally, interest continues accruing on all unpaid taxes, often at rates significantly higher than market interest rates. Some states also impose minimum penalties regardless of the amount owed.

Beyond financial penalties, missing extended deadlines may flag your account for additional scrutiny in future tax years and could complicate applications for loans, mortgages, or other financial services requiring tax documentation. In extreme cases of non-filing, states may pursue collection actions including liens, garnishments, or revocation of professional licenses.

Tips for Avoiding Penalties and Interest

Pay early and estimate accurately: Pay at least 90% of your expected tax obligation by the original filing deadline, even when filing for an extension. Consider making quarterly estimated tax payments throughout the year to reduce your year-end tax burden.

Set reminders and stay organized: Create calendar alerts for both original and extended deadlines with buffer time. Keep separate, organized records of all extension filings, payments, and relevant tax documents to demonstrate compliance.

Document everything: Maintain records of all extension-related communications with tax authorities, including confirmation numbers for electronic filings and certified mail receipts for paper submissions.

Use safe harbor provisions: Take advantage of state-specific "safe harbor" provisions by ensuring your payments match or exceed your previous year's tax liability, which can eliminate many penalties regardless of your current year's tax situation.

Seek help proactively: Contact your state tax authority about penalty abatement options if facing hardship circumstances, and consider using tax preparation software or professional services to coordinate both federal and state extension processes simultaneously.

Conclusion

Filing a state tax extension doesn't have to be a daunting task if you understand your state's policies, gather the necessary information, and follow the correct procedures. Remember, the key to a smooth process is preparation and attention to detail. If you need further assistance, don't hesitate to reach out to your state's tax authority or a tax professional.

NSKT Global offers experienced tax professionals that can streamline your state tax extension process, eliminating the stress and uncertainty. Our advisors stay current with changing tax laws across all 50 states, ensuring your extension is filed correctly and on time. Whether you need assistance with calculating estimated payments, completing state-specific forms, or developing a comprehensive tax strategy that includes appropriate extensions, NSKT Global provides personalized support tailored to your unique financial situation.

FAQs About State Tax Extensions

Is a state tax extension automatic?

No, most state tax extensions are not automatic. While some states automatically grant you an extension if you receive a federal extension, others require you to file a separate state-specific extension request. Always check your state's tax authority website for their specific requirements.

Do I still have to pay taxes if I file for an extension?

Yes. A tax extension gives you more time to file your return, not more time to pay. You're still required to pay your estimated taxes by the original deadline to avoid penalties and interest. The extension only applies to the paperwork submission.

Can I e-file my state tax extension?

Yes, most states allow e-filing for tax extensions. This is typically the fastest and most convenient method, providing immediate confirmation of receipt. Many states offer this service through their tax department websites or approved third-party tax preparation software.

What's the difference between a state and federal extension?

A federal extension applies only to your federal tax return and is filed with the IRS using Form 4868, typically granting a six-month extension. State extensions involve different forms, deadlines, and procedures that vary by state. Some states accept your federal extension automatically, while others require separate filings with state-specific forms.

Which states do not allow tax extensions?

All states with income taxes allow some form of extension, but the requirements and timeframes vary significantly. However, some states like Alabama and Wisconsin typically only grant extensions if you've paid 90% of taxes owed.