Table of Contents

The structure of your business plays a crucial role in shaping your financial future. Many entrepreneurs begin with a Limited Liability Company (LLC) because of its flexibility, but as profits grow, so do tax obligations. The right move at this stage? Converting to an S-Corporation (S-Corp) could unlock significant tax savings, especially by reducing self-employment taxes while maintaining the liability protection of an LLC.

Making this transition involves understanding key differences between LLCs and S-Corps, assessing eligibility, navigating the conversion process, and avoiding costly mistakes. A well-planned switch can streamline tax obligations and enhance financial efficiency.

Understanding the Differences Between LLCs and S-Corps

An LLC and an S-Corp serve as distinct business entities, each with unique legal and tax considerations. Understanding their fundamental differences helps business owners decide which structure best suits their needs.

LLC Overview

A Limited Liability Company (LLC) is a popular business structure due to its operational flexibility and pass-through taxation. It offers liability protection without the rigid formalities of a corporation.

- Ownership Flexibility: Can be owned by one or multiple members.

- Taxation: Default taxation is pass-through, where profits and losses are reported on personal tax returns.

- Self-Employment Taxes: Members pay self-employment taxes on all business profits.

- Management: Fewer formalities and reporting requirements, making it easier to operate.

S-Corp Overview

An S-Corporation (S-Corp) is not a separate business entity but rather a tax designation that an eligible LLC or corporation can elect. This structure provides tax benefits by allowing business owners to reduce self-employment tax liabilities.

- Ownership Restrictions: Limited to 100 shareholders, all of whom must be U.S. citizens or residents.

- Taxation: Pass-through taxation, but allows business owners to pay themselves a salary and take distributions, potentially reducing self-employment tax.

- Self-Employment Taxes: Only the salary portion is subject to payroll taxes, while distributions are not.

- Management: Requires more formalities, such as board meetings, corporate bylaws, and record-keeping to maintain compliance.

Understanding these distinctions is crucial in deciding whether an S-Corp conversion aligns with your business goals.

Benefits of Converting from an LLC to an S-Corp

Making the transition to an S-Corp can offer several advantages, particularly for business owners looking to optimize tax savings. Some key benefits include:

- Lower Self-Employment Taxes – Instead of paying self-employment taxes on all profits, S-Corp owners only pay these taxes on their salary. The remaining earnings, taken as distributions, are not subject to self-employment taxes, significantly reducing tax liability.

- Pass-Through Taxation – Like an LLC, an S-Corp avoids double taxation, meaning business profits are reported on the owners’ personal tax returns rather than being taxed at both corporate and personal levels.

- Increased Business Credibility – Operating as an S-Corp can improve a business’s reputation with potential investors, clients, and lenders, as it reflects a more structured and professional approach.

- Tax Deductions for Owners – S-Corp owners may deduct various expenses, including health insurance premiums and retirement contributions, leading to additional tax savings.

- Easier Transfer of Ownership – Unlike LLCs, which require complex agreements for transferring ownership, S-Corp shares can be more easily sold or transferred, simplifying business succession planning.

- Potential for Better Investment Opportunities – The structured governance of an S-Corp can make it more appealing to investors who prefer corporate frameworks over LLCs.

While these benefits are appealing, business owners should carefully evaluate whether the additional administrative responsibilities justify the potential tax savings.

Eligibility Criteria for S-Corp Status

Before converting your LLC to an S-Corp, it’s crucial to confirm that your business meets the strict IRS qualifications. Failing to meet any of these requirements can result in the IRS rejecting your election, leading to potential tax complications.

To qualify for S-Corp status, a business must adhere to the following guidelines:

- Domestic Business Requirement – Your company must be registered and operating within the United States.

- Shareholder Limitations – The S-Corp can have a maximum of 100 shareholders, all of whom must be U.S. citizens or resident individuals.

- Stock Restrictions – Only one class of stock is allowed, meaning all shares must have identical rights to distribution and liquidation proceeds.

- Qualified Shareholders – Owners must be individuals, estates, or certain eligible trusts. Other entities, such as partnerships, corporations, and non-resident aliens, are prohibited from holding shares.

- Permissible Tax Year – The IRS generally requires an S-Corp to use a calendar tax year unless a specific exception applies.

If your LLC does not currently meet these criteria, you may need to restructure ownership or operational details before filing for S-Corp election. Carefully reviewing these requirements in advance helps prevent future complications with tax authorities.

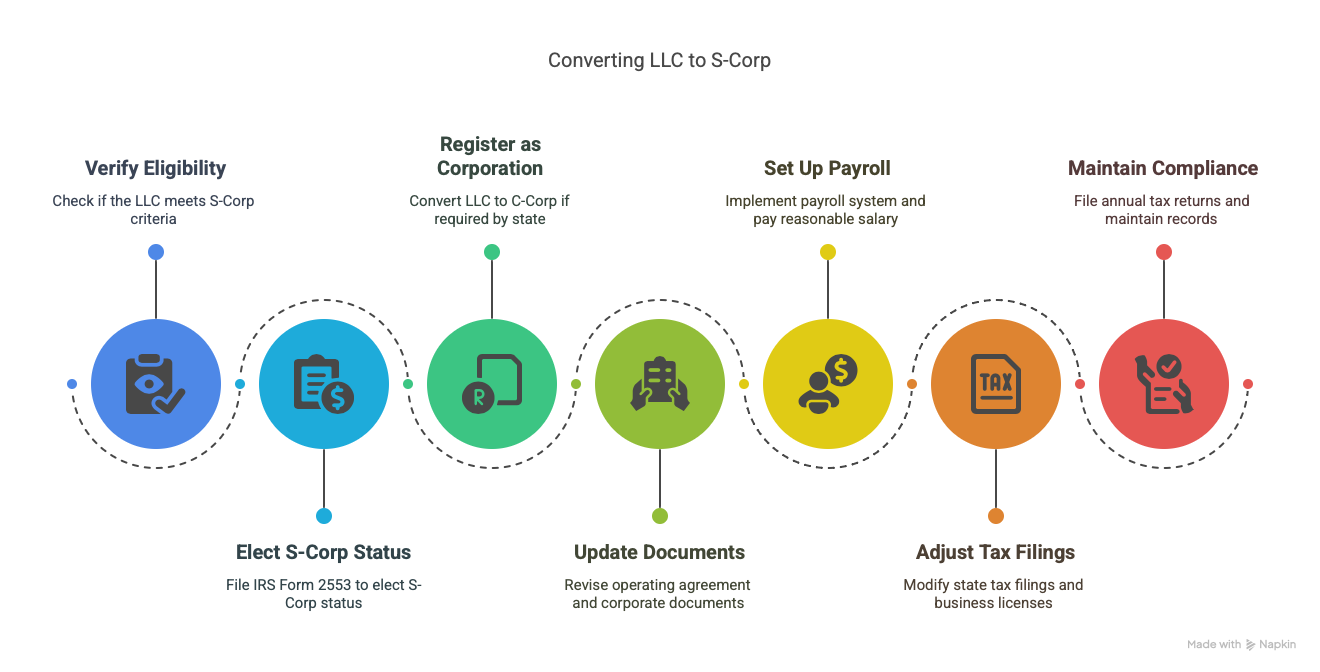

Step-by-Step Guide to Converting Your LLC to an S-Corp

Converting an LLC to an S-Corp requires filing the necessary documents with the IRS and ensuring compliance with both federal and state regulations. Follow these steps to complete the transition:

1. Verify Eligibility for S-Corp Status

Before starting the process, confirm that your business meets all the IRS S-Corp eligibility criteria, including:

- Being a domestic business operating in the U.S.

- Having 100 or fewer shareholders, all of whom must be individuals or eligible entities.

- Issuing only one class of stock to shareholders.

If your LLC does not meet these requirements, restructuring may be necessary before proceeding.

2. Elect S-Corp Status with the IRS (Form 2553)

To officially change tax classification, file IRS Form 2553 (Election by a Small Business Corporation) within:

- 75 days of forming the business (if new).

- By March 15 of the current tax year for the election to take effect that same year.

All LLC members must sign Form 2553, and the IRS will notify you of approval or rejection within approximately 60 days.

3. Register Your Business as a Corporation (If Required by Your State)

Some states require an LLC to first convert into a C-Corporation before electing S-Corp status. Check your state’s business registration office for specific requirements. This may involve:

- Filing an Articles of Incorporation or Amendment with the Secretary of State.

- Paying a conversion or incorporation fee (varies by state).

4. Update Operating Agreement & Corporate Documents

Unlike LLCs, S-Corps must follow corporate governance rules, including:

- Adopting corporate bylaws outlining business operations.

- Holding annual shareholder meetings and keeping minutes.

- Maintaining separate personal and business finances to uphold liability protections.

5. Set Up Payroll & Pay Yourself a “Reasonable Salary”

As an S-Corp owner, you must pay yourself a reasonable salary for your role in the company. The IRS expects:

- Wages to be comparable to industry standards for similar roles.

- Payroll taxes to be withheld and reported using Form 941 (Employer’s Quarterly Tax Return).

- Remaining profits to be taken as distributions, which are not subject to self-employment taxes.

6. Adjust State Tax Filings & Business Licenses

Certain states impose special S-Corp taxes or additional filing requirements, such as:

- Franchise taxes (e.g., in California and Texas).

- Additional state-level S-Corp election forms.

- Updating business licenses and registrations to reflect the new structure.

7. Maintain Compliance & File Business Taxes Properly

Once your LLC is converted to an S-Corp, you must file the correct tax returns and corporate records each year, including:

- Form 1120-S (U.S. Income Tax Return for an S-Corporation).

- Schedule K-1 (Shareholder’s Share of Income, Deductions, Credits, etc.) to report each owner’s earnings.

- Payroll tax filings for wages paid to employees and owners.

Staying compliant with both IRS and state regulations ensures the S-Corp status remains in effect and avoids potential penalties.

Tax Implications and Potential Savings

Converting an LLC to an S-Corp can offer substantial tax benefits, primarily by reducing self-employment tax obligations. Understanding these implications can help business owners maximize their savings while remaining compliant with IRS regulations.

Reduced Self-Employment Taxes

One of the biggest advantages of an S-Corp election is the ability to minimize self-employment taxes, which cover Social Security and Medicare contributions.

- LLC Owners: Pay 15.3% self-employment tax on all net earnings, which can significantly reduce overall profits.

- S-Corp Owners: Pay self-employment taxes only on the salary portion, while any remaining profits can be taken as distributions, which are subject to income tax but not self-employment tax.

Tax Savings Example:

Consider an LLC that earns $100,000 in profit:

- As an LLC, the owner would pay $15,300 in self-employment taxes on the full amount.

- As an S-Corp, if the owner takes a $50,000 salary, self-employment taxes apply only to that portion, resulting in a significant tax reduction.

Additional Tax Benefits:

- Deductible Employee Benefits – S-Corp owners may qualify for tax deductions on benefits such as health insurance and retirement contributions.

- Lower Overall Tax Liability – Business owners can optimize tax payments by balancing salary and distributions strategically.

- Potential State Tax Savings – Some states treat S-Corps differently than LLCs, offering additional tax advantages.

Important Considerations:

- Reasonable Salary Requirement – The IRS requires S-Corp owners to pay themselves a “reasonable salary” based on industry standards. Setting an unrealistically low salary to maximize distributions may result in penalties or audits.

- Payroll and Compliance Responsibilities – S-Corp owners must maintain proper payroll records, withhold payroll taxes, and comply with state and federal filing requirements.

Carefully structuring salary and distributions while staying within IRS guidelines ensures that business owners maximize their tax savings without facing compliance risks.

Common Mistakes to Avoid During the Conversion Process

Converting an LLC to an S-Corp can be beneficial, but mistakes along the way can lead to legal and financial complications. Here are some common pitfalls to avoid:

- Failing to Meet Eligibility Requirements – Ensure that your business meets all IRS criteria before filing, or your election may be rejected.

- Improper Salary Allocation – Assigning an unrealistically low salary can trigger IRS audits and penalties.

- Neglecting State Tax Considerations – Some states impose additional taxes on S-Corps, potentially diminishing expected savings.

- Ignoring Payroll Responsibilities – Failing to set up proper payroll systems and tax withholdings can lead to compliance issues.

- Poor Record-Keeping – Maintaining detailed financial records, corporate minutes, and shareholder agreements is essential for compliance and tax reporting.

Conclusion

Converting an LLC to an S-Corp offers valuable tax advantages, but the process requires careful planning. By understanding the requirements, benefits, and potential pitfalls, business owners can make an informed decision that aligns with their financial goals. Ensuring compliance with IRS rules and maintaining proper record-keeping will help maximize tax savings while protecting the business from legal complications. Seeking professional guidance from experts like NSKT Global can simplify the transition, ensuring all legal and financial aspects are handled correctly to maximize tax benefits and compliance.

FAQs About Converting an LLC to an S-Corp

What are the main tax advantages of converting an LLC to an S-Corp?

The biggest advantage is reducing self-employment taxes, as only the salary portion is subject to payroll taxes, while distributions are not.

How long does the conversion process typically take?

The IRS usually processes Form 2553 within 60 days, but the entire process, including state-level filings, can take up to 90 days.

Are there any additional costs associated with maintaining an S-Corp status?

Yes, S-Corps often have higher administrative costs due to payroll processing, bookkeeping, and required corporate formalities.

Can a single-member LLC elect to be taxed as an S-Corp?

Yes, a single-member LLC can elect S-Corp taxation, provided it meets IRS eligibility criteria.

What happens if my S-Corp election is denied by the IRS?

If denied, the business remains taxed as an LLC and may need to correct errors and reapply or continue operating under default tax rules.