Table of Contents

Missing a tax deadline can feel overwhelming, but it doesn’t have to spell disaster for your business. The IRS and state agencies may impose penalties and interest, creating financial headaches that can snowball over time. Beyond the numbers, a late filing can disrupt operations, hinder cash flow, and even damage your business's reputation. However, there are ways to minimize the damage and regain control. Taking swift action, understanding your options, and leveraging available relief programs can help you get back on track before the situation worsens.

Understanding Late Filing Penalties

The IRS imposes penalties on businesses that fail to file their taxes on time. These penalties can add up quickly and significantly impact your company’s finances, leading to cash flow problems and additional stress. Here’s a breakdown of the most common penalties:

- Failure-to-File Penalty: This penalty applies when a business does not submit its tax return by the due date. The penalty is typically 5% of the unpaid taxes for each month (or part of a month) that the return is late, up to a maximum of 25% of the total unpaid taxes. If the return is over 60 days late, the minimum penalty is either $485 (for 2025) or 100% of the unpaid tax amount, whichever is lower.

- Failure-to-Pay Penalty: Even if a business files its return on time, failing to pay taxes owed can still lead to penalties. The IRS imposes a 0.5% penalty on the unpaid amount each month, which can accumulate up to 25%. If a business enters into an installment agreement with the IRS, this penalty may be reduced to 0.25% per month.

- Interest on Unpaid Taxes: In addition to penalties, the IRS charges interest on any unpaid tax balance. Interest begins accruing from the original due date of the return until the tax is fully paid. The rate is adjusted quarterly and is generally based on the federal short-term rate plus 3%. Because interest compounds daily, the longer a tax debt remains unpaid, the more it grows.

- State-Level Penalties: In addition to federal penalties, businesses may also face penalties from state tax agencies. Each state has its own rules, but many impose similar late filing and payment penalties, some of which can be even more severe than the IRS penalties. Businesses operating in multiple states need to be aware of different filing requirements and due dates.

- Trust Fund Recovery Penalty (TFRP): If a business fails to remit payroll taxes (such as Social Security and Medicare taxes withheld from employees' wages), the IRS can impose the Trust Fund Recovery Penalty. This penalty is particularly severe, as responsible individuals—including business owners and certain employees—can be held personally liable for the unpaid taxes.

Understanding these penalties is essential for businesses to assess their financial risks and take proactive steps to avoid costly mistakes. Keeping up with tax deadlines and making timely payments can prevent unnecessary financial burdens and ensure compliance with tax laws.

Impact on Business Operations

Filing taxes late can have broader consequences beyond penalties and interest. Here are some ways it can impact your business:

- Cash Flow Issues: The accumulation of penalties and interest can strain your business’s cash flow, making it difficult to cover other operational expenses, such as payroll, rent, and supplier payments. A cash shortage can force businesses to cut costs, delay growth plans, or even take out high-interest loans to stay afloat.

- Loss of Tax Credits and Deductions: Some tax credits and deductions may be forfeited if a return is filed late, potentially increasing your overall tax liability. This can be particularly detrimental for small businesses relying on deductions for operational costs, investments in equipment, or employee benefits.

- IRS Enforcement Actions: If taxes remain unpaid for an extended period, the IRS may take collection actions, such as placing liens on business assets, levying bank accounts, or garnishing wages. These enforcement measures can cripple business operations by limiting access to working capital and credit lines.

- Reputational Risks: For corporations and partnerships, late tax filings can damage business credibility, affecting relationships with investors, lenders, and potential partners. Investors and creditors often check tax compliance records before making funding decisions, and repeated late filings may lead to lost financial opportunities.

- Limited Business Opportunities: Some government contracts and business licenses require tax compliance. A history of late filings may disqualify you from these opportunities, making it harder to secure projects or operate legally in regulated industries.

- Employee and Stakeholder Confidence: A business struggling with tax issues may raise concerns among employees, customers, and suppliers. If stakeholders perceive financial instability, they may seek alternative employment, partnerships, or suppliers, further disrupting operations.

By understanding these risks, businesses can take proactive measures to ensure tax deadlines are met.

Steps to Take If You’ve Missed the Deadline

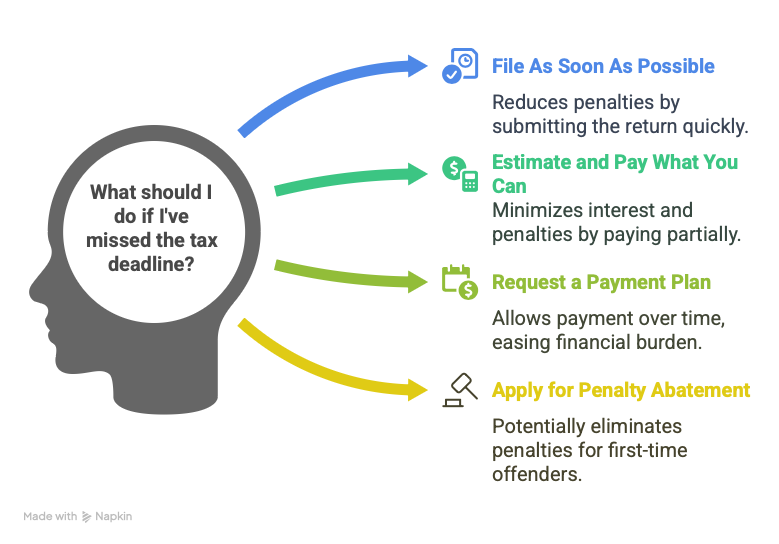

If you’ve missed the tax deadline, don’t panic. Here are the steps to mitigate penalties and get back in good standing:

- File As Soon As Possible: Prompt filing significantly reduces failure-to-file penalties, which can reach 25% of unpaid taxes. Even if you're unable to pay in full, submitting your return shows good faith compliance and limits the most severe penalties the IRS can impose, protecting your business's financial stability.

- Estimate and Pay What You Can: Partial payments demonstrate your commitment to resolving the tax liability and directly reduce both the principal amount and the ongoing interest charges. The IRS calculates failure-to-pay penalties based on outstanding balances, so every dollar paid reduces the penalties that accumulate monthly on unpaid taxes.

- Request a Payment Plan: IRS installment agreements allow businesses to spread tax payments over time while staying compliant. Short-term plans (120 days or less) have no setup fee, while longer-term arrangements require application fees and automatic monthly payments, but provide breathing room for businesses experiencing cash flow challenges.

- Apply for a Penalty Abatement: First-time penalty abatement provides relief for businesses with clean compliance histories over the previous three years. Businesses affected by circumstances beyond their control—such as natural disasters, serious illness, or unavoidable absence of key personnel—can request reasonable cause abatement, potentially saving thousands in penalty charges.

- Check State Tax Obligations: Each state has different filing requirements, deadlines, and penalty structures for businesses with nexus in their jurisdiction. Some states offer amnesty programs or voluntary disclosure agreements for businesses that have fallen behind on filings, which can reduce or eliminate penalties when coming into compliance.

- Consult a Tax Professional: Experienced tax advisors can identify overlooked deductions, credits, and strategies to minimize your tax liability while navigating complex IRS procedures. They can represent your business before the IRS, prepare offers in compromise for qualifying businesses, and develop comprehensive plans to address both immediate tax issues and prevent future compliance problems.

Taking these steps can help minimize financial burdens and prevent further complications.

Exploring Payment Options

If you owe taxes but cannot pay them in full, there are several options available to manage the debt:

- Installment Agreement: The IRS allows businesses to set up monthly payment plans. Short-term plans (up to 180 days) and long-term plans (over 180 days) are available.

- Offer in Compromise (OIC): This program lets businesses settle tax debt for less than the full amount owed. Eligibility is based on financial hardship.

- Short-Term Extension: Businesses that need additional time to pay may request a short-term extension from the IRS.

- Credit or Loan Options: Some businesses use business loans or lines of credit to cover tax liabilities and avoid IRS penalties.

- Penalty Abatement Request: If you have a history of timely filings, you may qualify for penalty relief, reducing the amount owed.

Understanding these payment options can help businesses avoid further financial stress while resolving their tax obligations.

Preventative Measures for the Future

Avoiding late tax filings not only helps maintain your business’s financial health but also prevents unnecessary stress and penalties. A proactive approach to tax planning can ensure compliance and keep your operations running smoothly. To avoid late filings in the future, consider implementing these strategies:

- Use Tax Software or an Accountant: Reliable tax software or professional accountants can help streamline tax preparation and filing, reducing errors and missed deadlines.

- Set Up a Tax Calendar: Establish reminders for important tax deadlines to ensure timely filings and payments.

- Make Estimated Tax Payments: Paying quarterly estimated taxes can prevent large tax bills at the end of the year.

- Keep Accurate Records: Maintain organized financial records, receipts, and tax documents to simplify filing and ensure compliance.

- Monitor Tax Law Changes: Stay informed about tax law updates that may impact your business to avoid surprises.

Implementing these preventative measures can help businesses maintain compliance and reduce tax-related stress.

Conclusion

Taxes may not be the most exciting part of running a business, but staying on top of deadlines can save you from unnecessary stress and financial setbacks. A late filing doesn’t have to spell disaster, as long as you take action, explore your options, and put safeguards in place for the future. With the right approach, you can turn a tax mishap into a learning experience that strengthens your financial strategy.

If tax compliance feels overwhelming, NSKT Global is here to help. Our team of tax professionals provides expert guidance on late filings, penalty relief, and strategic tax planning to keep your business compliant and financially sound. Don’t let tax issues hold you back, reach out today and take control of your tax obligations with confidence.

FAQs About Filing Business Taxes Late

What are the penalties for filing business taxes late?

The IRS charges a failure-to-file penalty (5% per month, up to 25%), a failure-to-pay penalty (0.5% per month), and interest on unpaid taxes.

Can I request an extension if I miss the tax deadline?

No, extensions must be requested before the deadline, but you can still file late to minimize penalties.

How can I set up a payment plan with the IRS?

Businesses can apply for an installment agreement online via the IRS website or by submitting Form 9465.

Will filing late affect my business credit?

While the IRS doesn’t report to credit bureaus, unpaid taxes can lead to liens, which negatively impact business credit.

What steps can I take to avoid missing tax deadlines in the future?

Use tax software or an accountant, set up calendar reminders, and make estimated tax payments throughout the year.