Table of Contents

When financial disputes escalate to legal battles, the numbers alone often don’t tell the full story. Forensic accountants are the experts that dig deep into financial records, uncover hidden assets, detect fraud, and provide critical insights that can make or break a case. In the courtroom, their ability to translate complex financial data into clear, actionable evidence is invaluable. Whether it’s a high-stakes commercial lawsuit, a divorce with hidden wealth, or a fraud investigation, forensic accountants are the unsung heroes ensuring that the financial truth prevails. Here’s a brief information on the role they play in litigation support, revealing how their skills can tip the scales of justice in favor of those seeking transparency, accountability, and a fair resolution.

What Is Forensic Accounting?

Forensic accounting is a specialized field that combines accounting, auditing, and investigative skills to examine financial statements and transactions. The term \"forensic\" implies that the information gathered is suitable for use in a court of law. Forensic accountants are trained to look beyond the numbers, analyzing the substance of financial activities to detect discrepancies, fraud, or other irregularities.

These professionals are adept at reconstructing complex financial data, often working backward to trace transactions and identify their origins. Their work involves scrutinizing financial records, conducting interviews, and employing various analytical techniques to uncover hidden information. The ultimate goal is to provide a clear and concise financial analysis that can withstand legal scrutiny and aid in the resolution of disputes.

Key Roles of Forensic Accountants in Litigation Support

Forensic accountants serve as pivotal figures in the litigation process, offering a range of services that bolster legal proceedings. Their ability to dissect complex financial matters, present findings in an understandable format, and support legal teams throughout a case makes them invaluable assets in legal disputes. Below are some of the key contributions they make to litigation support:

- Clarity and Credibility in Financial Matters

Legal disputes often involve intricate financial data that can be difficult for legal professionals, judges, and juries to interpret. Forensic accountants simplify complex transactions, identify key financial patterns, and present findings in a clear, structured manner. Their ability to translate financial data into concise and legally defensible reports enhances the credibility of evidence. As independent experts, they provide unbiased financial insights, strengthening legal arguments and increasing the chances of a favorable case outcome. - Fraud Detection, Asset Tracing, and Financial Investigations

Forensic accountants specialize in identifying fraudulent activities such as embezzlement, financial statement manipulation, and hidden assets. Through detailed financial analysis and transaction tracing, they uncover misappropriated funds and financial irregularities. Their expertise is crucial in cases involving fraud, divorce settlements, and corporate misconduct, ensuring transparency and accountability in legal proceedings. - Expert Testimony and Litigation Support

Forensic accountants serve as expert witnesses, presenting their findings in court and explaining complex financial matters in a way that judges and juries can understand. Their testimony adds credibility to financial evidence and helps legal teams substantiate their claims. Additionally, they assist with case strategy, discovery, and interrogatories, ensuring a well-prepared and data-driven legal approach. - Accurate Damage Assessment and Financial Valuation

In litigation, precise financial evaluation is essential for fair settlements and compensation. Forensic accountants calculate damages related to lost profits, breach of contract, shareholder disputes, and personal injury claims. Their in-depth analysis ensures courts have accurate financial insights to determine appropriate compensation, safeguarding the financial interests of all parties involved.

By fulfilling these roles, forensic accountants enhance the effectiveness of legal teams, ensuring that financial aspects of cases are thoroughly examined and accurately presented.

Common Areas of Litigation Involving Forensic Accountants

Forensic accountants provide essential financial expertise in complex legal disputes, helping attorneys, businesses, and individuals navigate financial challenges in litigation. The key areas include:

Commercial Disputes

In business litigation, forensic accountants assess the financial impact of contract breaches, shareholder and partnership disputes, and business interruptions. They conduct a detailed analysis of financial statements, revenue streams, and expense patterns to determine economic damages. By evaluating lost profits, diminished business value, and financial misconduct, forensic accountants provide expert opinions that assist in settlement negotiations or court proceedings. Their work ensures that damages are accurately quantified and supported by financial evidence.

Family Law Matters

Forensic accountants play a vital role in divorce and family law disputes, particularly in cases involving asset division, spousal support, and child support. They examine financial records to ensure full disclosure of income, investments, and property holdings, often uncovering hidden assets or unreported income. Their expertise extends to business valuations, forensic tracing of marital and non-marital assets, and determining appropriate support obligations based on accurate financial assessments. By providing a clear financial picture, forensic accountants help ensure fair and equitable settlements.

Fraud Investigations

Businesses, government agencies, and nonprofit organizations frequently engage forensic accountants to investigate suspected fraud. These professionals conduct in-depth forensic examinations of financial records to detect embezzlement, misappropriation of funds, fraudulent financial reporting, and corruption. They use advanced investigative techniques such as data analytics, asset tracing, and transaction monitoring to identify suspicious activities. In addition to uncovering fraudulent transactions, forensic accountants also recommend internal controls and preventive measures to mitigate future risks.

Bankruptcy and Insolvency

Forensic accountants are instrumental in bankruptcy proceedings, where they analyze financial transactions to identify fraudulent conveyances, preferential transfers, and mismanagement of assets. They work closely with bankruptcy trustees, creditors, and legal teams to assess the financial condition of the debtor and determine whether insolvency resulted from fraud or poor financial management. Their insights help in asset recovery, restructuring efforts, and creditor negotiations, ensuring that financial misconduct is identified and addressed appropriately.

Intellectual Property Disputes

When intellectual property (IP) rights are violated, forensic accountants evaluate the financial consequences of infringement. They calculate lost profits, assess the impact on market share, and determine reasonable royalty rates for unauthorized use of patents, trademarks, copyrights, and trade secrets. Their expertise in valuing intangible assets helps in litigation, arbitration, and settlement discussions, ensuring that IP owners receive fair compensation for financial losses resulting from infringement.

Insurance Claims

Forensic accountants are often engaged in disputes involving insurance claims, such as those arising from business interruptions, property damage, natural disasters, and personal injury cases. They analyze financial records to determine the legitimacy of claims and quantify the financial losses incurred. Their role includes reviewing policy terms, verifying income losses, assessing additional expenses, and ensuring that claims are neither overstated nor undervalued. By providing objective financial assessments, forensic accountants support fair settlements between insurers and claimants.

These diverse areas underscore the versatility of forensic accountants and their ability to adapt their skills to various legal contexts.

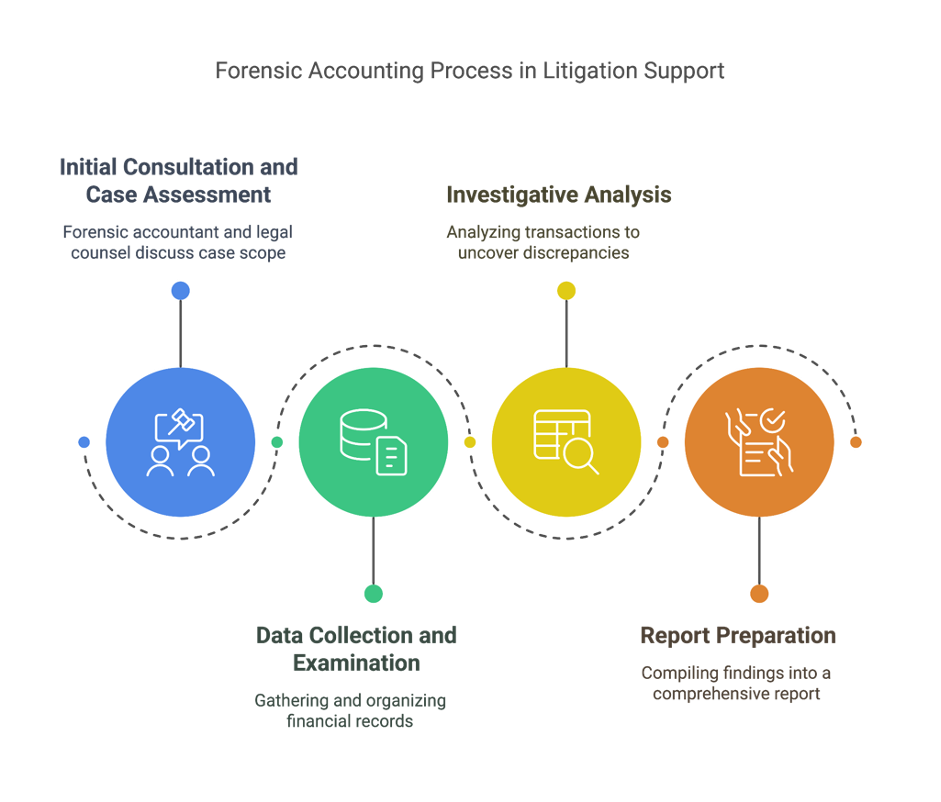

The Forensic Accounting Process in Litigation Support

The forensic accounting process in litigation support follows a structured approach to ensure financial analysis is thorough, credible, and legally admissible. Forensic accountants utilize a combination of investigative techniques, financial analysis, and legal knowledge to support their findings. Below are the key steps involved in this process:

Step 1: Initial Consultation and Case Assessment

The process begins with a consultation between the forensic accountant and legal counsel to define the case scope, identify financial issues, and assess transaction complexity. This helps shape the investigation strategy and determine the resources needed.

Step 2: Data Collection and Examination

Forensic accountants gather financial records from multiple sources such as banks, accounting systems, tax filings and scrutinize transactions for inconsistencies or suspicious activity. Organized documentation ensures findings are court-admissible.

Step 3: Investigative Analysis

Using advanced techniques, forensic accountants analyze transactions to uncover fraud, asset concealment, or discrepancies. They trace funds, identify fraudulent entities, and reconstruct incomplete records to provide a clear financial picture.

Step 4: Report Preparation

After analysis, forensic accountants prepare a detailed, court-ready report summarizing findings, methodologies, and conclusions. The report often includes visual aids like charts and timelines to simplify complex financial data for legal teams.

By following this structured process, forensic accountants help ensure the financial aspects of litigation are accurately presented and legally sound.

Challenges and Considerations

Forensic accountants are essential in uncovering financial discrepancies and providing critical evidence in legal cases. However, their work comes with significant challenges. From analyzing complex financial transactions to ensuring legal compliance and maintaining confidentiality, they must navigate various obstacles to provide reliable findings. Below are some of the key challenges they face:

- Complex Financial Data: Financial transactions can be intricate, involving multiple entities and international dealings. Forensic accountants must sift through vast amounts of data, detect anomalies, and reconstruct missing financial information using advanced analytical tools and accounting expertise.

- Legal and Ethical Constraints: Their work is governed by strict financial regulations, legal precedents, and professional ethical standards. Compliance with laws such as the Sarbanes-Oxley Act and adherence to the guidelines of organizations like the ACFE are essential to maintaining credibility and avoiding legal repercussions.

- Evidentiary Challenges: Courts require financial evidence to be properly documented, with a clear chain of custody and verifiable sources. Any inconsistencies or mishandling of evidence can result in its exclusion, weakening legal cases.

- Confidentiality Concerns: Given the sensitive nature of financial investigations, maintaining confidentiality is critical. Unauthorized disclosure of findings can lead to legal liabilities and reputational harm, making secure data management and adherence to non-disclosure agreements essential.

Despite these challenges, forensic accountants apply rigorous methodologies and uphold ethical standards to deliver accurate and reliable litigation support.

Conclusion

Forensic accountants have proven indispensable in modern litigation support, bridging complex financial analysis and legal proceedings. Their expertise extends beyond traditional accounting into fraud detection, expert testimony, and damage quantification. As financial matters grow increasingly sophisticated, these professionals continue to serve as crucial partners in the legal system, ensuring transparent, accurate, and just resolutions through their unique combination of investigative skills and accounting knowledge.

FAQs

1. What is the primary role of a forensic accountant in litigation support?

The primary role of a forensic accountant in litigation support is to analyze financial data, uncover fraud, and provide expert testimony to strengthen legal cases.

- How do forensic accountants detect and investigate fraud in legal cases?

Forensic accountants detect and investigate fraud by examining financial records, tracing transactions, identifying discrepancies, and using forensic data analysis techniques. - In what types of litigation cases are forensic accountants most commonly involved?

Forensic accountants are commonly involved in commercial disputes, fraud investigations, family law cases, bankruptcy proceedings, intellectual property disputes, and insurance claims. - What is the process for a forensic accountant when engaged in a legal dispute?

The forensic accounting process in legal disputes involves case assessment, data collection, financial analysis, report preparation, and expert testimony.

5. How can hiring a forensic accountant benefit my legal case?

Hiring a forensic accountant benefits legal cases by providing financial clarity, detecting fraud, strengthening evidence, ensuring accurate damage assessment, and improving litigation outcomes.