Table of Contents

Unexpected disasters or thefts can significantly impact your personal or business property. To ease the financial burden, the IRS allows taxpayers to claim casualty loss deductions using Form 4684. Whether you're an individual or a business owner, understanding how this form works and the associated eligibility criteria is essential for maximizing your tax benefits.

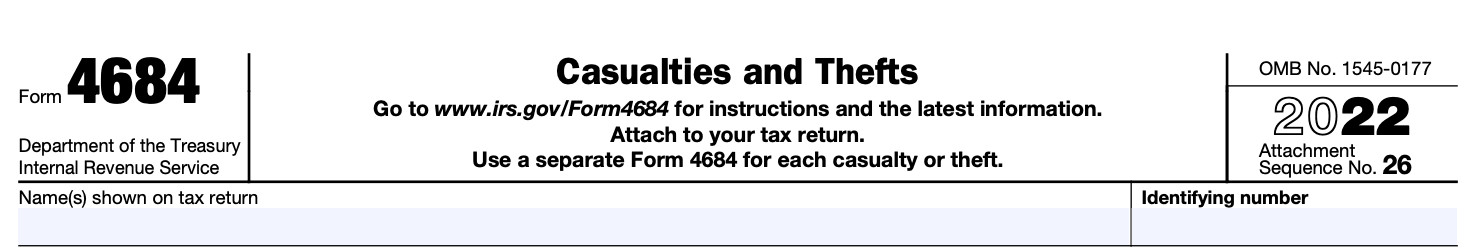

What Is IRS Form 4684?

IRS Form 4684 is used to report losses resulting from theft, disaster, or other casualty events. This form plays a vital role in helping taxpayers calculate deductible losses and report them appropriately on their federal tax returns. Casualty losses typically arise from sudden, unexpected, or unusual events.

This form integrates with other tax forms, particularly Form 1040, where the calculated deductions are reported. For individuals itemizing deductions, the results from Form 4684 are transferred to Schedule A. In the case of businesses, casualty and theft losses are detailed separately in Section B of the form, which focuses on income-producing or business property. Ensuring accurate completion of Form 4684 can help taxpayers maximize their deductions while complying with IRS regulations.

What Qualifies as a Casualty or Theft Loss?

A casualty loss involves damage or destruction of property due to identifiable events that are sudden, unexpected, or unusual. Common examples include:

- Natural disasters: Hurricanes, tornadoes, earthquakes, or floods

- Fires

- Terrorist attacks

- Car accidents (if not caused by negligence)

- Government-ordered demolitions due to unsafe conditions

Theft loss occurs when property is unlawfully taken with criminal intent. Examples include:

- Burglary or robbery

- Embezzlement

- Fraudulent schemes

What Doesn’t Qualify as a Casualty Loss?

Certain losses do not qualify for a casualty loss deduction, such as:

- Damage caused by normal wear and tear

- Termite or pest damage

- Accidental breakage of personal items under regular circumstances

- Losses that are covered by insurance but for which you fail to file a claim

For the tax years 2018 through 2025, only casualty losses resulting from federally declared disasters are deductible for personal property. Losses outside of this scope generally do not qualify.

Eligibility Criteria for Casualty Loss Deduction

To qualify for a casualty loss deduction, the following conditions must be met:

- Identifiable Event: The loss must result from a specific, identifiable event that is sudden, unexpected, or unusual. For example, if a hurricane damages your home, the event qualifies as it was a natural disaster that occurred abruptly. However, long-term deterioration of a roof due to poor maintenance would not qualify.

- Ownership: You must own the damaged or stolen property. For instance, if a car you personally own is vandalized, you may claim the loss. However, if the damaged property belongs to someone else, you cannot claim it unless you are legally responsible for its replacement or repair under an agreement.

- Non-Reimbursed Loss: The loss must not be fully reimbursed by insurance or other sources. For example, if a tree falls on your garage, and your insurance covers only 70% of the repair costs, the remaining 30% could be claimed as a casualty loss deduction.

- Federally Declared Disaster: For personal property, the loss must occur in a federally declared disaster area for tax years 2018 through 2025. For instance, if an earthquake damages your property in an area declared a disaster by the President, the loss qualifies under this criterion.

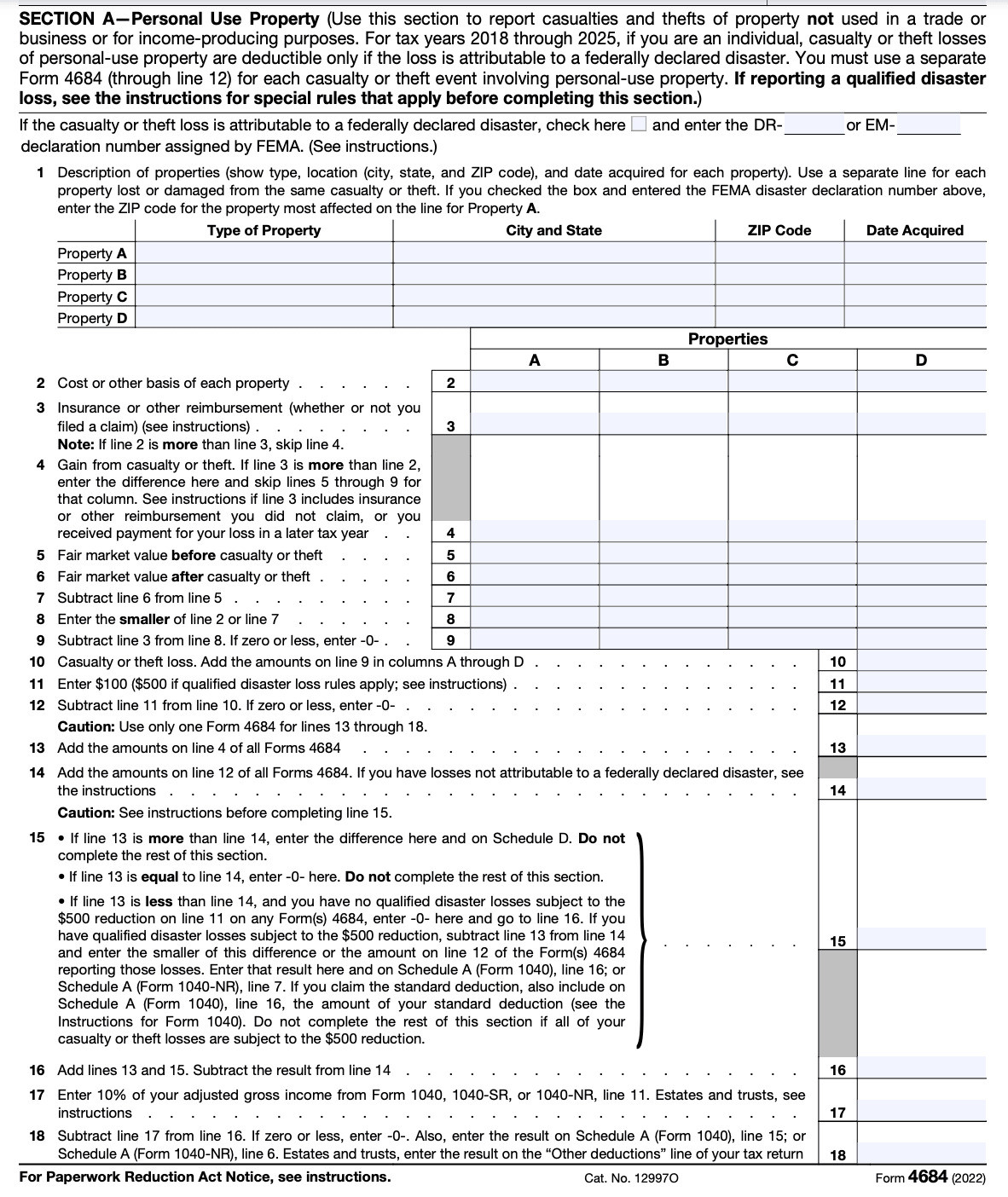

Additionally, you’ll need to meet certain thresholds:

- $100 Rule: Subtract $100 from each casualty event for personal property. For example, if you incur $5,000 in losses due to a tornado, only $4,900 would be eligible after applying the $100 rule.

- 10% of AGI Rule: The total of all casualty losses must exceed 10% of your adjusted gross income (AGI) for the deductible amount to apply. For instance, if your AGI is $60,000, your deductible casualty losses must exceed $6,000 after applying the $100 rule.

How to Fill Out Form 4684

Filling out Form 4684 involves several steps. Below is an example scenario to illustrate the process:

Step 1: Obtain the Form

- Where to get it: Download Form 4684 from the IRS website (www.irs.gov) or request a physical copy by calling the IRS.

Step 2: Provide Your Personal Information

- Required Information: Enter your name, Social Security Number (SSN), and other personal details at the top of the form.

Step 3: Determine the Type of Loss

- Identify the Section: Form 4684 is divided into two main sections:

- Section A: For personal-use property (e.g., personal belongings, a home).

- Section B: For business or income-producing property (e.g., rental property, business equipment).

Which Section Applies to you?

Based on the nature of your property and loss, determine which section to complete:

- Personal property (such as the homeowner's roof in the example) goes under Section A.

- Business or income-producing property (e.g., rental property) goes under Section B.

Step 4: Complete the Applicable Section (A or B)

Section A: Personal-Use Property

- Part I - Description of Property and Date of Loss

- Example: In the case of a homeowner, describe the roof and the event that caused the damage, such as a hurricane.

- Date of loss: Provide the date when the loss occurred (e.g., the date of the hurricane).

- Part II - Cost or Other Basis

- Example: The homeowner purchased the property for $200,000, and the adjusted basis of the roof was $30,000 (as it was depreciated for tax purposes).

- Part III - Decrease in Fair Market Value (FMV)

- Example: The homeowner’s property’s FMV before the hurricane was $250,000. After the hurricane, the FMV dropped to $180,000.

- FMV decrease = $250,000 - $180,000 = $70,000 decrease.

- Part IV - Adjusted Basis

- Example: The adjusted basis of the roof was $30,000.

- You use the smaller amount between the decrease in FMV ($70,000) and the adjusted basis ($30,000).

- Adjusted basis used: $30,000 (since it’s lower than the FMV decrease).

- Part V - Gain or (Loss)

- Example: The homeowner received $40,000 in insurance proceeds, which is more than the $30,000 adjusted basis.

- Insurance proceeds exceed adjusted basis, so there’s no deductible loss.

- Calculation: $30,000 (adjusted basis) - $40,000 (insurance proceeds) = $0 deductible loss.

- Part VI - Amount of Loss

- Example: Since the insurance proceeds exceed the adjusted basis, no deductible loss remains.

- Part VII - Casualty and Theft Losses from Other Events

- If the homeowner had other losses from a different event, they would report it here.

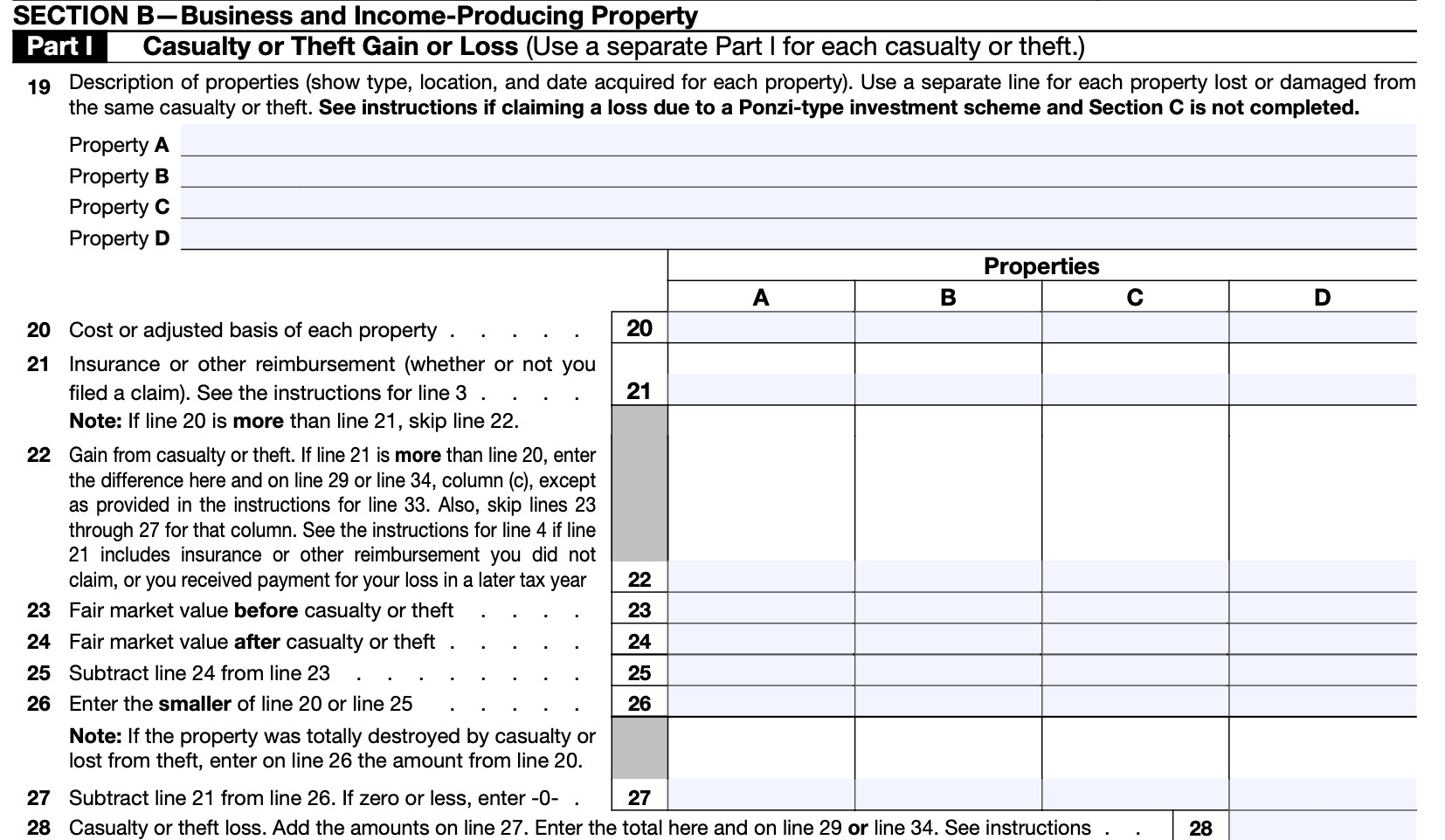

Section B: Business or Income-Producing Property

- Part I - Description of Property and Date of Loss

- Example: If the damage involved a rental property instead of personal-use property, describe the rental house or property and the date of loss (e.g., the same hurricane).

- Part II - Cost or Other Basis

- Example: The homeowner purchased the rental property for $200,000, and the adjusted basis for tax purposes was $30,000.

- Part III - Decrease in Fair Market Value (FMV)

- Example: The FMV of the rental property decreased from $250,000 to $180,000 due to the hurricane.

- FMV decrease = $250,000 - $180,000 = $70,000 decrease.

- Part IV - Adjusted Basis

- Example: The adjusted basis of the property was $30,000 (same as for personal-use property).

- Part V - Gain or (Loss)

- Example: The insurance reimbursement of $40,000 exceeds the $30,000 adjusted basis of the rental property.

- Calculation: $30,000 (adjusted basis) - $40,000 (insurance proceeds) = $0 deductible business loss.

- Part VI - Amount of Loss

- Example: Since the insurance proceeds exceed the adjusted basis, the deductible business loss is $0.

- Part VII - Casualty and Theft Losses from Other Events

- If there are any additional losses not covered by insurance, report them here.

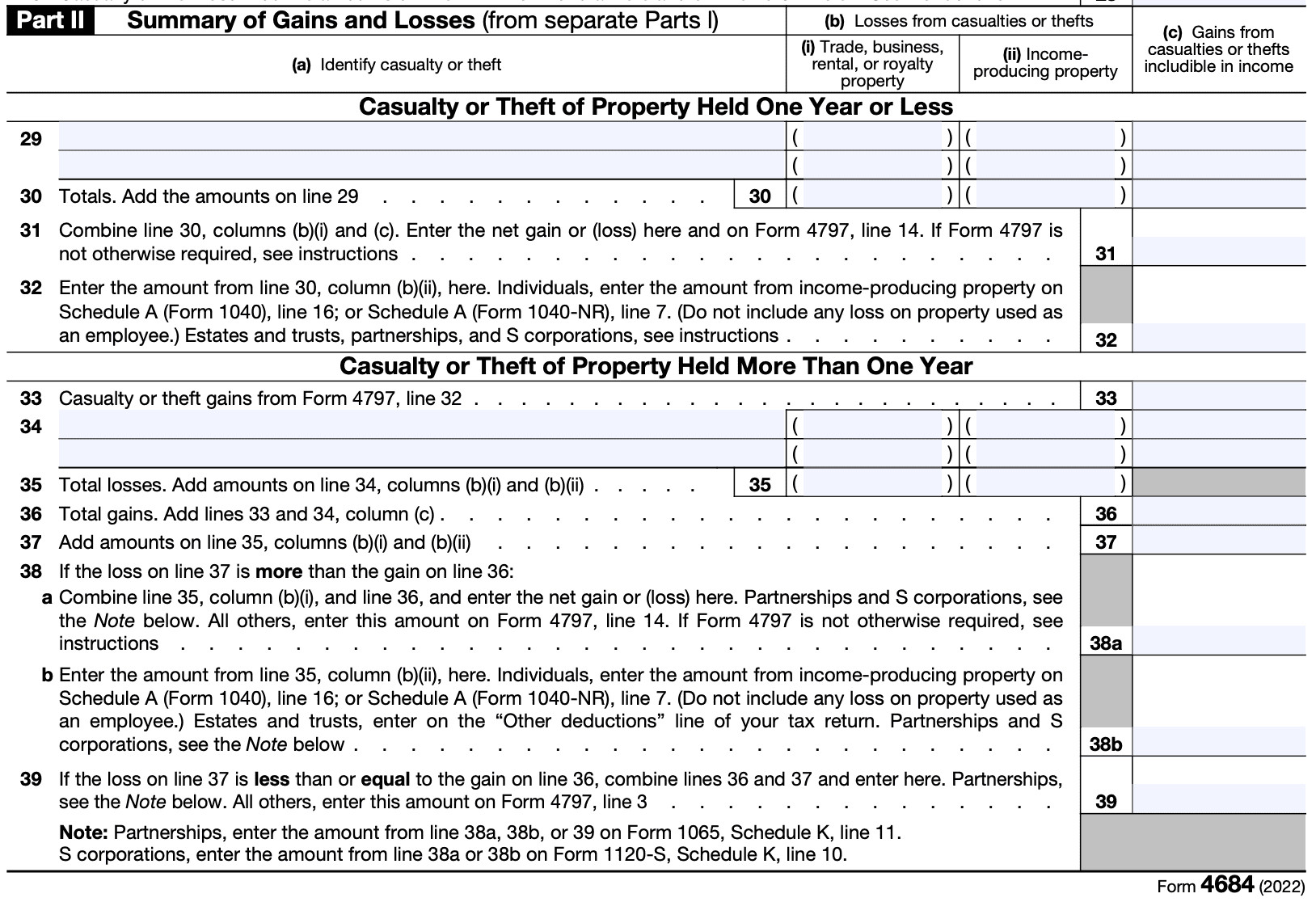

Step 5: Determine the Amount of Loss

- Total Loss Calculation: After completing the appropriate sections, calculate the total loss from all affected properties.

- Personal property: If the homeowner’s adjusted basis of the roof was less than the insurance proceeds, there’s no deductible loss.

- Business property: Similarly, for the rental property, the insurance proceeds exceed the adjusted basis, resulting in no deductible loss.

Step 6: Transfer the Loss Amount to Your Tax Return

- For Personal Property: If you’re itemizing deductions, transfer the total loss amount from Section A to Schedule A (Itemized Deductions) on Form 1040.

Example: In the homeowner scenario, no deductible loss is reported because the insurance proceeds exceed the adjusted basis.

- For Business Property: If you're claiming business property losses, transfer the total amount to Schedule C (Profit or Loss from Business) or the relevant business form.

Example: In the rental property scenario, the deductible business loss is $0, so no amount would be transferred.

Step 7: Retain Documentation

- Keep All Supporting Documentation:

- Photos of the damaged property (e.g., the roof)

- Appraisals to verify FMV before and after the damage

- Repair estimates and receipts

- Insurance documentation that details the reimbursement received

- IRS Requests: You may need to provide these documents if the IRS requests further details about your loss.

Additional Notes for Form 4684:

Carryforward of Losses: If your loss is greater than the amount you can deduct due to the insurance reimbursement, the excess loss may be carried forward or offset against future years' income, subject to certain conditions

Supporting Documentation: Always keep records, such as:

- Receipts for repairs or property valuation.

- Appraisals to substantiate the FMV before and after the damage.

- Photographs showing the extent of the damage.

Other Considerations:

-

- If the loss is due to theft or another event, be sure to follow the specific instructions for that type of casualty.

- For business losses, be mindful that the $100 rule (deductible only for losses exceeding $100 per casualty) and the 10% AGI (Adjusted Gross Income) rule do not apply for business losses, but they do apply for personal property losses.

Limits on Casualty Loss Deductions

There are specific limits on claiming casualty loss deductions:

- Personal Property: Only losses from federally declared disasters are eligible during 2018-2025.

- Insurance Requirements: You must file an insurance claim if coverage is available. Unclaimed insurance amounts disqualify the loss.

- Income Threshold: Personal property losses are subject to the $100 and 10% of AGI rules.

- Business Property: No $100 or 10% of AGI limits apply, but losses must be reduced by any salvage value or reimbursements.

Filing Deadlines & Extensions for Form 4684

Original Filing Deadline

- The original filing deadline for Form 4684 is typically the same as the deadline for your federal income tax return.

- For most individuals, this is April 15 of the following year.

- If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day.

Extension Deadline

- If you need more time to file your tax return, you can request an extension. This gives you an additional six months to file your return.

- The extension deadline moves your filing deadline to October 15.

- To request an extension, you must file Form 4868 (Application for Automatic Extension of Time To File U.S. Individual Income Tax Return) with the IRS by the original filing deadline (usually April 15).

Extended Filing Deadline

- If you receive an extension by filing Form 4868, your extended filing deadline for Form 4684 will be October 15.

- Be sure to include Form 4684 when you file your tax return by the extended deadline.

Casualty Loss Deductions for Businesses vs. Individuals

The rules for casualty loss deductions vary depending on whether the property is personal or business-related. Below is a detailed comparison to clarify the distinctions:

|

Aspect |

Personal Property |

Business Property |

|

Qualifying Events |

Federally declared disasters are required. |

Federally declared disasters are not a requirement. |

|

Deduction Rules |

Subject to the $100 rule and 10% of AGI threshold. |

Not subject to the $100 rule or 10% of AGI threshold. |

|

Examples of Deductible Losses |

Damage to a primary residence or personal vehicle. |

Losses to rental properties, equipment, or inventory. |

|

Documentation Requirements |

Requires proof of event, damage, and property value. |

Requires detailed business records and valuations. |

|

Reporting Section on Form 4684 |

Section A |

Section B |

For instance, if a hurricane damages your personal home, you must deduct $100 per casualty event and ensure the remaining losses exceed 10% of your AGI. However, if the same hurricane damages your rental property, the $100 rule and AGI threshold do not apply, allowing you to deduct the full loss (minus insurance reimbursements).

Personal Property:

- Federally declared disasters are the primary qualifier for deductions.

- Subject to the $100 and 10% of AGI rules.

Business Property:

- Losses can be deducted without the $100 or 10% of AGI limitations.

- Deductible losses include those for equipment, vehicles, or rental properties.

- Losses are reported in Section B of Form 4684.

Businesses must keep detailed records of property values before and after the loss, insurance reimbursements, and any related expenses.

Conclusion

Casualty loss deductions can provide much-needed financial relief after a disaster or theft. By understanding the rules, eligibility criteria, and proper use of Form 4684, taxpayers can maximize their deductions and ease their recovery process. Keep detailed records and consult a tax professional when needed to ensure compliance and accuracy.

FAQs

What is the difference between casualty and theft loss?

Casualty loss results from damage or destruction due to sudden events, while theft loss involves the unlawful taking of property.

Can I claim casualty losses for damage caused by natural disasters?

Yes, but for personal property, the event must occur in a federally declared disaster area for tax years 2018-2025.

What records should I keep for a casualty loss claim?

Maintain purchase receipts, photographs, appraisals, and any documentation of insurance claims and reimbursements.

Are casualty loss deductions subject to income thresholds?

Yes, for personal property, the $100 rule and the 10% of AGI rule apply.

Can I claim a casualty loss deduction for personal property damage?

Only if the loss occurs in a federally declared disaster area and meets other eligibility criteria.