Table of Contents

Expanding your business operations across state lines can open new markets and opportunities for growth, but it also introduces a complex web of tax obligations. As businesses increasingly operate in multiple states through physical presence, remote employees, or online sales, navigating the varied tax landscapes becomes crucial for compliance and financial planning. Whether you're a growing startup exploring new territories or an established company with operations across multiple states, understanding these tax implications can help you avoid costly penalties while optimizing your tax position..

Understanding Nexus: Establishing Tax Obligations

Nexus is the connection between your business and a state that creates tax obligations. Understanding when and where you have nexus is fundamental to multi-state tax compliance.

Tax nexus represents the bond your business has with a state, obligating you to register, collect, and remit taxes. This connection determines where you owe taxes and what types of taxes apply to your business activities.

How Nexus is Determined:

- Physical presence: Having offices, employees, inventory, or property in a state typically creates nexus.

- Economic activity: Following the landmark South Dakota v. Wayfair decision, most states now impose tax obligations based on sales volume or transaction counts, even without physical presence.

- Industry-specific factors: Certain industries face unique nexus rules based on their business activities.

Different states have different thresholds and criteria for establishing nexus. For example, selling products in one state might create nexus there, while doing the same volume of business in another state might not trigger tax obligations. Understanding these variations is essential for proper tax planning and compliance.

Income Tax Apportionment: Allocating Income Across States

When your business has nexus in multiple states, you must determine how much of your income is taxable in each jurisdiction through a process called apportionment.

Apportionment Methods:

- Three-factor formula: Many states traditionally used a formula considering your property, payroll, and sales in the state relative to your total business activity.

- Single-factor sales: Increasingly, states are using sales alone to determine how much of your income they can tax.

- Different state approaches: Each state can have unique formulas and rules for allocating business income.

Apportionment challenges often arise when determining how much income should be allocated to each state where you operate. While some states use a three-factor formula based on property, payroll, and sales, others rely solely on sales or different combinations of factors.

Understanding these apportionment methods is essential because they directly impact your effective tax rate and can create opportunities for tax planning as your business grows.

Business Structure and Multi-State Taxation

Your business structure significantly impacts how you're taxed when operating across state lines. Each entity type faces different multi-state tax considerations and challenges.

LLC Multi-State Tax Implications

LLCs offer flexible tax treatment that varies based on ownership structure. By default, single-member LLCs are taxed as sole proprietorships, while multi-member LLCs are taxed as partnerships. This means profits and losses pass through to the owners' personal tax returns.

When operating in multiple states, LLCs face several unique considerations:

- You'll need to file tax returns in every state where your LLC has nexus, not just your home state

- States like California, New York, and Texas impose entity-level taxes or fees on LLCs ($800 minimum tax in California, publication fees in New York, and margin tax in Texas)

- Member-managers must file personal income tax returns in states where they perform services (for example, if you live in Florida but work for your LLC in Georgia, you'll owe Georgia state income tax)

- Multi-state LLCs should include specific language in operating agreements addressing how state-specific taxes will be allocated among members (especially important when some members work in high-tax states and others don't)

C Corporation Multi-State Tax Implications

C Corporations are taxed separately from their owners, which creates both challenges and opportunities in a multi-state context:

- The corporation files separate corporate income tax returns in each state where it has nexus, with corporate tax rates ranging from 0% (in states like Nevada and Wyoming) to over 11% (in states like New Jersey)

- Corporate income faces potential double taxation—taxed once at the corporate level (at varying state rates) and again when distributed as dividends to shareholders at their personal tax rates

- Twenty-eight states and DC require combined reporting, forcing related corporations to file as a single entity, while others allow separate company filing that may benefit certain corporate structures

- C Corporations often receive more favorable treatment of interstate business income through greater access to apportionment formulas and P.L. 86-272 protections that limit income tax nexus

- Strategic timing of dividend distributions can help shareholders minimize personal tax impacts (for example, distributing to shareholders who reside in no-income-tax states)

S Corporation Multi-State Tax Implications

S Corporations are pass-through entities for federal tax purposes, but states treat them differently:

- Five states (Louisiana, New Hampshire, Tennessee, Texas, and New York City) don't fully recognize S corporation status and may tax them similarly to C corporations

- S corporation shareholders must file personal income tax returns in all states where the corporation has nexus and they receive income, creating multiple state filing requirements

- Many states impose entity-level taxes despite pass-through status (California's $800 minimum franchise tax, New York's fixed dollar minimum tax)

- When shareholders live in different states than where the business operates, complex residency rules apply—non-resident shareholders may receive credits in their home state for taxes paid to other states, but these credits often don't fully offset double taxation

- Most states require S corporations to withhold income tax on behalf of non-resident shareholders, with rates ranging from 2% to over 9% depending on the state

When selecting or maintaining your business structure, consider not just your current operations but your expansion plans. A structure that works well in your home state might create tax inefficiencies as you expand across state lines. Regular review of your structure becomes increasingly important as your multi-state footprint grows.

Sales Tax Considerations: Compliance Across Jurisdictions

Sales tax compliance has become increasingly complex for businesses operating across state lines, especially following the Wayfair decision that expanded the concept of economic nexus.

Multi-State Sales Tax Challenges:

- Varying rates and rules: Sales tax rates and what items are taxable differ not only by state but often by local jurisdictions within states.

- Economic nexus thresholds: Most states now require you to collect sales tax once you exceed certain sales thresholds, even without physical presence.

- Product and service taxability: What's taxable in one state may be exempt in another, creating significant compliance challenges.

For ecommerce businesses and online sellers, these varying regulations create particular challenges. The concept of "economic nexus" means that surpassing a certain threshold of sales or transactions in a state can trigger tax obligations, even without a physical presence there.

Amazon sellers face additional complexity, as products stored in Amazon fulfillment centers across different states can create nexus in those locations, requiring careful tracking of inventory placement and sales patterns.

Payroll Taxes: Managing Multi-State Employee Obligations

With the rise of remote work, many businesses now have employees in multiple states, creating complex payroll tax obligations.

Key Payroll Tax Considerations:

- State unemployment insurance: Generally paid to the state where work is performed, with rates varying significantly between states.

- Income tax withholding: Most states require withholding for residents and nonresidents working in the state, with potentially conflicting rules for remote workers.

- Registration requirements: Each state has unique registration processes for employers.

If you have employees in multiple states, you must accurately withhold state income tax according to each state's standards. This requires staying updated on where your employees work and ensuring proper withholding for each jurisdiction.

The complexity increases when employees work remotely or travel between states, potentially creating withholding obligations in multiple jurisdictions for the same employee.

Registration and Compliance: Meeting State-Specific Requirements

Operating across state lines triggers various registration and compliance obligations beyond taxation.

Business Entity Registration: Before you can legally operate in a new state, you need to "foreign qualify" your business. This process registers your company with the state government and typically requires filing paperwork, appointing a registered agent with a physical address in the state, and paying registration fees. Maintaining this registration requires annual or biennial reports and renewal fees.

Specialized Licenses and Permits: Many industries require state-specific licenses to operate legally. Research licensing requirements in advance by checking state professional licensing boards for your industry, contacting state departments of revenue, and consulting with local industry associations familiar with requirements.

Unclaimed Property: Most small businesses are surprised to learn they must report uncashed checks, unused customer credits, and other abandoned funds to state governments. Track customer deposits and credits, implement procedures to maintain current customer contact information, and document attempts to return funds to rightful owners.

Audit Defense Preparation: Operating in multiple states increases your audit risk. Maintain organized records that clearly document multi-state transactions, keep copies of tax returns and supporting documentation readily accessible, and document your reasoning for tax positions taken on complex issues.

Tax Calendar Management: With different filing deadlines across states, staying compliant requires systematic tracking. Create a master calendar of all filing requirements by state, set reminders at least two weeks before deadlines, and consider technology solutions that automate deadline tracking.

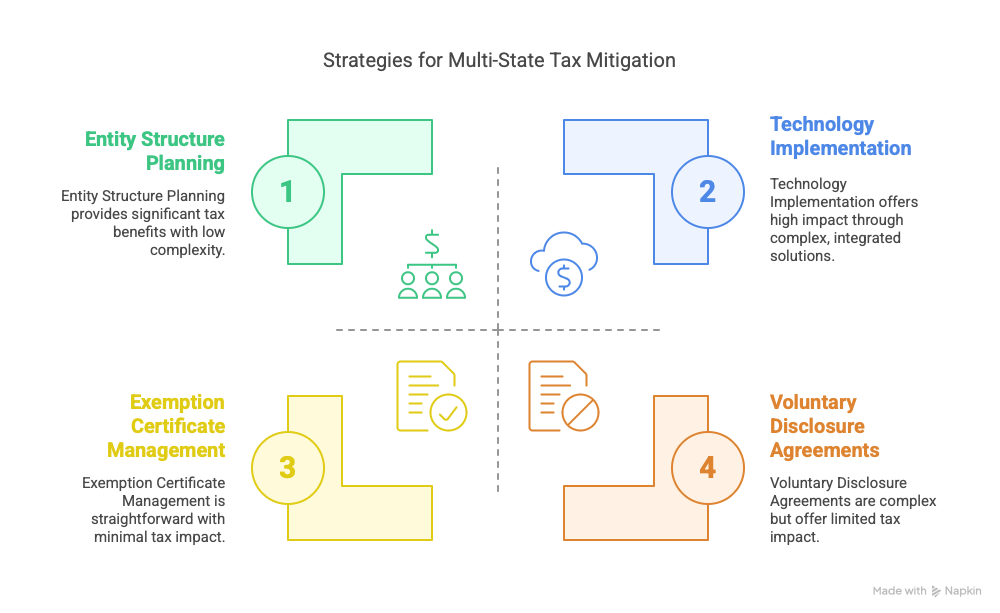

Strategies to Mitigate Multi-State Tax Liabilities

While maintaining compliance is essential, there are legitimate strategies to manage and potentially reduce your multi-state tax burden.

Entity Structure Planning: How you structure your business can significantly impact your tax situation across states. Consider whether an LLC taxed as an S-corporation might reduce self-employment taxes while maintaining flexibility across states. Evaluate whether separate entities for different state operations might limit liability exposure. Review how your home state treats income from other states to avoid double taxation.

Location Planning: Strategic decisions about where you locate people, inventory, and operations can substantially impact your tax obligations. Consider border regions where locating just miles away might offer significant tax advantages. Evaluate whether remote workers create new tax obligations in their states. Plan inventory placement to minimize sales tax complexity while maintaining customer service levels.

Exemption Certificate Management: For businesses selling to tax-exempt organizations or resellers, properly managing exemption documentation prevents unexpected tax liabilities. Create a simple system to collect and verify exemption certificates at the time of sale, regularly review certificates for expiration dates, and keep digital copies organized by customer and state for easy access.

Voluntary Disclosure Agreements (VDAs): If you discover you've had unreported tax obligations in other states, VDAs offer a way to come into compliance with reduced penalties. These programs typically waive or reduce penalties while limiting lookback periods, often provide confidentiality during initial negotiations, and create a clean slate moving forward.

Technology Implementation: Even small businesses can leverage affordable technology solutions to manage multi-state compliance. Consider cloud-based accounting systems with multi-state tax capabilities, sales tax calculation services that integrate with e-commerce platforms, and document management systems that organize compliance records by state and tax type.

Conclusion

As your business grows across state lines, understanding and managing multi-state tax obligations becomes increasingly important. While the complexity can be daunting, taking a proactive approach to compliance can help you avoid penalties while identifying opportunities to optimize your tax position. The multi-state tax landscape continues to evolve, with states frequently updating nexus thresholds, changing apportionment formulas, and implementing new compliance requirements. Working with knowledgeable tax professionals like NSKT Global can help you navigate these challenges successfully.

By understanding your nexus footprint, properly allocating income across states, managing sales tax obligations, and implementing smart tax planning strategies, NSKT Global can help you growing your business with confidence while minimizing tax-related risks and costs.

FAQs About Multi-State Business Taxation

What triggers tax obligations in multiple states?

Tax obligations can be triggered by physical presence (offices, employees, inventory), economic activity (reaching sales or transaction thresholds), marketplace sales, affiliate relationships, or temporary business activity. Since the 2018 Wayfair decision, most states have implemented economic nexus standards that don't require physical presence to create tax obligations.

How is income apportioned among states for tax purposes?

States use various formulas to determine what portion of a business's income they can tax. While traditionally many used a three-factor formula based on property, payroll, and sales, most states have shifted to single-factor sales apportionment. Different states might use different formulas, so understanding each state's approach is essential for accurate tax planning.

Are sales taxes required for online sales to other states?

Yes, following the South Dakota v. Wayfair decision, businesses can be required to collect sales tax on online sales to customers in states where they exceed economic nexus thresholds, even without physical presence. These thresholds typically involve sales revenue or transaction counts within the state during a defined period.

What are the penalties for non-compliance with multi-state tax laws?

Penalties vary by state and tax type but commonly include failure-to-file penalties, failure-to-pay penalties, interest charges, and potential personal liability for responsible parties. Some states impose minimum penalties regardless of tax due, making compliance important even for businesses with relatively small multi-state activity.

How can businesses streamline compliance with varying state tax regulations?

Businesses can streamline compliance by implementing tax automation software, centralizing compliance management, participating in voluntary compliance programs, conducting regular nexus studies to identify obligations, and developing standardized processes for registration, filing, and documentation across jurisdictions.