Case Study: How Strategic Tax Planning Saved Our Client Thousands in Tax Liabilities

Strategic tax planning is a cornerstone of sound financial management in the modern landscape. It involves reducing liabilities while aligning your financial decisions with your broader financial goals. A well-structured tax strategy can not only lower your immediate tax burden but also create lasting benefits that align with your financial aspirations. This case study examines how a comprehensive, tailored tax plan enabled a client to reduce their federal and state tax liabilities, optimize business income, and achieve significant savings, all while ensuring compliance and mitigating potential penalties.

Client Profile

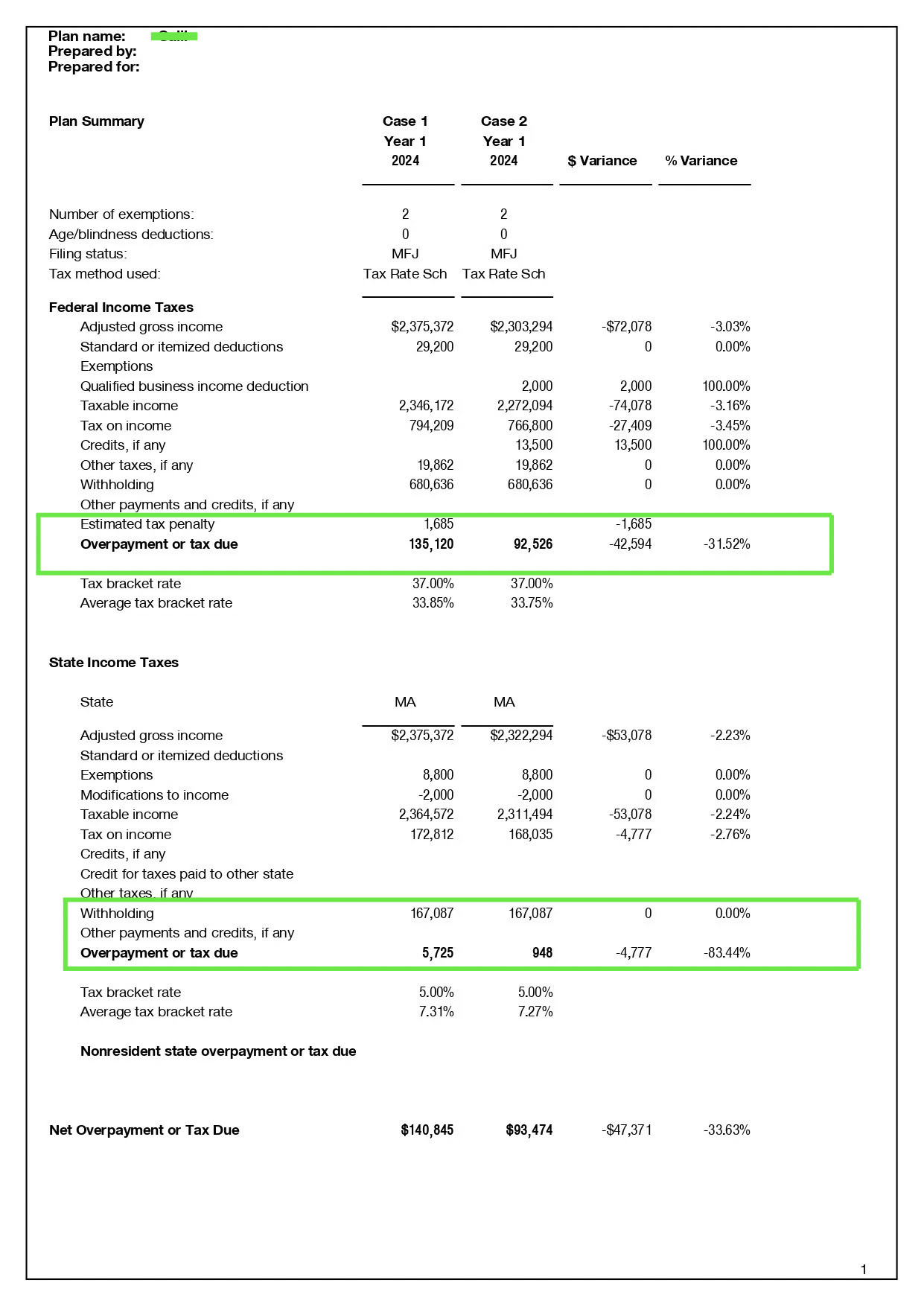

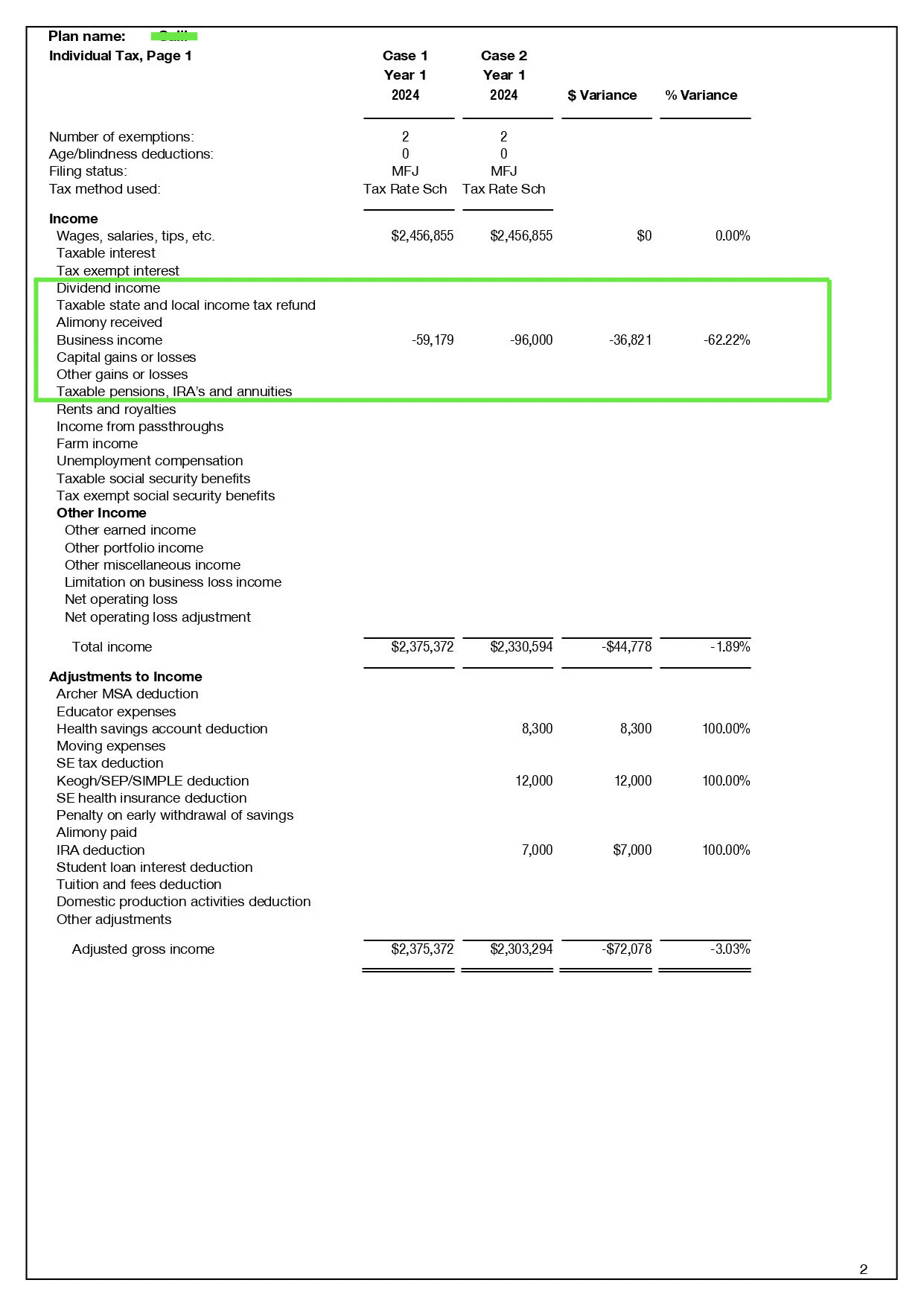

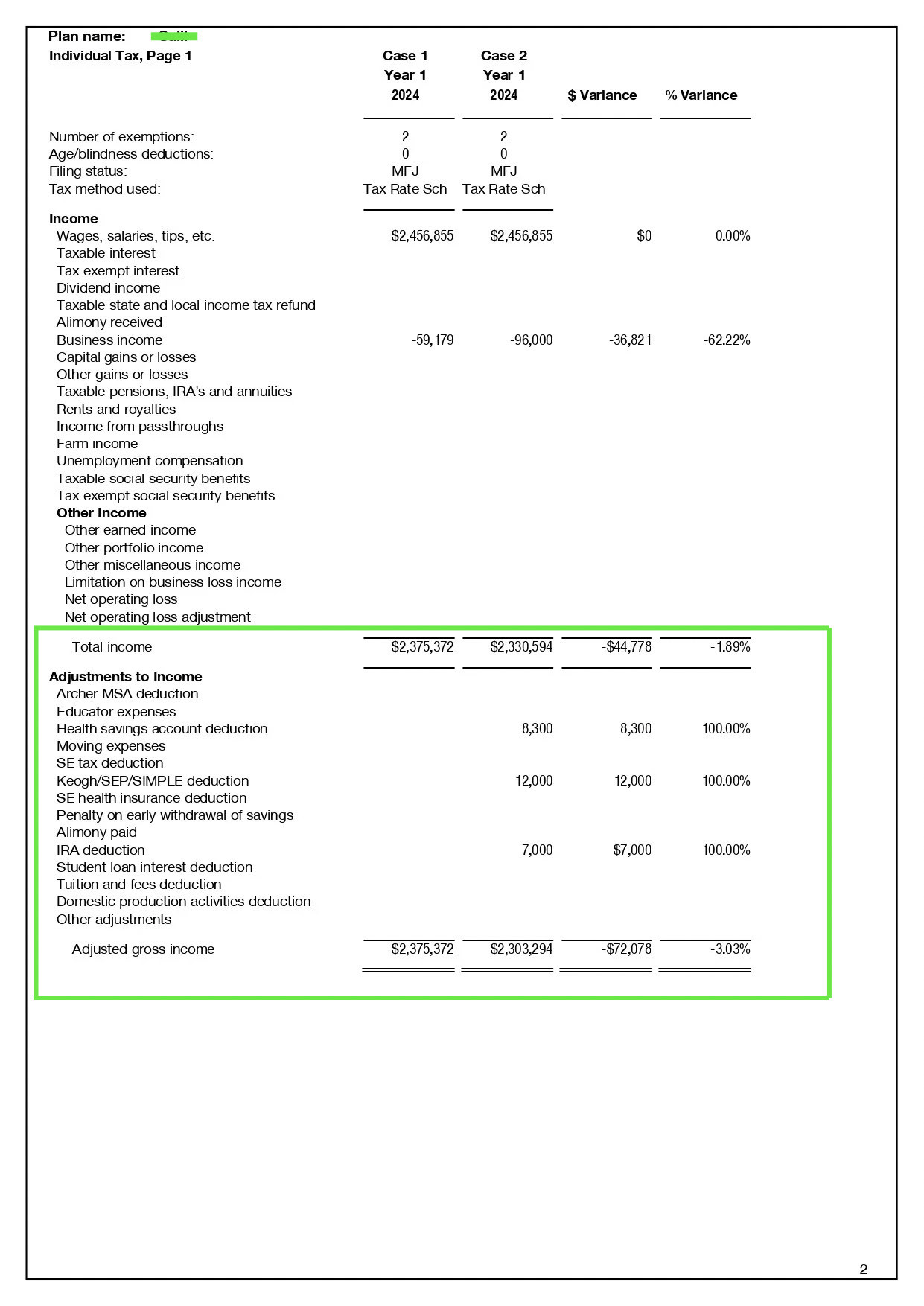

Our client, a high-income earner with an annual adjusted gross income (AGI) exceeding $2.3 million, faced multiple challenges due to their financial profile. Filing jointly with their spouse under the Married Filing Jointly (MFJ) status, they were highly exposed to federal and state tax liabilities. Despite their substantial income, they had underutilized deductions and credits and faced inefficiencies in structuring their business income, which compounded their tax burden.

Key Challenges

We conducted a thorough review of the client’s financials and identified several areas requiring immediate attention:

- Federal Tax Liability: The client’s projected federal tax due for the year exceeded $135,000. With a top tax bracket rate of 37%, reducing taxable income was critical to minimizing liability.

- State Tax Burden: The state income tax liability was significant, initially projected at over $172,000. Limited utilization of state-specific deductions and credits added to the challenge.

- Business Loss Optimization: The client’s business reported losses totaling $96,000. Maximizing the deduction of these losses while ensuring compliance was a priority.

- Underpayment Penalties: Irregular tax payments led to an estimated tax penalty of $1,685, further increasing the financial burden.

Our Approach

To address these challenges, we implemented a multi-pronged approach:

- Income Adjustment Strategies:

We leveraged the Qualified Business Income (QBI) deduction, which allowed a 20% deduction on eligible business income. Additionally, we optimized deductible adjustments, such as contributions to an Individual Retirement Account (IRA), to further reduce taxable income.

- Health Savings Account (HSA) Optimization:

We set up a Health Savings Account (HSA) for the client, providing $8,300 in tax-deferred savings. HSAs offer a triple tax benefit: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free. This approach not only reduced the client's taxable income but also supported long-term financial planning for healthcare needs. - Solo 401(k) Business Plan Implementation:

To maximize retirement savings, we assisted the client in setting up a Solo 401(k) plan before the year-end deadline, resulting in $12,000 in tax-deferred contributions. This strategic move reduced taxable income and established a foundation for future financial security. - Deductions Optimization:

A thorough review of the client’s QuickBooks data uncovered missed business expenses that could be written off, enhancing tax efficiency. - Residential Energy Credit:

The client invested in energy-efficient home improvements, such as solar panels and energy-efficient windows. These upgrades qualified for $13,500 in Residential Energy Credits, a federal incentive encouraging eco-friendly investments to reduce energy consumption. - State Tax Planning:

By strategically modifying the client’s state-adjusted gross income, we reduced it by $2,000, effectively lowering their taxable income and state tax burden. - S-Corp and Payroll Structuring:

We restructured the client’s business into an S-Corporation, paying the client a reasonable salary and adding their spouse to payroll. This approach reduced taxable income by $36,821, achieving significant tax savings. - Penalty Mitigation:

We recalculated and optimized the client’s estimated quarterly tax payments, eliminating the $1,685 underpayment penalty and ensuring compliance for future tax cycles.

Results Achieved

Our strategic planning efforts led to significant results for the client:

- Federal Tax Liability: By leveraging a combination of deductions, including the QBI deduction and adjustments for contributions to IRAs and HSAs, we reduced the client’s federal tax liability from $135,120 to $92,526. This 31.5% reduction saved the client $42,594, providing them with immediate cash flow benefits and increased financial flexibility.

- State Tax Liability: Through state-level adjustments and credits, we effectively reduced the client’s taxable income by $53,078. This resulted in a $4,777 reduction in state tax liability, which not only decreased the overall tax burden but also optimized compliance with state-specific tax requirements.

- Total Net Savings: Combining federal and state savings, the client’s overall tax liability decreased by $47,371. These savings were achieved without compromising compliance or exposing the client to unnecessary audit risks. The additional funds could now be reallocated to personal or business investments.

- Penalty Savings: By restructuring the client’s estimated quarterly tax payments and addressing prior inconsistencies, we completely eliminated the $1,685 underpayment penalty. This not only saved money but also ensured the client maintained a clean tax compliance record.

Add section

Additional Tax Optimization Strategies

Beyond the strategies implemented in this case, several other options can be leveraged to reduce tax liabilities effectively:

- Tax-Loss Harvesting:

Offset capital gains by selling underperforming investments at a loss. These losses can be used to reduce taxable gains and even offset up to $3,000 of ordinary income annually. Unused losses can be carried forward to future years. - Charitable Contributions:

Donations to qualified charitable organizations allow for itemized deductions, reducing taxable income. In addition to cash donations, contributions of appreciated assets like stocks can help avoid capital gains taxes while still providing a deduction. - Depreciation and Amortization:

Businesses can claim deductions for the gradual loss of value of tangible assets (like equipment) and intangible assets (like patents). This reduces taxable income while ensuring compliance with accounting standards. - Tax-Advantaged Accounts:

Accounts like 529 plans for education savings, Flexible Spending Accounts (FSAs), and Health Savings Accounts (HSAs) offer tax benefits. Contributions are often pre-tax, and withdrawals for qualified expenses are tax-free, maximizing savings. - Business Tax Credits:

Credits like the Research & Development (R&D) Tax Credit, Work Opportunity Tax Credit, and Small Employer Pension Plan Startup Costs Credit reduce the amount of taxes owed dollar-for-dollar. They are particularly valuable for businesses looking to innovate or expand. - Income Splitting:

Shifting income to family members in lower tax brackets, such as paying reasonable salaries to family members working in a business, can reduce overall family tax liabilities. - Section 179 Deduction:

Businesses can immediately deduct the full purchase price of qualifying equipment or software in the year it is placed into service, reducing taxable income significantly. - Energy Efficiency Incentives:

Federal and state programs offer credits for investments in energy-efficient property, such as solar panels, wind turbines, and geothermal systems, reducing both tax liabilities and energy costs. - Retirement Plan Contributions:

Maximizing contributions to plans like 401(k)s, SEP IRAs, and SIMPLE IRAs allows individuals and business owners to reduce taxable income while securing their financial future. Catch-up contributions for those over 50 provide additional opportunities for savings. - Tax-Deferred Annuities:

Investing in tax-deferred annuities allows income to grow tax-free until withdrawals begin, offering flexibility in tax planning for retirement. - State-Specific Deductions and Credits:

Many states offer unique tax-saving opportunities, such as deductions for college savings, adoption expenses, or local energy efficiency programs. These incentives vary by location but can provide significant savings.

By combining these strategies and customizing them to the individual or business’s financial situation, it’s possible to significantly reduce tax liabilities while improving overall financial health and compliance.

Conclusion

Strategic tax planning is essential for achieving long-term financial success, especially for individuals with complex financial profiles, such as high-income earners. Life events, including starting a business, purchasing a home, saving for education, retirement planning, or even inheritance, often present unique tax planning opportunities. By understanding these events and leveraging available deductions, credits, and adjustments, it’s possible to significantly reduce tax liabilities and enhance financial stability.

At NSKT Global, we specialize in crafting tailored tax solutions aligned with your unique financial circumstances and life events. Whether you're navigating the complexities of setting up a business, planning for your child’s education through tax-advantaged accounts, maximizing retirement contributions, or managing tax implications of inheritance, our team of experts is here to guide you.

We are well-versed in navigating the intricacies of tax regulations, enabling us to maximize your savings, minimize risks, and ensure full compliance. Whether you are a high-net-worth individual or a business owner, our comprehensive tax planning services are designed to help you retain more of your earnings, optimize deductions, and achieve peace of mind during every phase of your financial journey.

If you’re looking to reduce your tax burden and take control of your financial future, NSKT Global is here to help.

Contact us today to schedule a consultation and let us create a customized tax strategy that will drive your financial success.